Agent Migratory Patterns

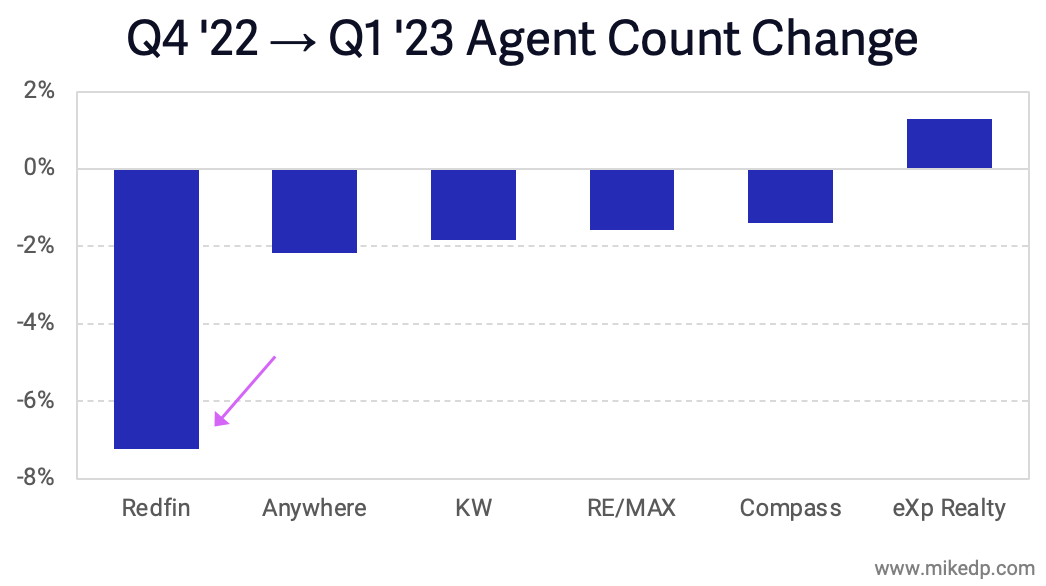

/The first quarter of 2023 saw a variety of winners and losers in terms of brokerage agent count – the numerical manifestation of agent recruitment and retention.

Why it matters: As I’ve previously asserted, agents are central to the real estate transaction; growth in transaction volumes goes hand in hand with growth in agent count, because agents sell houses.

Dig deeper: Disruptive, low-fee brokerages like eXp Realty, Real Brokerage, United Real Estate, and RealtyOne all added agents during the first three months of the year.

Meanwhile, some of the largest incumbent brokerages and franchises – Keller Williams, RE/MAX, and Anywhere – all lost agents.

The five largest brokerages and franchises in this list – Anywhere, Keller Williams, RE/MAX, Compass, and eXp Realty – account for over 427,000 agents, down 1.1 percent from the previous quarter.

Among them, only eXp Realty grew its agent count from the last quarter.

Redfin, with less than 2,000 salaried principle agents, is the downside outlier after three rounds of layoffs.

Real Brokerage is the clear upside outlier, growing its agent count over 20 percent – to 10,000 agents – from the previous quarter.

10,000 agents is considerably fewer than Anywhere’s 58,000 or RE/MAX’s 82,000, but Real is catching up to Compass’ 28,000 agents.

Speaking of Compass, Q1 2023 was the first time that the brokerage’s agent count decreased.

Context is important: many brokerages lost agents!

But Compass is no longer in the ranks of “fast growing brokerages,” a category it dominated over the past three years – that mantle now passes to eXp Realty and Real (and several other low-fee brokerage models).

What to watch: Agent migration patterns are a significant leading indicator of future brokerage growth.

In a period of belt-tightening and fewer transactions, agents are moving away from traditional brands and flocking to relatively newer models where they're able to keep more of their commission.

The bottom line: Agents – and not AI, machine learning, a sophisticated CRM, a one-click transaction, nor any other tech buzzwords – sell houses.

This period of market scarcity reveals the brokerage business models able to thrive in a downturn, as well as those facing more fundamental challenges.

To identify the brokerage business models of the future, one simply needs to follow the agents.