Logical Fallacies, Seller Motives, and Private Exclusives

During last week’s Compass v. Zillow court hearing, surveys and research were presented to support each side’s position on the relative merits of exclusive listings versus broad exposure.

Why it matters: Evidence can be presented in such a way to tell whatever story you want – and in this case, digging deeper shows that the data and associated conclusions are not as straightforward as each side would have you believe.

Dig in: During the hearing, a Zillow consumer survey on private listing networks was shown as evidence, and despite the intended result, raised more questions than it answered – especially when you consider the inverse of the results.

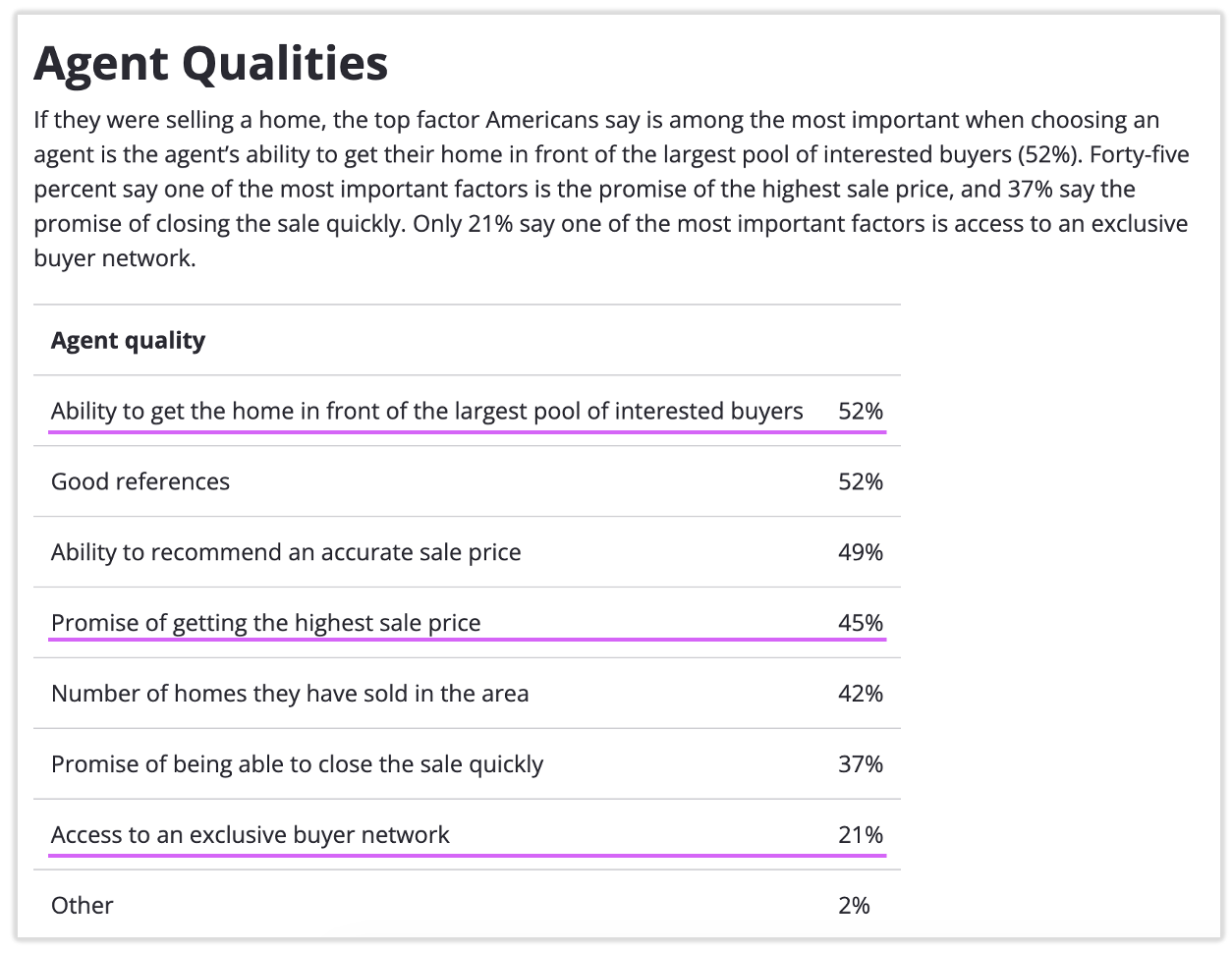

For instance: 52 percent of respondents said one of the most important factors when choosing an agent is that agent’s ability to get their home in front of the largest pool of interested buyers – meaning that broad exposure was not among the most important factors for 48 percent of people.

In the same survey, 45 percent of respondents said one of the most important factors was the promise of getting the highest sale price – with the inverse suggesting that 55 percent of people did not consider getting the best price as one of the most important factors when choosing an agent.

Even though the question is about choosing an agent, the results suggest a diverse range of seller motivations.

The survey results were equally enlightening on the topic of private listing networks: on the same question, 21 percent of respondents said one of the most important factors is access to an exclusive buyer network.

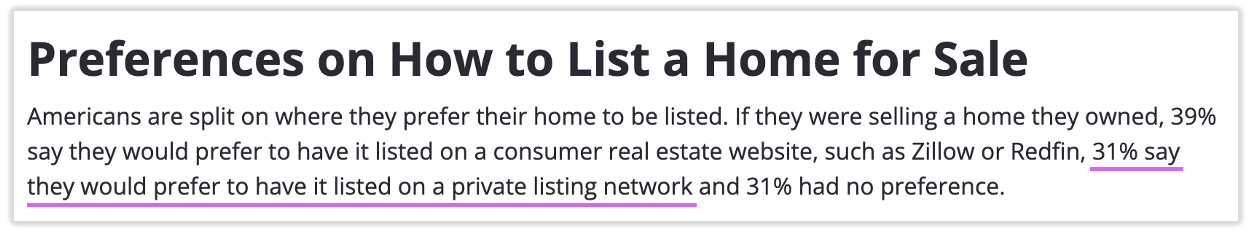

And on a different question, respondents said if they were selling a home, 39 percent would prefer to have it listed on a consumer real estate website, while 31 percent would prefer to have it listed on a private listing network.

The survey results reveal a significant population of sellers that prefer listing on a private listing network for a period of time – and notably, 21–31 percent is in the same ballpark as the percentage of Compass exclusive listings: around 24 percent.

The debate around private exclusives often includes research showing the efficacy of listing off-market vs. on-MLS.

Unsurprisingly, each side has released research – with similar underlying datasets – to numerically support their position.

It’s like I say in my presentation, Propaganda: you can manipulate data to tell whatever story you want.

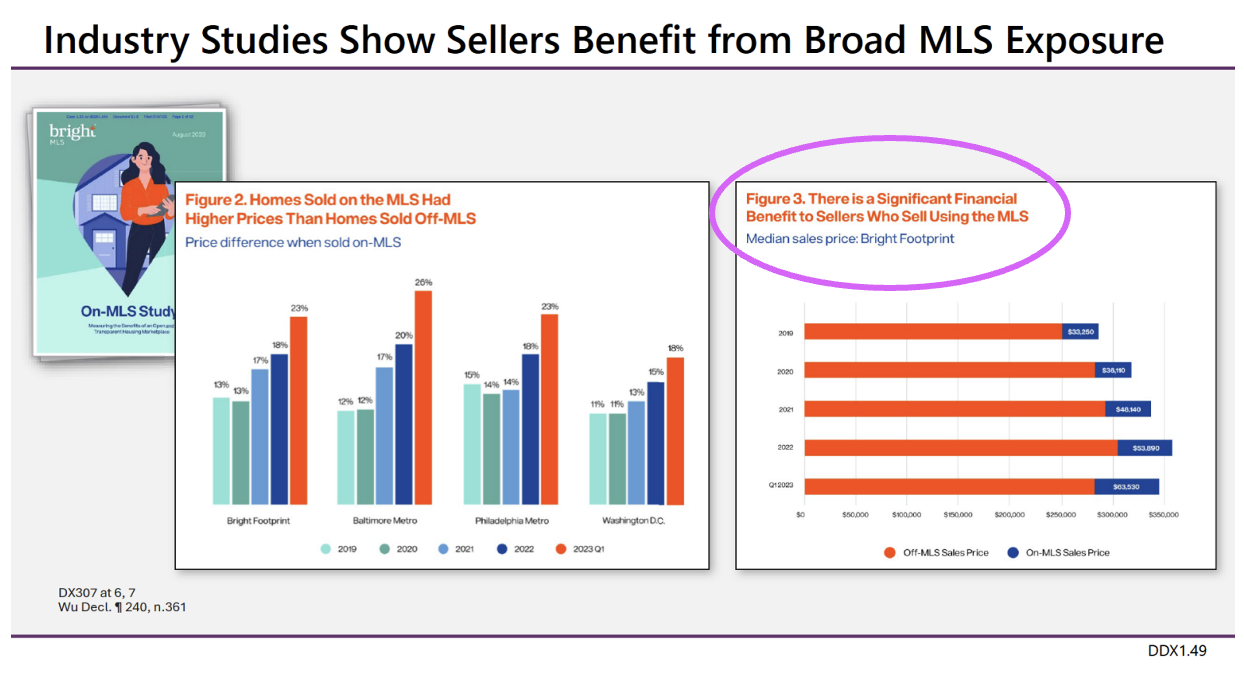

Oft-quoted research from Bright MLS showed that homes listed on an MLS sell for 17.5 percent more than homes that are sold off-MLS.

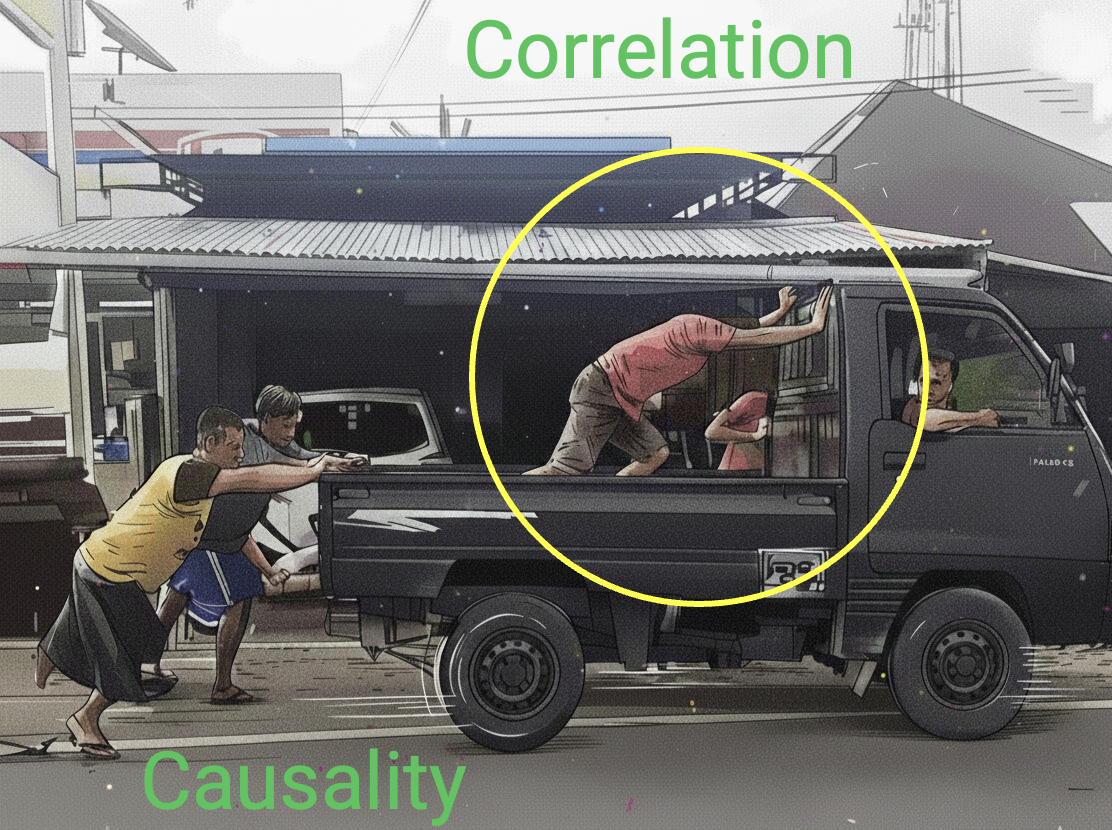

The logical fallacy here is that correlation does not equal causation: the study treats the observed premium as an effect caused by MLS exposure rather than from any underlying differences between homes.

For example: the off-MLS data includes for sale by owner (FSBO) listings, which, according to NAR, have a median sales price 18 percent lower than agent-assisted sales – in part because they “tend to be more frequently lower-cost mobile homes or those located in rural areas.”

If we already know FSBOs sell for less, putting them in the off-MLS group and then “discovering” that off-MLS sells for less is circular — the conclusion is already baked into the grouping.

Similar research from Zillow helpfully excludes FSBO from its off-MLS dataset and found a sale price difference of 1.5 percent, and more recent research from Bright MLS focused on office exclusives (not FSBO) and found that “whether or not a home was pre-marketed as an office exclusive has no impact on the close price.”

Similar research from Compass shows pre-marketed listings were associated with 2.9 percent higher sales prices.

Same problem: the homes that are pre-marketed may be systematically different (price point, marketability, price- and time-sensitivity).

The key point is that pre-marketed listings are not random; Compass’s research simply shows that the types of homes that opted for pre-marketing sell for slightly more, not that pre-marketing a home makes it more valuable.

The competing research all makes the same logical leap: looking at two very different, self-selected groups and claiming the only meaningful difference is pre-marketing or the MLS.

The correlation ≠ causation fallacy confuses the path chosen with what that path actually does – in the same way that flying business class doesn’t make you richer, ticking the “MLS” or “pre-marketing” box doesn’t automatically add 17% or 3% to the sales price.

It is worth noting that once we exclude FSBO, the research from Zillow, Compass, and Bright MLS all present similar results: -1.5%, +2.9%, and no price difference at all – seemingly within a practical, economic, and methodological margin of error for real-world home prices.

The bottom line: There’s a lot of data out there and it’s not telling a straightforward story.

To really answer the question of where a home will sell for more, we would need quantum real estate: the ability to sell the same home across an infinite number of parallel universes to see which factors yield the highest sales price.

The evidence does suggest that homesellers’ motivations are more varied than most assume, and “exposure is everything” is not universally true.

In the end, any claims about which path “sells for more” or what’s “best for consumers” are oversimplifications of a far more dynamic and surprising reality.