Innovation is a tricky, vital component for every firm, and the world’s largest real estate portals are no exception.

I thought a lot about innovation during my four-year tenure as head of strategy at New Zealand’s leading property portal Trade Me. Much of my time centered on identifying and growing new ventures.

When I joined the business in 2012, it had about 300 employees. I used to say there were 299 people focused on growing the existing business and one (me) focused on growing new lines of business.

That was a big portion of my attraction to Trade Me and the role in the first place. I was intrigued by the idea of running a “conveyor belt of growth,” as the job description stated. I quickly learned that innovation at a large, publicly-traded business is vital, for reasons I didn’t fully realize until years later.

Why is innovation important?

Many assume, of course, that innovation is important at a big corporate, but rarely ask why.

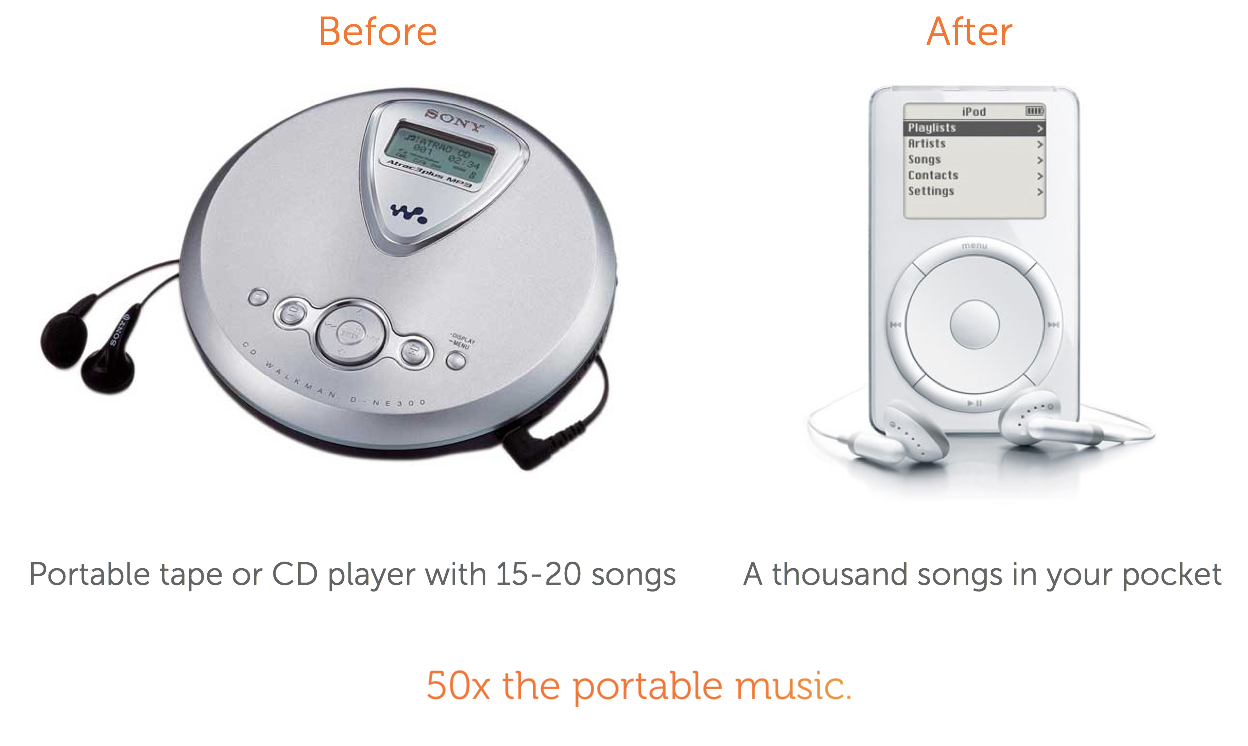

The answer, in my eyes, boils down to relevance. The world moves lightning-fast; if you stand still too long, you die. Innovation isn’t a luxury; it’s standard operating procedure for any business.

But you can’t simply go to your teams, announce your intent to innovate and rejoice when the magic begins. You need to focus your efforts in the right areas, where you have a strong competitive advantage or existing network effects. In other words, areas that will naturally multiply your efforts.

For example, at Trade Me we knew when people were looking for new homes or browsing for vehicles. That was our competitive advantage. So we acquired an insurance-comparison business and launched a new insurance brand.

Innovation vs Execution

Execution is a critical component of effective innovation, a fact easily overlooked. Ideas are a dime a dozen; execution animates innovation but it’s where most companies fall down.

In a big company, new ideas come from all sources like water out of a firehose: customers, employees, market scans, books, board directors. Everyone has ideas, and they’re rarely unique.

Execution is the critical component of successful innovation. It breeds winners. Mismanaged ideas mire leaders with deadly false hopes. Those who execute on a new idea best, succeeds. It’s simple: if you want to improve innovation, focus on execution (more on this later).

The differing models of innovation

Large firms can tackle innovation in a number of ways. Below isn’t an exhaustive list, but how we thought about and considered innovation at Trade Me:

- Run an internal skunkworks team. This is the sexiest option. Who doesn’t love the idea of a small, elite group of contributors in a dimly lit side office working on the next big thing. On the plus side, you have dedicated resources working on new, new, new all the time. On the downside -- it’s very easy to fly off the rails without proper oversight.

- Corporate venturing. This was the strategy at Trade Me while I was there. We regularly scanned the market and made opportunistic investments and acquisitions in interesting businesses. Once we made an investment, we worked with the firm’s leaders to supercharge their company. Our big goal: make 1+1 equal 3. (Big not-so-secret secret: it doesn’t always work out.)

- Work with local innovation aggregators. Find your local incubator or accelerator programs, scout for new opportunities and help promising startups. This can be a great place to find talented people and nurture promising ideas. This tactic marks a much earlier stage than corporate venturing and requires patience.

- Internal hackathons. Shut your entire company down for a number of days and get everyone working on prototyping new ideas. At Trade Me, we held 24-hour hackathons twice a year. It’s a great way to get ideas flowing and increase motivation and excitement, but the outcomes are usually smaller and more incremental and can suffer without proper follow-up.

- Nothing. Just acquire businesses or potential competitors when they get big enough. Let the market do the hard work for you by vetting new ideas, teams and execution. You’ll pay a higher price for the business, but with the higher price comes a higher certainty of success.

The challenges of corporate venturing

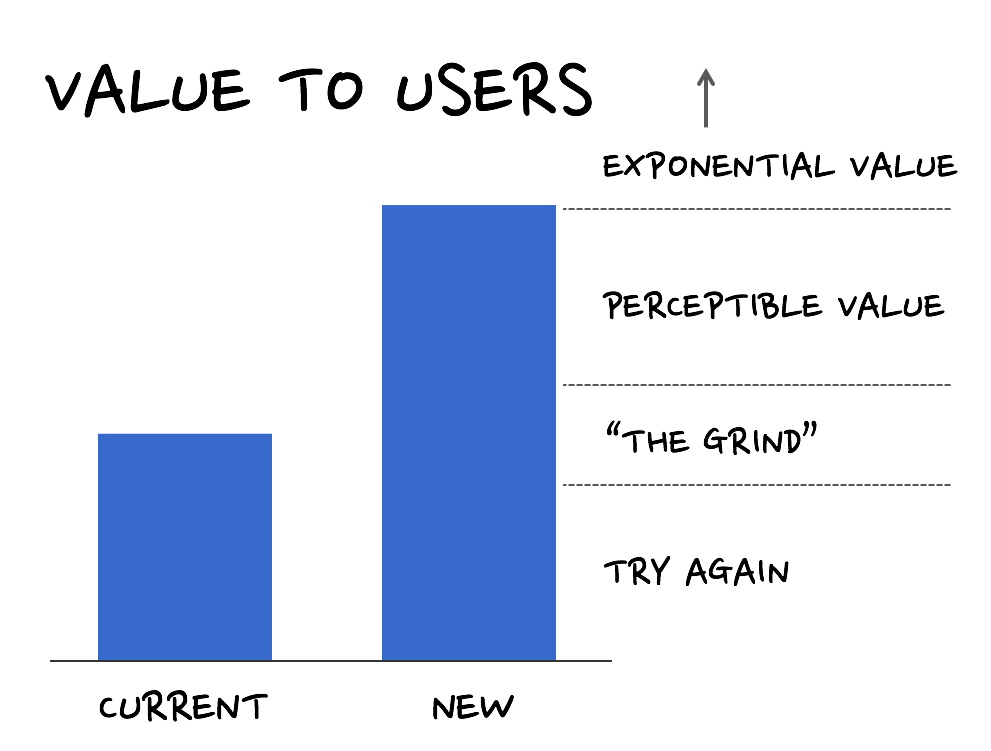

All big corporates face many innovation challenges. In my opinion, the biggest is always attention. How do new programs with uncertain outcomes compete against known opportunities with more certain results? As a CEO, I would much rather put my resources behind an initiative I know will pay off, rather than one that might pay off. That’s the innovator’s challenge.

Based on my experience as an entrepreneur and corporate ventures guy, I recommend segregating resources to solve this inherent perceived value disconnect.

Commit most of your resources to your existing businesses, but set aside resources, time and effort for the new stuff: 1 percent, 5 percent, 10 percent -- whatever you think makes sense for your business. Make the delineation in your mind, keep the two separate and stick with it.

One of the other big problems we faced at Trade Me was our small market. With a population of approximately 4.5 million, New Zealand has a smaller number of potential startups and entrepreneurs available, in addition to low deal flow.

The inherent challenge of working with startups narrowed our opportunities further. In my venturing, I found that startups don’t like to solve your problems; they like to solve their problems.

So what about everyone else?

When I left Trade Me in 2016, I knew deeply how we thought about innovation. But, like my interest in how other major property portals look at investments, I am intrigued by how other major portals think about innovation. How important is it to them? What processes do they have in place to efficiently execute on it?

Let’s take a look!

Innovation at three of the world’s top property portals

Trulia’s Innovation Weeks

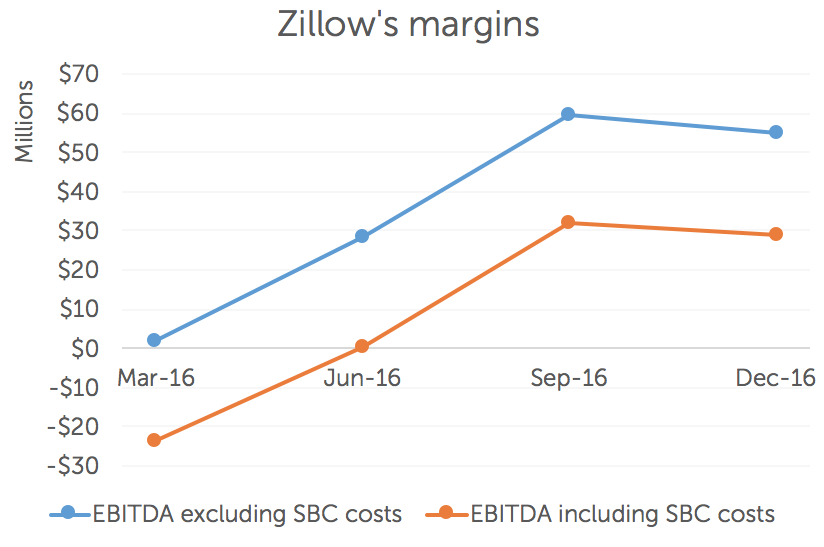

When Zillow and Trulia combined forces in February 2015, they became the dominant real estate portal in the U.S.

Although they’re united under Zillow Group, they operate separate consumer teams. Each brand sets a week aside each quarter for innovation. Trulia calls it “Innovation Week”; Zillow calls it “Hack Week.” It’s a time for their teams to dream big and develop new products and features.

“Our culture emphasizes autonomy and innovation,” said Jeff McConathy, Trulia’s vice president of engineering. “Anyone can participate in an Innovation Week. You don’t have to be in a technical role or an engineer.”

Trulia sees this as dedicated time for all employees to experiment with new product ideas or work on pet projects they’re passionate about.

“We like to encourage employees to work with new technologies and new teammates so they can hone new skills and engage with colleagues they may not interact with on a daily basis,” Jeff said.

Each Innovation Week has a theme. When I visited earlier this year, the theme was personalization and user behavior.

The event starts the week before with a pitch party, where participants pitch their project ideas to the group. A social mixer follows to encourage team formation.

During Innovation Week, senior leaders and subject matter experts make themselves available with scheduled office hours. Trulia also trains teams on public speaking and designing pitches.

The Monday after the week of hacking -- where all participants are encouraged to put aside their normal job tasks and to avoid scheduling any unrelated meetings -- teams present their work at an event open to all in the company.

A panel of judges and the audience choose the winners. Judges pick a theme winner and the audience picks three winners: first, second and third place. The theme and first place winners work with Trulia leadership to get their ideas on the release roadmap.

Last year, teams presented more than 120 projects. Five Innovation Week projects have already shipped this year: updated Local Info Pages, Rent Near Transit, Trulia bot for Facebook Messenger, Trulia for Apple TV and Quiet Streets Map.

In addition to the week dedicated each quarter to innovation at its largest consumer brands, Zillow Group also practices a good deal of corporate venturing through acquisitions of related businesses. It also maintains strong ties with the startup community through formal relationships with two U.S. real estate tech accelerators: MetaProp NYC in New York City and Elmspring in Chicago.

Earlier this year, Zillow also hosted MetaProp’s demo day at its San Francisco offices.

REA Group’s Big Idea

Leading global digital business REA Group, parent company of Australia’s realestate.com.au, has several innovation programs.

REA Group Chief Technology Officer Tomas Varsavsky summed up his firm’s position: “We disrupted the industry 20 years ago, now we’re the incumbent to get disrupted.” Innovation is already in the DNA of the company, but its innovation programs -- it hopes -- will help it stay ahead of the curve.

Similar to Trulia and Zillow, it runs quarterly three-day hackathon events it calls “REA.io.” It encourages its employees across the globe to work on anything during these events -- even projects that aren’t directly related to the firm’s business. “It’s as much about the culture of the company as about the ideas,” Tomas said.

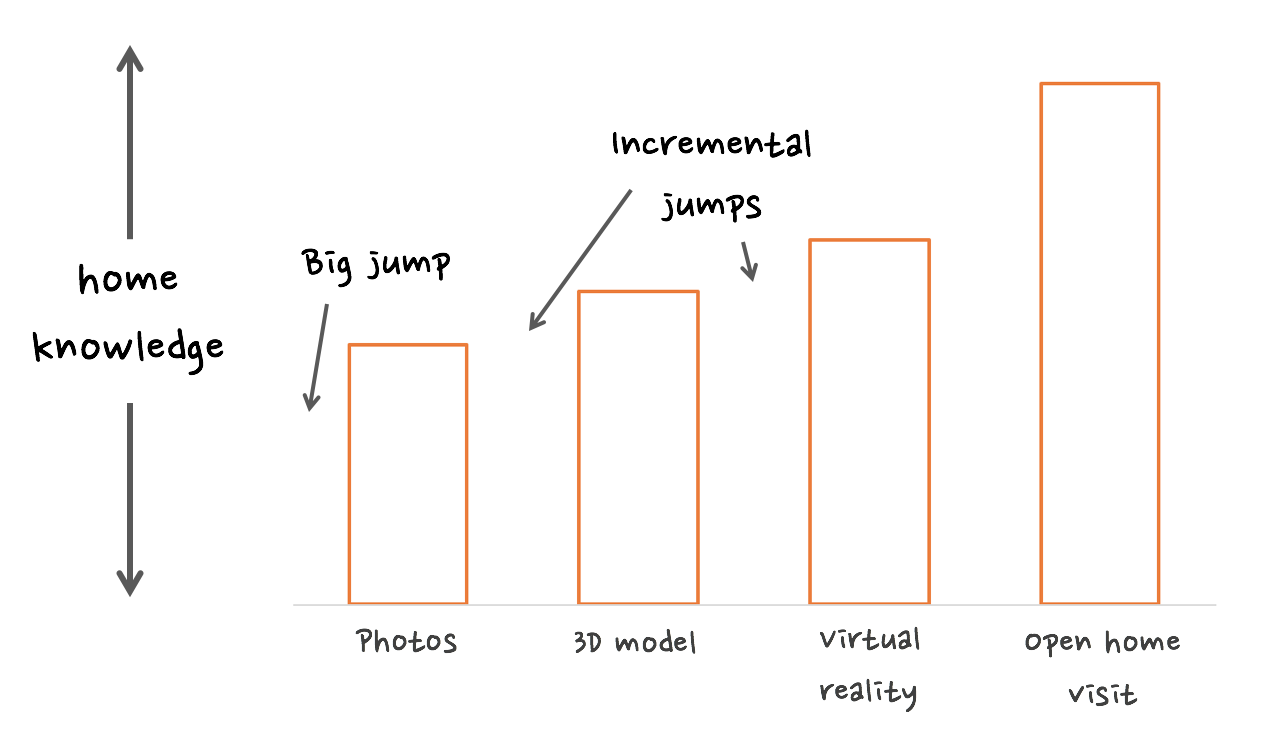

The firm also runs a small “Innovation Team” focused on consumer tech. It’s an internal team that plays with virtual reality, augmented reality, 3D modeling, a HoloLens, drones and more to help keep the firm on technology’s bleeding edge.

But the big idea came two years ago.

In an effort to bridge the gap between an idea that’s too big for a two-to-three-day hackathon and a business-as-usual product roadmap, it launched “The Big Idea” in May 2015.

The event starts with a company-wide call for project ideas -- typically bigger, more ambitious and more disruptive than hackdays projects. Dozens of ideas pour in not only from tech pros, but also the firm’s salespeople, marketers and those in its legal department. The firm posts those ideas for all employees to view and reviews them on a global scale. Eventually, it filters the ideas to six finalists.

REA Group then holds a “Shark Tank”-style event where the finalists pitch their ideas. The panel picks a winner (or winners) who receive $100,000 and 60 days to develop their idea into a working prototype. The company provides resources -- both internal and external -- to help the teams succeed.

The first year employees submitted over 40 ideas. This year they submitted over 60. “I was worried that we’d use up all of our good ideas the first year, but there was very little overlap and repeat ideas the second time around,” Tomas said.

For example, this year’s winner Linda Brunetti, a digital engagement consultant from REA Group’s Corporate IT team, is preparing to kick-off her project. She’ll get support from one of REA Group’s existing lines of business, an exec-level mentor, internal IT resource, and a connection to an agency to produce a minimum viable build. In addition, she gets two months off from her day job to focus on the project.

Tomas has some advice for other companies thinking about rolling out innovation programs: “People often get caught up on the ROI of a hackday, but the culture you’re creating and the signals you’re sending companywide are just as important. Everyone is an innovator and we’re going to create space to make it happen.”

Rightmove’s Head of Innovation

Rightmove, the U.K.’s top real estate portal, is the only major portal I found with a dedicated head of innovation. A big part of Hannes Buhrmann’s job is to experiment with new consumer ideas the firm may want to implement in the near future.

To accomplish this, Hannes typically works with external teams.

“My focus is to conceptualize and validate the propositions,” Hannes said. “Sometimes that validation might consist of user research, clickable prototypes, functional prototypes and, at times, deploying fully functional features in a closed alpha or beta environment.

“When developing fully functional features, we specifically assume that the code will eventually be thrown away,” Hannes added. “This is for two main reasons: speed of development and avoidance of polishing something that may fail as a consumer proposition. The basic approach is fail as fast as possible, and as cheaply as possible.”

Hannes’ team’s inspiration for its innovation efforts include:

- To aid Rightmove’s overall business objectives

- To better understand the broader competitive environment (i.e. not only what other portals are doing, but also what other companies are doing within the property vertical, whether established or startups)

- To uncover technological advances that present new opportunities for disruption

In general, the firm focuses on ideas and technologies that it can produce in the near term, not blue sky stuff.

For example, the team is currently toying with a “Where Can I afford to Live?” tool. It’s live in early alpha here (best viewed on a desktop). It’s rough around the edges and has some usability issues, but that’s the point. The goal is to get stuff out early, pull in feedback, plan next steps and release frequently.

Like the others, Rightmove also runs a hackathon event. The annual three-day event has been going for over a decade.

Making innovation work for you

While innovation is all about execution, success doesn’t happen without a smart framework to cultivate it. Like Trade Me, many of the top portals have structured programs designed to encourage innovation and build a culture of experimentation. Then they pump promising ideas through the execution engines of their larger businesses.

We held hackathons at Agora Games, the tech company I founded and ran before my time at Trade Me. It’s safe to say that the primary impetus for holding the events – and the primary outcome – was to reinforce a culture of innovation.

I’m impressed by the depth and breadth of innovation at REA Group and Zillow Group. They both run a number of different programs – from hackathons to innovation teams to a heavy involvement in the entrepreneurial scene. I’m also impressed by the massive commitment senior management at Zillow makes; one week every quarter is a big chunk of time! And given the number of projects that have launched from the event, I’d say this is a good model to follow.

A successful program requires commitment and structure.

Outside of these programs’ tangible results, the other benefits flourish. Employees receive a clear message that innovation is important. The firms maintain a vigilant eye on the future. They’re willing to make a real investment in their talent and the future of the business by supporting these programs.

When I speak to property portals from around the world about innovation, my advice boils down to three points:

- Stay plugged in to the local entrepreneurial environment (like Zillow Group does with its strong ties to the startup community)

- Hold structured innovation programs multiple times a year (like REA Group does with its quarterly hackathons)

- Devote some resource – however small – to experimentation (like Hannes’ team at Rightmove)

Doing the above will keep you on the cutting edge, so you don’t get left behind.