Opendoor: Down, But Not Out

/This week Opendoor announced it was laying off 35 percent of its workforce, or around 600 people. The move, designed to give Opendoor more runway, increases its chances of survival, but comes at a competitive cost -- and is far from the largest layoff the industry will see in 2020.

A Tactical Retreat is Not a Defeat

The biggest mistake anyone can make is confusing this move with the failure of the iBuyer business model. Pausing new home purchases, controlling costs, and reducing headcount are all sensible strategies in the current environment. Common advice to business leaders during uncertain situations is simple: conserve cash.

The strategies taken by iBuyers are signs of a smart business trying to survive a market downturn. Blindly pushing ahead, regardless of a rapidly changing environment, is not a smart strategy. And a tactical retreat to reassess the situation and reallocate resources is not a defeat.

The Biggest Layoffs Have Yet to Come

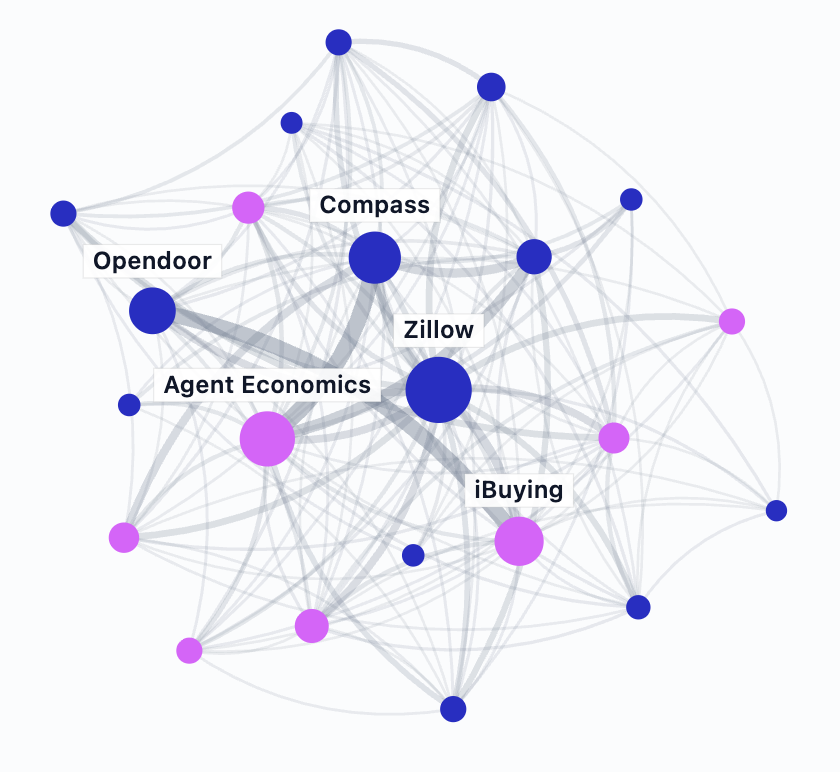

Massive layoffs are occurring across the real estate industry. The ones that involve full time employees generate press: Opendoor, Redfin, and Compass. But those pale in comparison to the largest “workforce reduction” that will occur in slow-motion over the next six months -- real estate agents.

Real estate agents are independent contractors that work for themselves. They don’t issue a press release when they’re out of work; they simply disappear from the workforce.

In 2019, there were about 1.3 million real estate agents in the U.S., supported by about $70 billion in commissions (that’s $54,000 per agent). If the total number of transactions in 2020 drops as expected -- perhaps up to 50 percent -- there’s $35 billion less in commissions to support those agents. During the financial crisis of 2008, the industry lost about 25 percent -- or 300,000 -- active agents.

Just because Opendoor, Redfin, and Compass are announcing layoffs is not a repudiation of their business models; it’s a reflection of their employment models. Layoffs will hit the traditional industry just as hard; it just won’t be in a press release.

Deep Pockets Win

While Opendoor claims it is well capitalized and in a healthy financial position, it’s not in a healthy enough position to completely avoid layoffs (as is the case with arch-competitor Zillow, which outlined cost-cutting measures that didn't include layoffs).

Opendoor’s move buys it time to weather the storm, but at the expense of weakening the business. Saying goodbye to 35 percent of a well-oiled team puts it at an executional disadvantage to pre-covid Opendoor. And to Zillow.

In my Inman presentation from February 2019, I said that companies with deep pockets will win. Opendoor’s deep pockets allow it to weather the current storm and remain intact (albeit smaller). Zillow’s deeper pockets allow it to weather the storm and keep the team together, giving it a potential advantage in the coming recovery.