Offerpad and Its More Profitable Flavor of iBuying

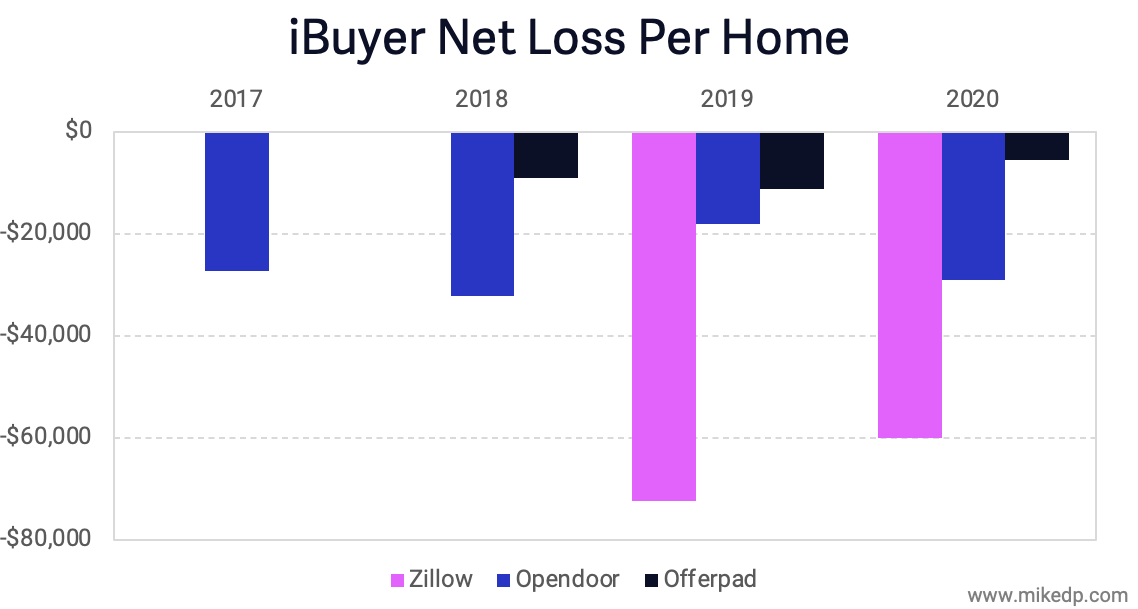

/The Offerpad story presents the clearest signal yet that iBuying can become profitable. Its latest Q1 2021 numbers show a business only losing $230 per home bought and sold -- a breathtaking achievement compared to losses of tens of thousands of dollars per home at Opendoor and Zillow.

All up, on a GAAP basis, Offerpad's Q1 net loss was just $233k, compared to $58 million for Zillow Offers and $270 million for Opendoor. Staggering differences.

Background

Following Opendoor, Offerpad was the second iBuyer to launch in the middle of the last decade. In terms of size, it was eclipsed by Opendoor but has maintained parity with Zillow, buying and selling more than 4,000 homes per year.

Offerpad's version of iBuying stands out because it is losing radically less money than its peers. Offerpad's overall net loss per home is significantly lower than Zillow and Opendoor -- $5,400 compared to Opendoor's $29,000 in 2020. And it's overall net loss in 2020 was $23 million, twelve times smaller than Opendoor's $286 million.

Comparing Unit Economics

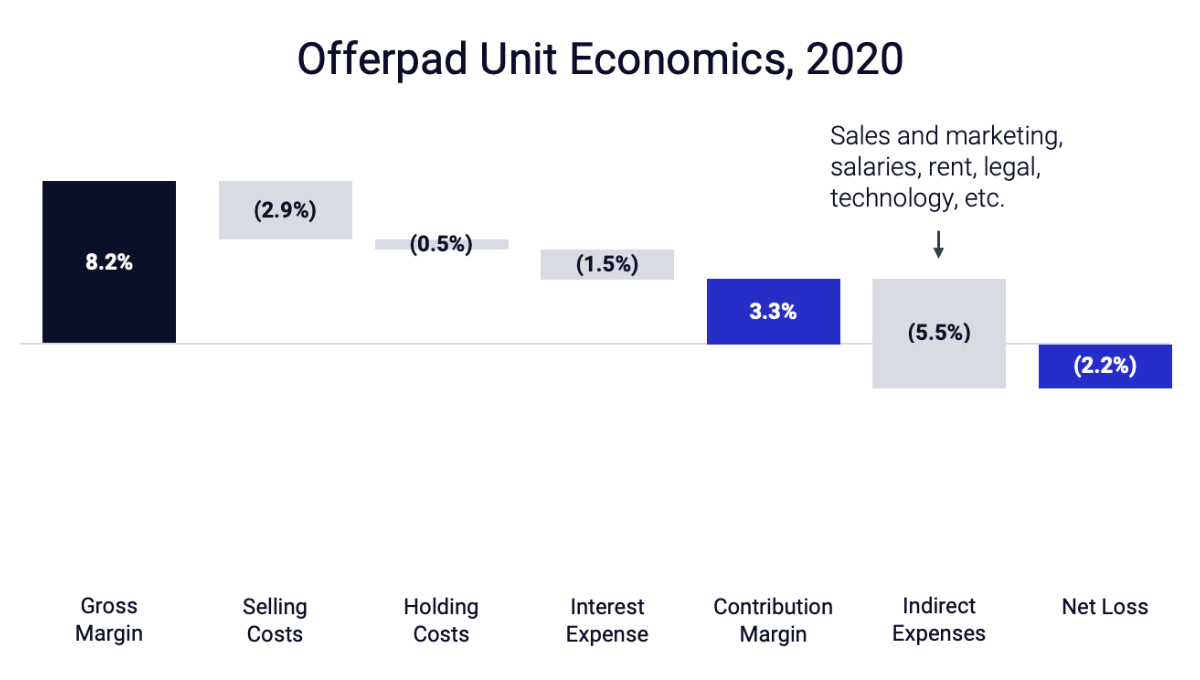

Financially, there are two possible explanations for this difference: either Offerpad is generating more revenue, or it is incurring less expense, per home bought and sold.

On the first point, the evidence suggests nearly identical revenue generation at Offerpad and Opendoor, as measured by gross margins (this accounts for purchase price, sale price, renovations, and ancillary services).

Both companies are tracking above Zillow, with all iBuyers seeing significant gross margin gains in Q1 2021 due to higher home price appreciation in the current market (and Opendoor is almost certainly benefiting from withholding new listings in 2020).

Offerpad and Opendoor have very similar direct costs as well (as measured by selling costs, holding costs, and interest expense in the charts below). The primary difference appears to be in each company's indirect expenses.

The unit economics between the two companies are nearly identical. But as a percentage of revenue, Offerpad's indirect expenses were 5.5 percent in 2020, compared to Opendoor's 14.6 percent (and Zillow's 17.5 percent). This is the key difference driving profitability.

Indirect Expenses

Each company has three main expense lines:

Sales, marketing and operating

General and administrative

Technology and development

Sales, marketing and operating generally scales with volume; it includes selling costs, holding costs, and other costs directly involved in the transaction. General and administrative consists of corporate overhead like executive and admin salaries and rent, while technology and development includes all tech costs, including headcount.

The iBuyers have vastly different approaches to their technology investment; Opendoor is spending about eight times more on technology and development than Offerpad (and both companies are dwarfed by Zillow -- but given Zillow's wider technology ecosystem, I'm going to focus on an Opendoor comparison).

Since 2018, Opendoor has invested over $150 million into technology, compared to just over $20 million at Offerpad.

Offerpad's General and Administrative (G&A) expense -- think of it as general corporate overhead -- is also well below its peers. Again, Opendoor is outspending Offerpad by a factor of eight.

The differences in investment aren't explained by volume. In 2019, Opendoor sold about 4x the houses as Offerpad, but its overhead and tech costs were about 7x higher. In 2020, Opendoor sold about 2x the houses as Offerpad, and its overhead and tech costs were about 8x higher (a trend that continues into 2021).

Certainly each company has slight variations on how it accounts for expenses, but the overall narrative is clear: In aggregate and on a per unit basis, Offerpad is spending a fraction of what Opendoor is on technology and corporate overhead, resulting in significantly lower indirect costs.

The Impact of Technology

How does Opendoor's $150 million technology investment compare to Offerpad's $20 million? Looking at the bottom line, the results show a negligible difference and no competitive operating advantage.

I would expect technology development to allow iBuyers to more accurately price homes, improve operational efficiency, or reduce expenses -- but Offerpad and Opendoor have nearly identical unit economics and direct selling costs (Opendoor's gross margin advantage is being driven by home price appreciation, which is a gravy train that won't last forever).

Two Teams, Two Approaches

Offerpad and Opendoor are illustrating two different approaches to iBuying specifically, and venture-fueled disruption more generally.

Each company raised radically different amounts of venture capital before becoming public companies. At $1.3 billion, Opendoor had nearly 10x the capital to grow the business compared to Offerpad. The amount of capital raised is a direct result of differing growth mindsets, and has enabled two different growth strategies.

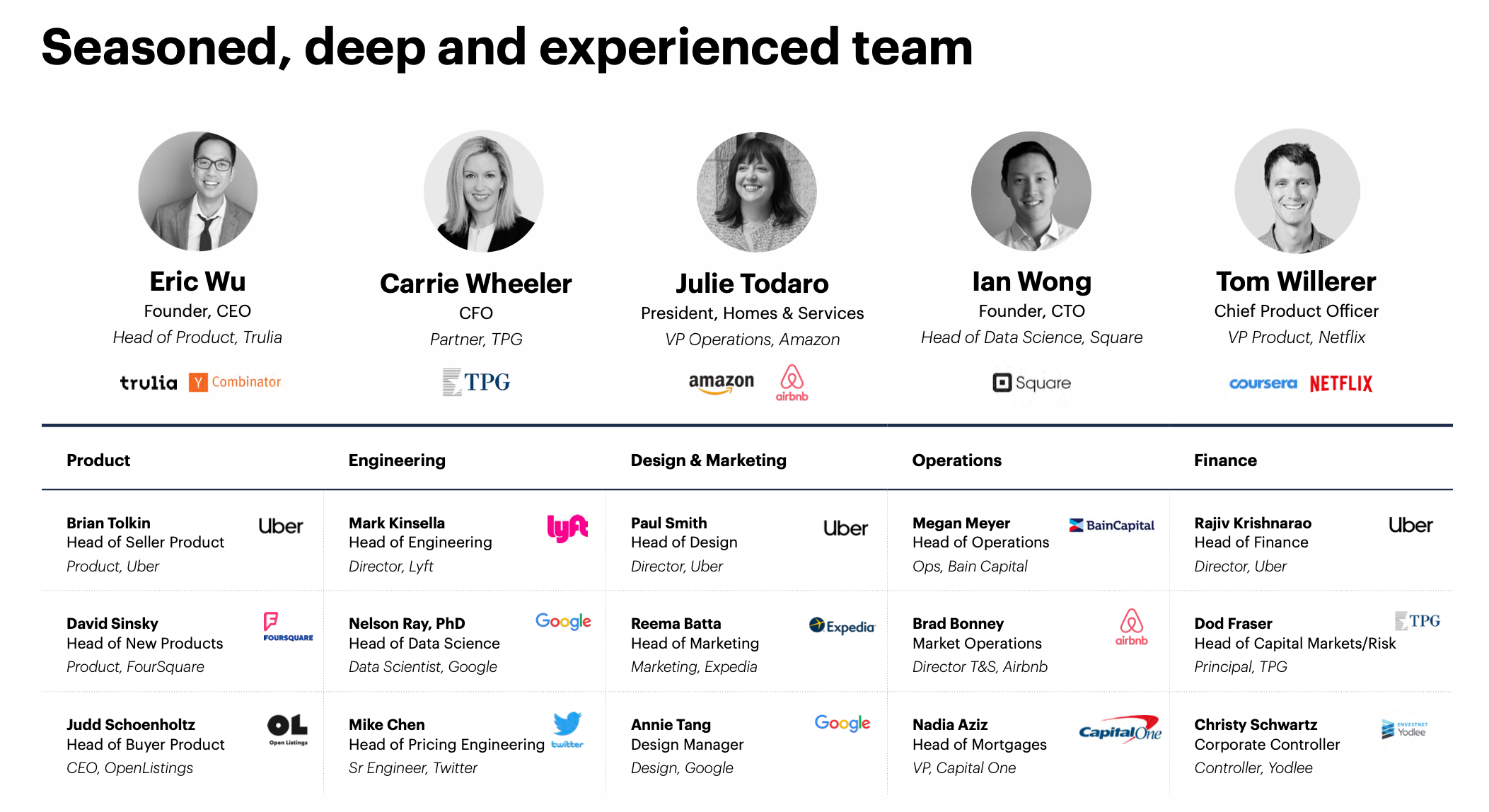

A look at each company's management team is illuminating. Nearly half of Offerpad's team come from a real estate background, including a co-founder (not pictured) that also co-founded single family rental behemoth Invitation Homes.

Contrast this with Opendoor, where not one single person listed has a real estate background. It appears that all of its executives come from venture-funded technology businesses.

The end result is two completely different teams with completely different approaches -- one centered in real estate, and the other centered in technology.

Strategic Implications

Offerpad's latest financials strongly suggest that a less venture-funded, less tech-enabled, more real estate focused, and less breakneck version of iBuying can be (almost) profitable.

And while Offerpad is nearly profitable on a small scale, perhaps it also suggests that Opendoor and Zillow can become profitable on a large scale -- not at 4,000, but at 40,000 houses per year -- once sales volumes catch up with overhead expenses.

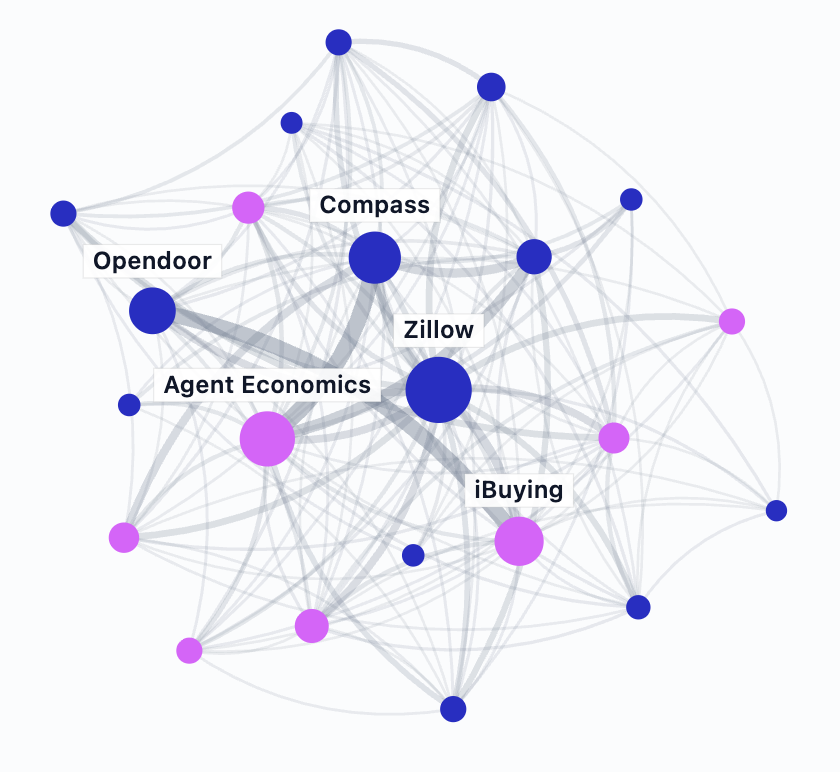

Finally, the Offerpad story raises questions around the true value of technology in real estate. Like Compass' massive investment in technology (and WeWork before it), Opendoor is over-investing in tech with little to show for it on the bottom line. Technology helps create a great story, but at the end of the day, real estate is still...real estate.