easyProperty: lessons in how not to build a business

/On March 29, easyProperty released its full year 2016 financials to the U.K.’s Companies House. While a few days early, it turns out that it wasn’t an April Fool’s Day joke. The numbers announced begged to be looked at further.

EasyProperty, launched in 2015, is a hybrid online estate agency in the U.K. It has a similar business model to Purplebricks and eMoov, which aim to sell houses for a low, fixed fee instead of a percentage-based commission, and thus disrupt the traditional real estate agency and brokerage model.

EasyProperty has raised just shy of of £40 million since inception, making it one of the best-funded entrants in the field (second only to Purplebricks).

What drew me to this story is the sheer amount of money raised and subsequently spent. According to its filings, easyProperty had a full year loss of £11.4 million in 2016, having lost £6.8 million the year before.

And what did that money buy? A staggeringly small £874,000 in revenue for 2016.

How did easyProperty manage to spend so much money and achieve such little market traction? It’s a crowded space, but there are a number of other players making significant gains. To me, this is a lesson in how not to build a business.

The Purplebricks comparison

Let’s look at Purplebricks for a comparison. It’s a direct competitor as a hybrid online estate agency, also a start-up, and because it’s publically listed has financials we can analyze (which I did so here, looking at how Purplebricks has successfully scaled).

Let’s start with an overview using the most recent data available. For easyProperty, this is its full year 2016 results. For Purplebricks, we have its half-year 2017 results, announced last December.

While the time periods don’t match up, it’s clear to see the disparity between spend and traction.

What’s striking is not how much money easyProperty is spending, but how little return it’s getting for that spend. Back when the business launched, Mr. Ellice, the CEO, is quoted as saying the company expects to be listing 4,000 to 5,000 properties each month by 2016. Two years later, the reality is around 80 properties per month.

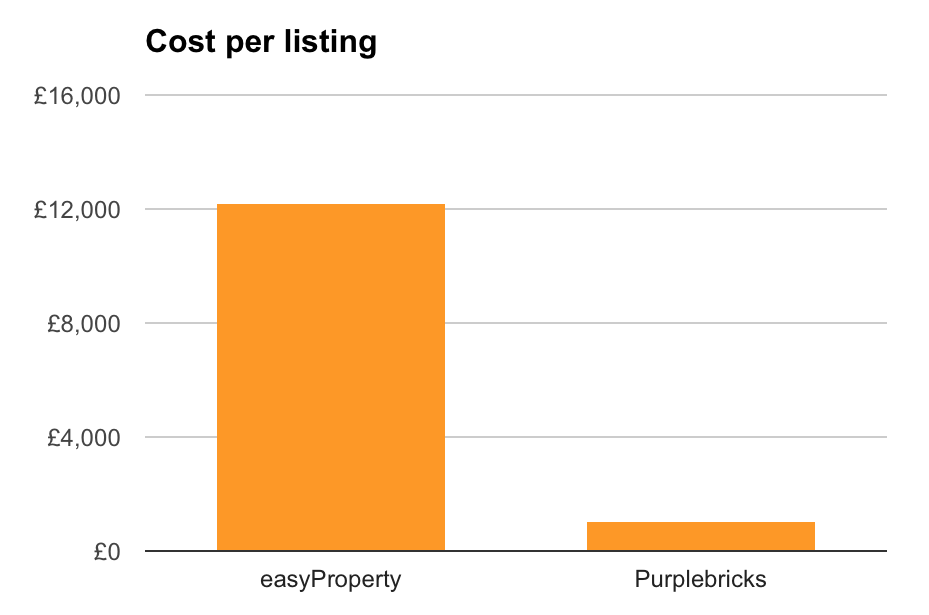

There are a few interesting ways to slice this data. First, let’s look at the total cost per listing. This is what each business is spending per listing. Clearly there will be economies of scale and it should be nonlinear, but looking at the metric is illuminating!

EasyProperty is spending around £12,000 for each of its listings, compared to around £1,000 at Purplebricks. That’s not a great return for the massive sums being spent.

At a higher level, we can also look at how much easyProperty is spending for each £1 in revenue. Spoiler alert: it’s not pretty.

So while Purplebricks is spending around £1 for every £1 in revenue (breakeven), easyProperty is spending £14 for every £1 in revenue. That’s an outrageously bad return on investment.

If easyProperty had simply given away 1,000 listings at its list price of £825 each, it would have cost the firm less than 1/10th of what it ended up spending in 2016.

Technology is not a key differentiator

There’s a choice quote in the director’s report: “The directors consider the level of technology within the business to be more sophisticated than its competitors in its capacity to be able to create and maintain product catalogues across multiple verticals and territories, including product variations, variable pricing and packages that may or may not have optional elements.”

I fundamentally disagree with the premise that technology is a key differentiator or represents a sustainable competitive advantage in this space. I’ve researched and spoken to dozens of leaders in this field around the world, and I’ve yet to find a correlation between an amazing technology platform and market traction.

As I recently wrote in my analysis of eMoov’s technology platform, the winning combination is people + technology. And as the eMoov case study makes clear, technology is only as good as the business behind it.

In other words, the fact that your technology supports packages that “may or may not have optional elements” is not a reason to think the business will succeed against competitors.

With a tech team of 26 developers (compared to eMoov’s tech team of nine), my sense is that easyProperty just needs to get on with it and stop investing millions in its technology platform.

Mo’ Money, Mo’ Problems

There are a number of businesses in this space around the world. The most successful have a great customer proposition and scrappy, driven founders with a burning desire to change the industry.

The director’s report states, “...as is typical for businesses at this stage of their lifecycle it is generating start-up losses as it uses working capital to develop the business.”

I’m not sure that I would describe this situation as “typical.” Purplebricks generated losses to build the business. EasyProperty is just spending a lot of money.