Slowdown: The Velocity of Brokerage Revenue Decline

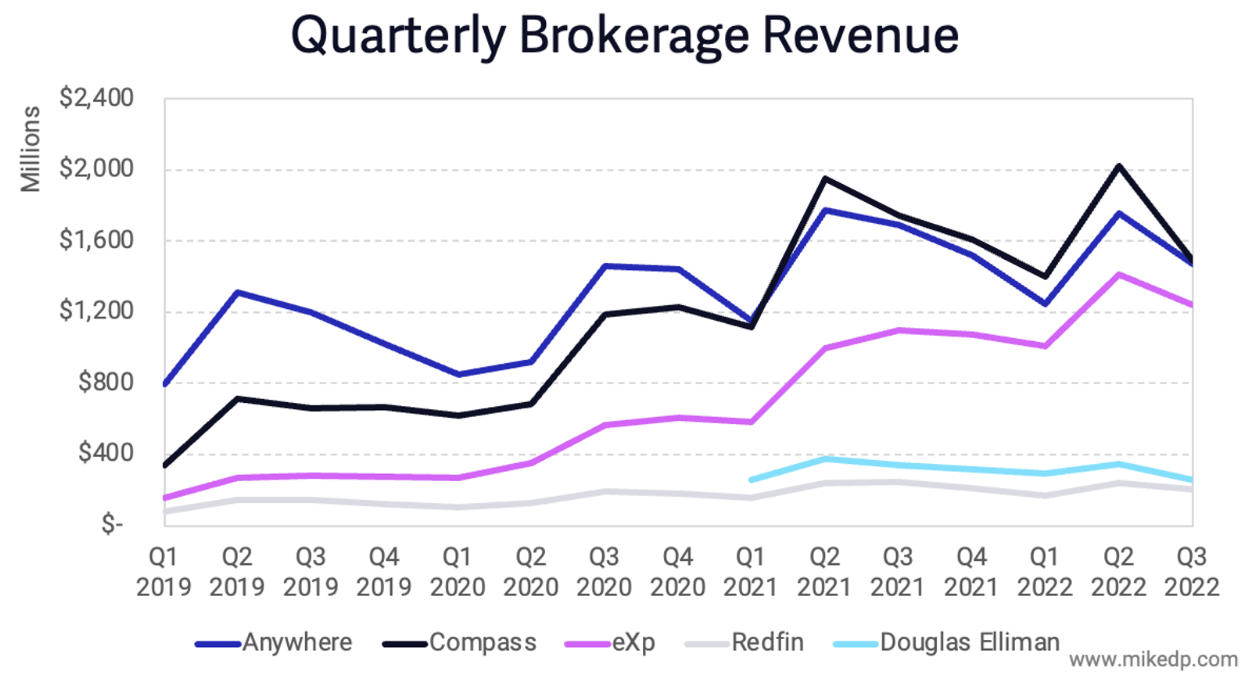

Q3 results are in for the large, publicly-listed brokerages and revenues are down across the board – but that’s only part of the story.

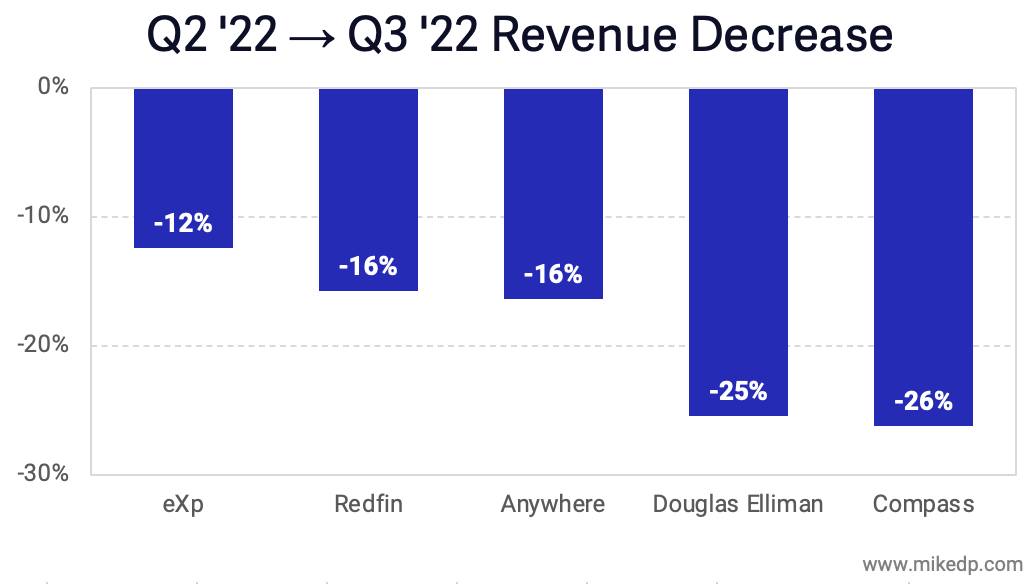

Why it matters: The velocity of decline between brokerages varies, providing early insight into which companies may be at higher risk than others in a cooling market.

Dig deeper: Compared to the previous quarter, all brokerages experienced a drop in revenue – which is expected from a seasonal perspective.

Douglas Elliman and Compass experienced the largest decline, a likely combination of concentration in more upscale markets (NYC and California) that are cooling faster than others.

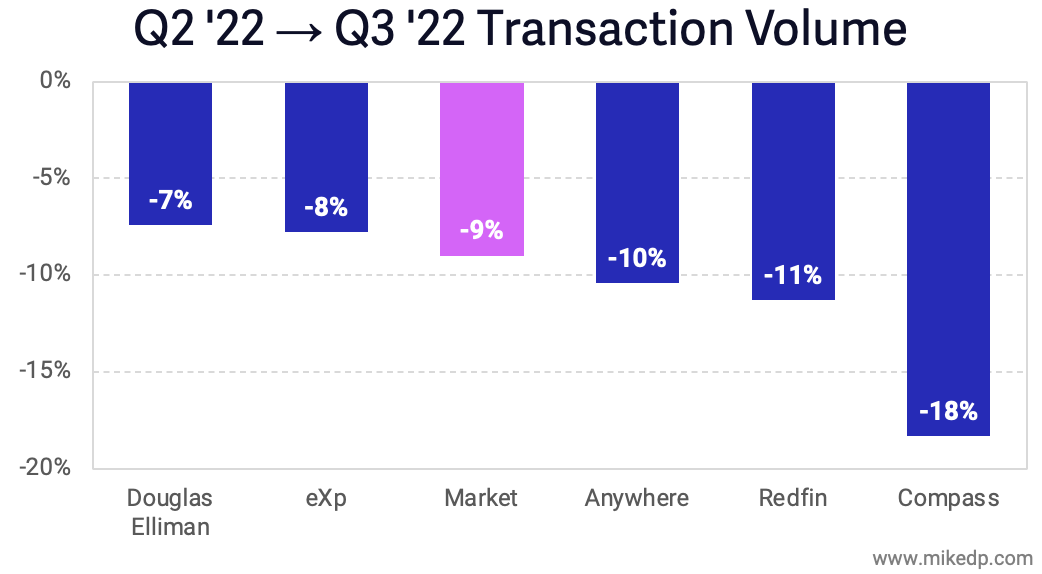

Behind the numbers: Driving the revenue decline is a drop in overall market transactions compared to the previous quarter.

Notably, Compass closed 18 percent fewer transactions than the previous quarter, which is double the 9 percent decline in transactions for the entire residential real estate market as reported by NAR.

Astute observers will note Douglas Elliman’s 7 percent decline in transactions compared to a 25 percent decline in revenue; this is driven by a 13 percent drop in average sale price.

Yes, but: In Q2, Compass outperformed the market with a 41 percent quarterly increase in transactions compared to an overall market increase of 28 percent.

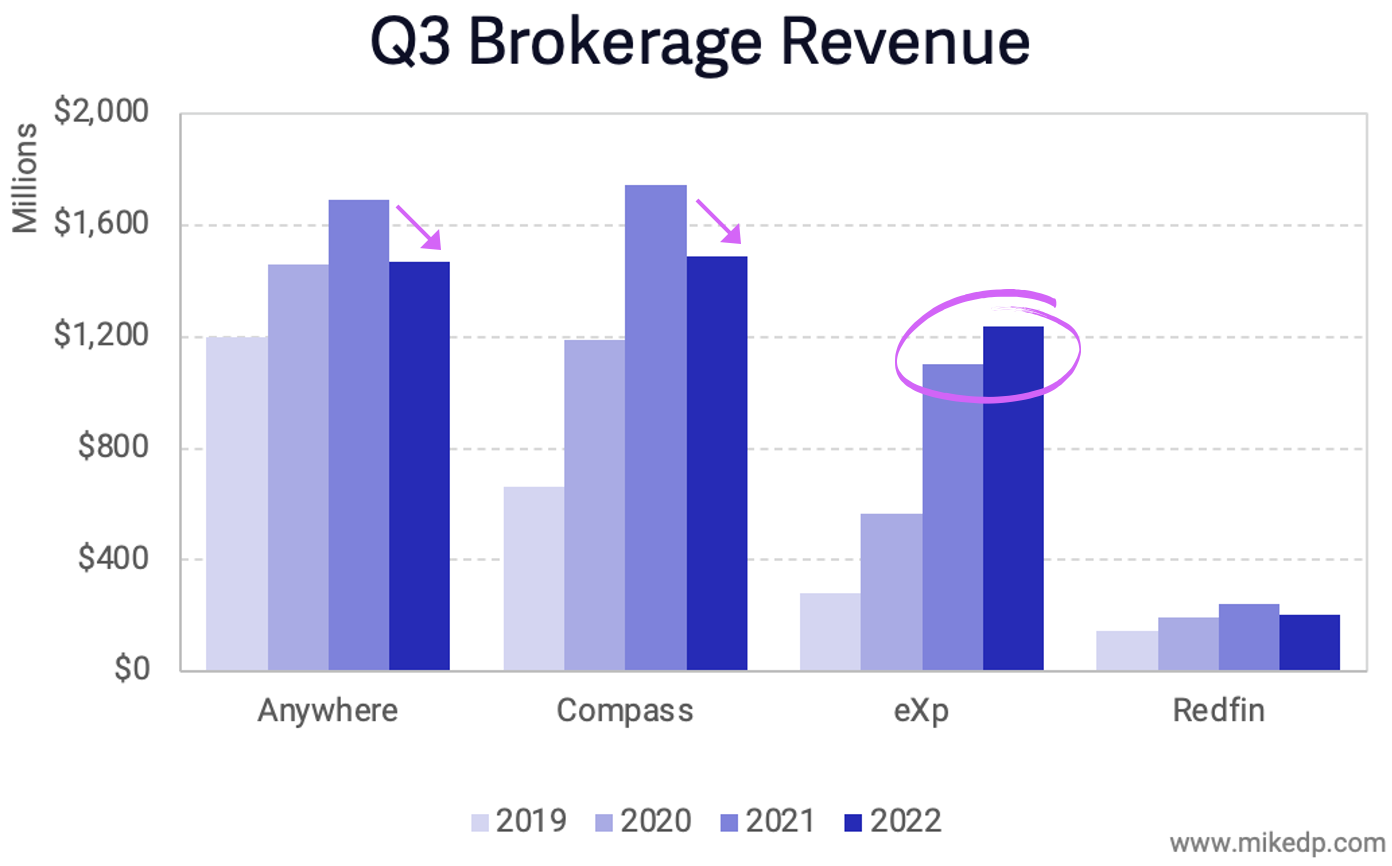

Compared to last year, most brokerages experienced a significant revenue decline in Q3 (remember, 2021 was an outlier).

The exception is eXp, which is benefiting from tremendous growth in agent count, transaction volume, and market share.

eXp’s year-over-year growth stands in notable contrast to industry heavyweights Anywhere and Compass, which both experienced year-over-year declines in revenue.

What to watch: It’s exceedingly likely that revenue will continue to decline for the next two quarters, which is absolutely normal from a historical and seasonal perspective.

The key metric to watch is the velocity of decline and how it varies between peers and compares to the overall market.

The bottom line: All brokerages are entering the literal and figurative winter of real estate.

The next two quarters are always the slowest in the industry, and coupled with a cooling market, are going to be especially challenging.

Fewer transactions and lower revenue will put pressure on all brokerages, with some affected more severely than others.