Rightmove's Growth Continues to Slow

/Rightmove announced its half-year financial results today, with revenue growth continuing to slow (down to 9.7 percent).

Why it matters: This is a continuation of the "Rightmove dilemma" of a narrow strategy with slowing growth, and no other revenue streams. It's neither good nor bad, but a fact that investors (and my readers) should be aware of.

A narrow strategy with slowing growth

Rightmove, the U.K.'s leading real estate portal, is a company that I frequently analyze. It is a global leader in the field with a unique, focused strategy.

In my latest report, The Future of Real Estate Portals, I discuss the Rightmove dilemma extensively. Unlike many other portals, it has not diversified its products or revenue streams beyond the core listing advertising business.

The strategy has served the business well for the past decade, but the strategy is beginning to show limitations. Revenue growth is slowing, and today's announcement shows a continuation of that trend.

The two key numbers

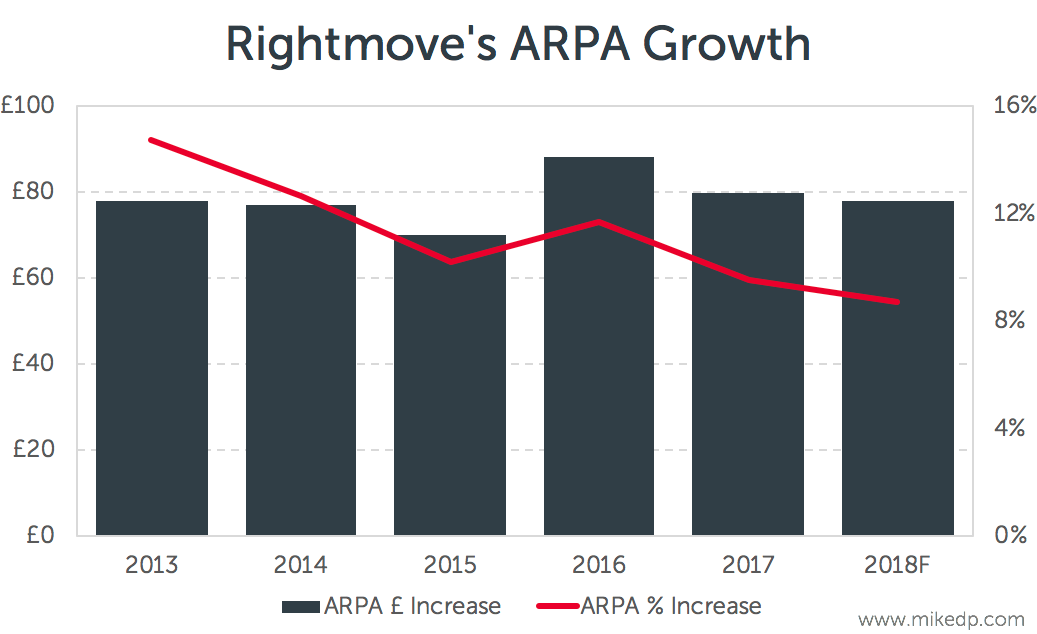

The key narrative is growth, with two key numbers: revenue growth and ARPA (average revenue per advertiser) growth.

Once an additional decimal is added, Rightmove's results show annual revenue growth of 9.7 percent (which it rounded up to 10 percent). This is the lowest number in years, and is the first time it has dipped below 10 percent.

Because Rightmove has not diversified its revenue streams, revenue growth is almost entirely driven by ARPA growth (how much it is able to charge its customers). This number, too, is dropping.

ARPA growth for the half-year is down to 8.3 percent, and is projected to stay at that rate for the full year. Once again, this is the lowest number in years. Rightmove can only raise its prices so much.

Implications for Rightmove

This is not the demise of Rightmove. It is still an incredibly strong business, with nearly-impregnable network effects that will likely protect its core business for years. The dilemma is about growth, and the right strategy to match its ambitions. Its growth prospects are challenged.

Rightmove is bumping up against the glass ceiling of price rises; growth is slowing. Slowing revenue growth is leading to tighter cost control, which could inhibit its ability to invest for the future.

Rightmove has not diversified its revenue streams. Nothing new is taking up the slack in the revenue slowdown. It has been promoting new premium features and new products for over a year, but they are not stopping the decline in growth.

Implications for real estate portals

For other real estate portals, there are a number of takeaways to this story:

Despite your market dominance and powerful network effects, there is a limit to how much revenue you can extract from your customers each year. It will slow over time.

Additional premium products and services take more effort to build, and are valued less by your customers.

Continued revenue growth comes from diversification into adjacent revenue streams.