The Pandemic’s Varied Effect on International Real Estate Markets

/The pandemic affected international real estate markets in strikingly different ways. Markets with stringent lockdowns saw new listings plummet by 90 percent, while other markets saw no change. And as the world begins to recover, the data suggests that the longer and more severe the lockdown, the faster the initial recovery.

New Listings

The number of new listings coming to market is a key indicator of a healthy real estate marketplace, representing high-intent seller demand and available inventory. The decline in new listing volumes across seven countries has varied wildly, from no change to a 90 percent drop, depending on the market and its associated lockdown.

Unsurprisingly, the drop in new listing volumes is tightly correlated to the severity of lockdown imposed by national and local governments. Of the nations analyzed, Italy and the U.K. had the most stringent lockdowns, with many real estate activities deemed non-essential and severely limited. The drop in new listings was greatest in these markets: between 75-90 percent.

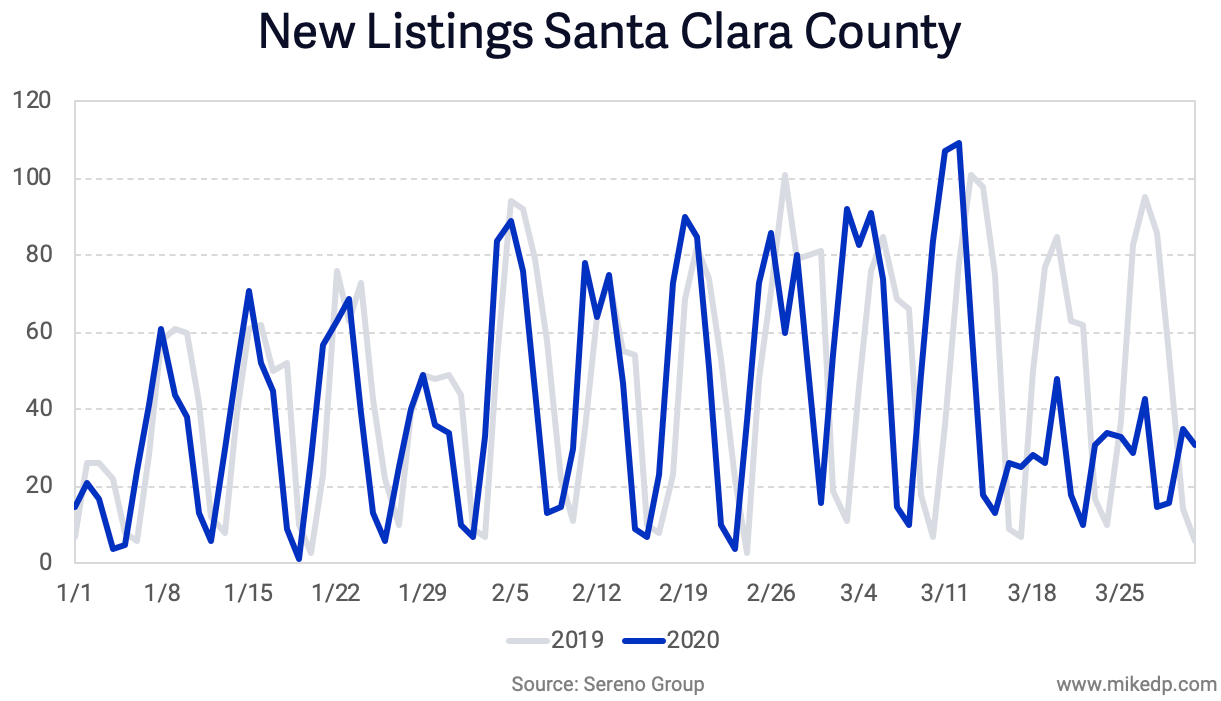

The Australian, U.S., and Canadian real estate markets were less restrictive, and the drop in new listings reflects that: 40-50 percent at a national level. In the U.S., that number varies greatly by state, with some markets (Pennsylvania, Michigan, and New York) mirroring the severe drop of up to 90 percent seen in the U.K. and Italy.

Most surprisingly, some markets were barely affected. The Netherlands and Sweden imposed “intelligent lockdowns” far less restrictive than many other countries. As a result, The Netherlands in particular hasn’t seen a significant drop in new listings; rather, it’s enjoying annual highs. Interestingly, new listing volumes in Sweden have seen a limited, delayed decline -- about a month after most other markets -- of 20 percent.

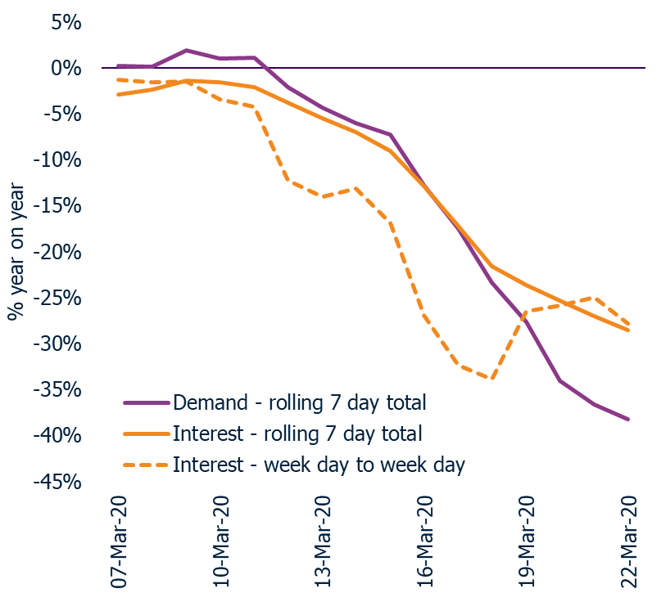

Portal Traffic

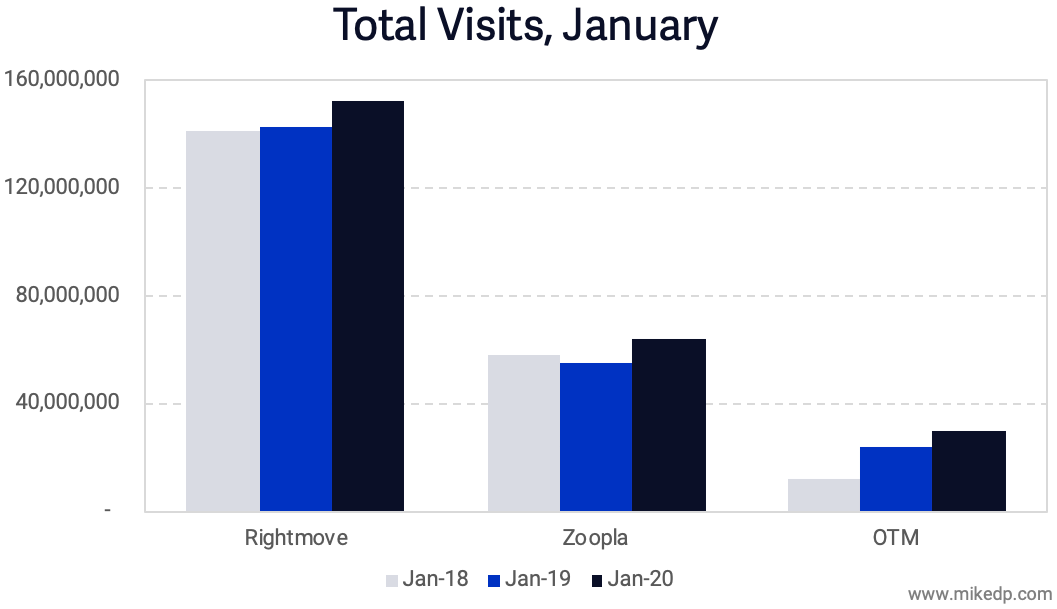

Web site and mobile traffic to real estate portals suffered an expected drop, but quickly recovered in most of the markets analyzed.

Once again, markets with “intelligent lockdowns” -- The Netherlands and Sweden -- saw less of a drop and are currently experiencing annual highs. Australia and the U.S. quickly recovered and are up from last year, while the U.K. lagged behind due to its stringent lockdown (why browse when the market is closed).

A less restrictive lockdown doesn’t directly affect someone’s browsing behavior. But the closer to “normal” a lockdown is, the more consumers will continue their normal portal browsing behavior.

A Fast Recovery

Based on the evidence from the U.K. and Italy, it appears that the longer and more severe the lockdown, the faster the recovery. Both countries have seen a surge in new listing volumes after restrictions were lifted, a signal of strong pent-up demand. The following chart shows the rise in new listings after the U.K. reopened the housing market on May 13th.

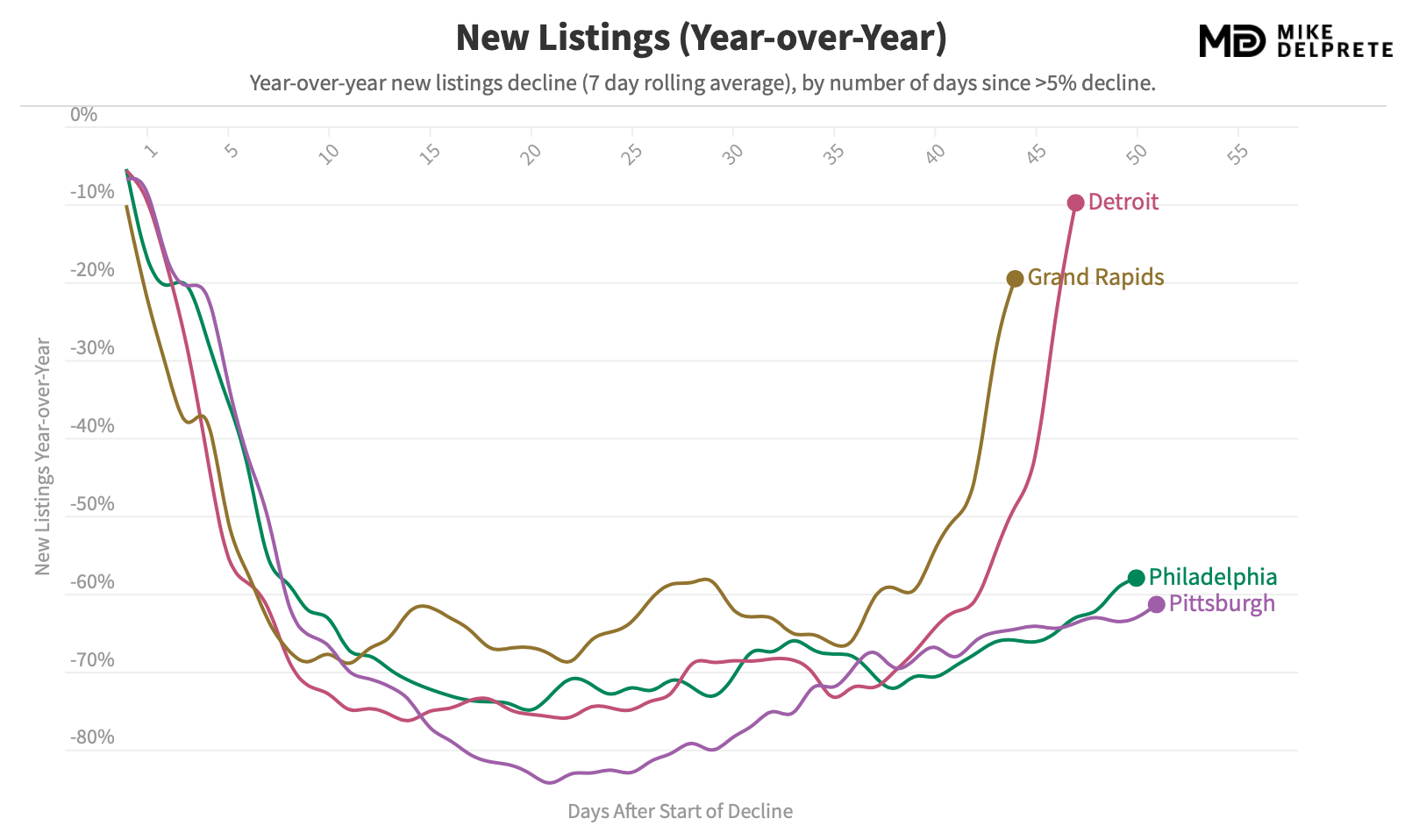

That market behavior is similar to two of the hardest hit U.S. markets -- Pennsylvania and Michigan -- which prohibited most real estate activity and saw new listings drop 70-80 percent. After easing restrictions, Michigan’s Detroit and Grand Rapids saw an immediate surge in new listings come to market -- similar to Italy and the U.K.

The evidence suggests that once restrictions are lifted in the hardest hit markets, new listings rebound quickly. However, new listings are only one component of a full market recovery. Buyer demand, leading to completed real estate transactions, will come over time -- and it’s unclear how long that recovery will take.

A Note on Data Sources

This analysis uses previously unpublished data from a number of international real estate portals and organizations:

Hemnet (Sweden’s top real estate portal)

Funda (The Netherlands’ top real estate portal)

REA Group (Australia’s top real estate portal)

Zoopla (U.K.’s #2 real estate portal)

Fourwalls and rennie (Canada)

A top Italian real estate portal (Thanks!)

Redfin’s Data Center (U.S. new listing volumes)

Zillow’s quarterly shareholder letter (U.S. traffic volumes)

Thank you to the leading real estate portals and other organizations around the world that collaborated with me to produce this first-of-its-kind international analysis. How does your market compare? Let me know!