Agent Compensation at the Top U.S. Brokerages

/Agent compensation structures at U.S. real estate brokerages vary, with some firms paying out a significantly higher percentage of their revenue to agents than others.

Why it matters: Commission and fee structure is foundational when it comes to agent loyalty and recruitment; as agents seek to maximize their earnings, they're naturally drawn to brokerages offering higher splits and lower fees.

Dig deeper: Brokerages generate revenue from the commission on the sale of a house.

The brokerage and agent then effectively split the commission, through a varied combination of commission splits, fees, and revenue sharing.

Once added up, the result is a percentage of total brokerage revenue that is paid out to agents – ranging from 77 to 96 percent in this analysis.

The low-fee / high-split brokerages like eXp Realty, Real, RealtyONE, Fathom, and United end up paying significantly more of the commission out to agents.

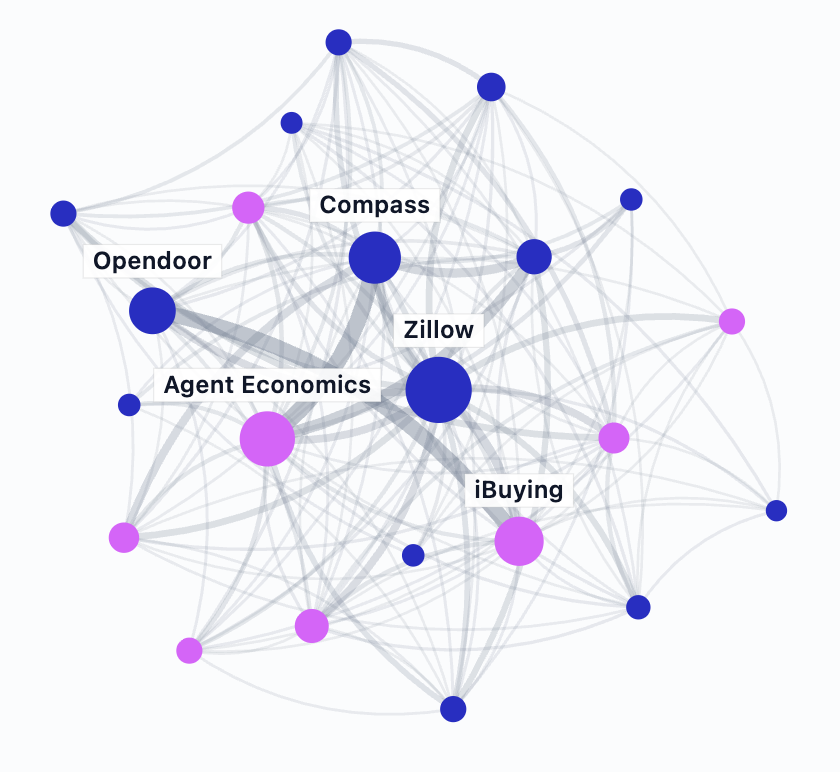

Compass, which famously offered agents high commission splits as a recruitment incentive, is, on aggregate, closer to traditional industry stalwart Anywhere (home of Coldwell Banker and Sotheby's) than the others.

Compass is paying its agents less over time, through a combination of reducing existing agent splits, recruiting new agents with lower splits, and higher fees.

The one percent reduction in revenue paid out to agents over the last two years represents about $9.5 million retained by Compass and not paid out to agents in Q1 2023.

Compass highlights this achievement, which it is clearly proud of, in its quarterly earnings, declaring that its “commissions expense as a percentage of revenue” is “improving.”

In fact, Compass is so pleased with this achievement that it is the first data point in its earnings press release and the second financial highlight, behind total revenue, in its investor presentation.

Enjoy it while you can; after this article, I doubt Compass will be highlighting these numbers so strongly in the future – and it certainly won’t kick off its agent gatherings with the same metrics.

Agents like to make money, so it’s unsurprising that as natural entrepreneurs they flock to brokerages where they can maximize their earning potential.

It’s no coincidence that the top 5 brokerages that grew agent count over the past quarter are the exact same brokerages that paid the most out to agents: eXp, Real, Fathom, RealtyONE, and United.

The bottom line: It’s a simple equation: More money attracts more agents, and more agents sell more houses.

Brokerages paying a smaller proportion of revenue to agents is an effective strategy to improve short-term financials, but the long-term implications around agent recruitment and retention are significant.

In a period of fewer transactions and overall belt-tightening, it's more important than ever for agents to carefully consider commission splits when deciding where to work.