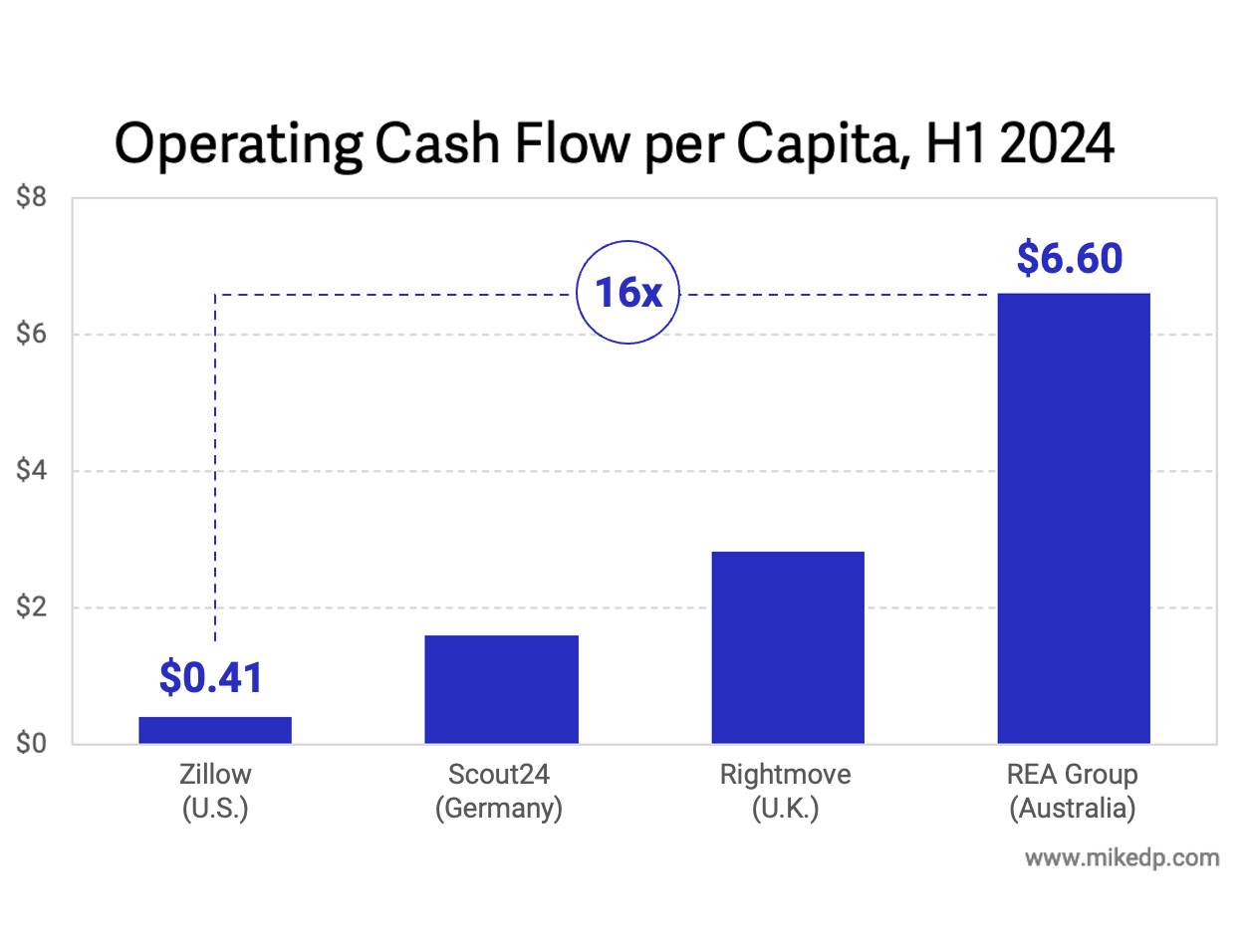

About the author: Mike DelPrete (email me)

Mike is a global real estate tech strategist, and a scholar-in-residence at the University of Colorado Boulder. He is internationally recognized as an expert and thought-leader in real estate tech. His evidence-based analysis is widely read by global leaders, and he is a sought-after strategy and new ventures consultant. His research and insights have featured in the New York Times, Wall Street Journal, Financial Times, and The Economist.