Opendoor, Zillow, and the iBuyer Business Model

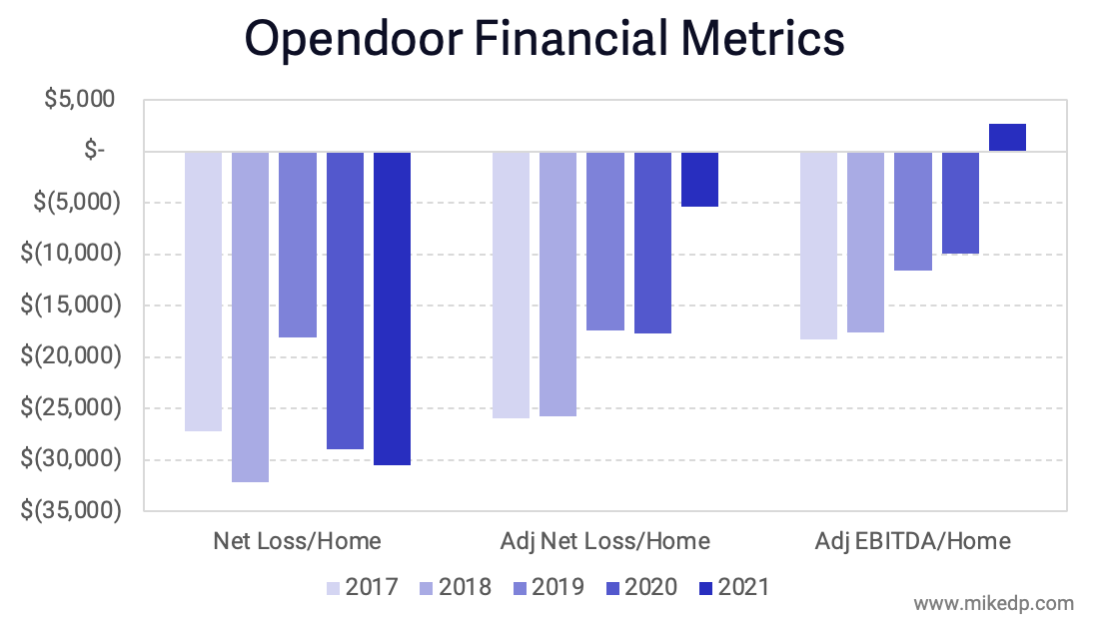

Instant buyers, or iBuyers, represent one of the most revolutionary changes to occur in real estate. They aim to transform how consumers buy and sell houses – shaking up a large industry. Billions of dollars have been invested into iBuying since 2014, and the field is led by ambitious, well-funded, and well-equipped disruptors.

The iBuyer Business Model

The Opendoor and iBuyer business model is relatively straightforward:

Opendoor buys houses and owns them, acting as a middleman (as opposed to a matchmaker) in residential real estate transactions.

Opendoor won’t buy every house -- qualifying properties include single-family homes built after 1960 with a value between $125,000 and $500,000.

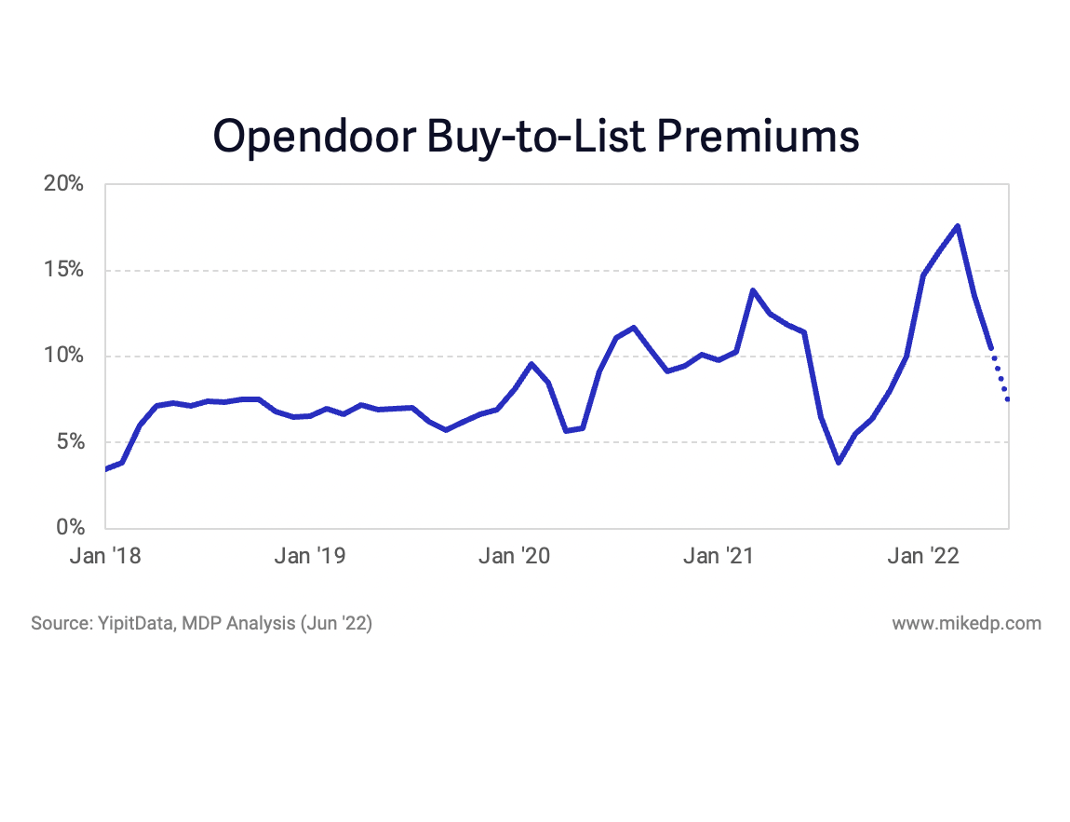

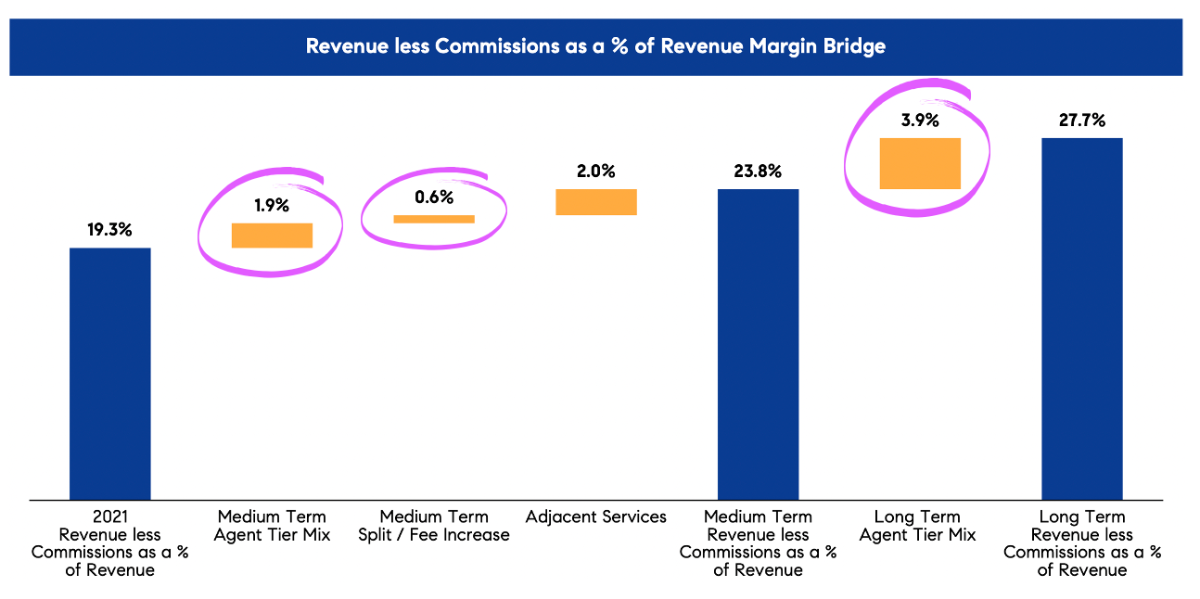

Opendoor makes money in two ways: from the service fees it charges, and from any difference between what it buys houses for and what it sells them for.

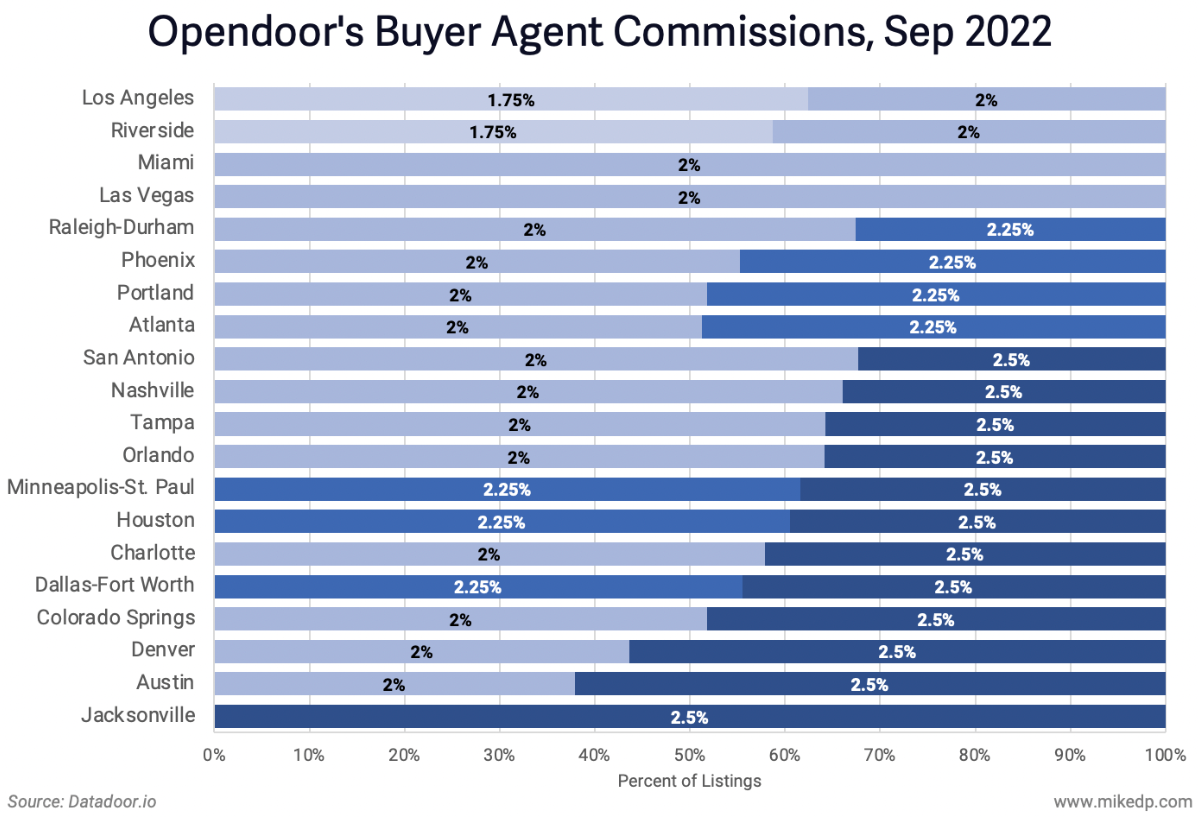

Opendoor works with real estate agents, offering to pay full buyer commissions, as well as seller commissions if a sale comes from an agent.

Opendoor charges a variable fee for its services, starting at 6 percent and rising to 12 percent for more risky properties. The average fee falls between 8 percent and 9 percent for sellers, which is higher than the standard 6 percent fee charged by traditional real estate agents. But with the higher fees come certainty around a transaction.

The customer proposition for using Opendoor is strong. For home sellers, Opendoor offers to eliminate all of the hassle and uncertainty of selling a house with a simple, transparent offer. In other words: don’t worry about fixing the fence, mowing the lawn, picking the right agent, and wondering if and when your home will finally sell.

Who are the iBuyer Companies?

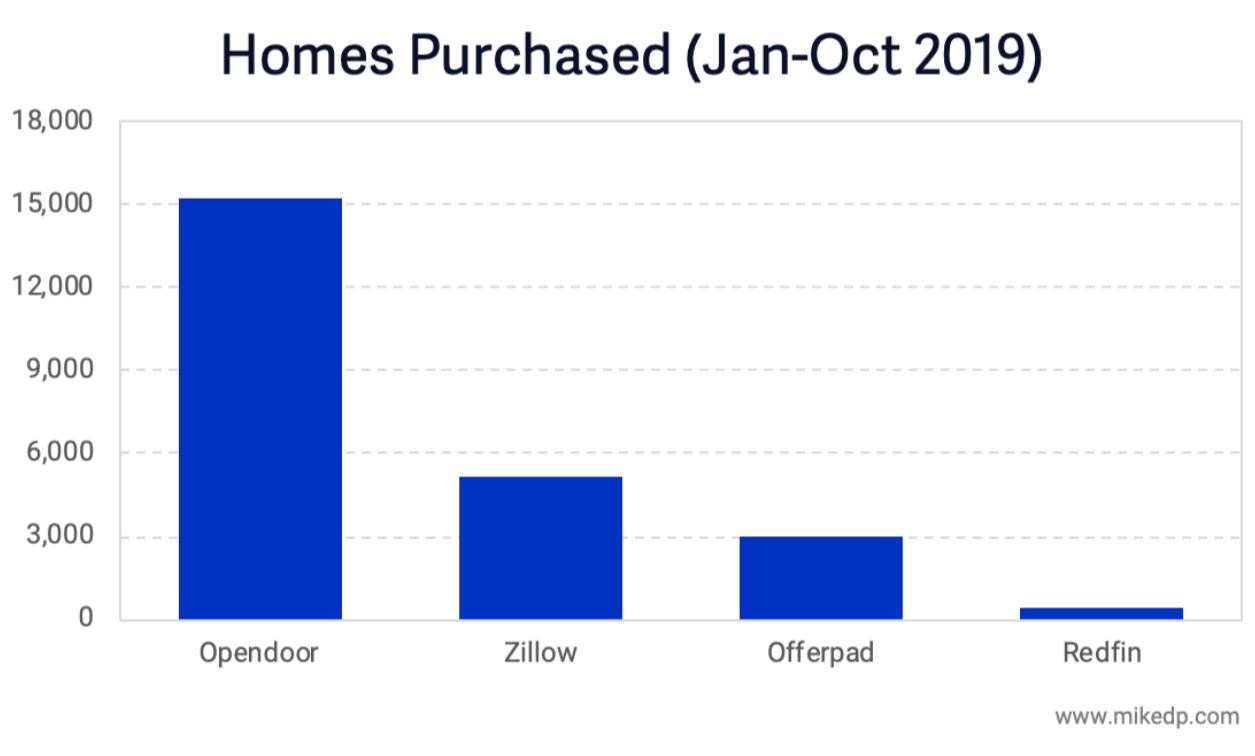

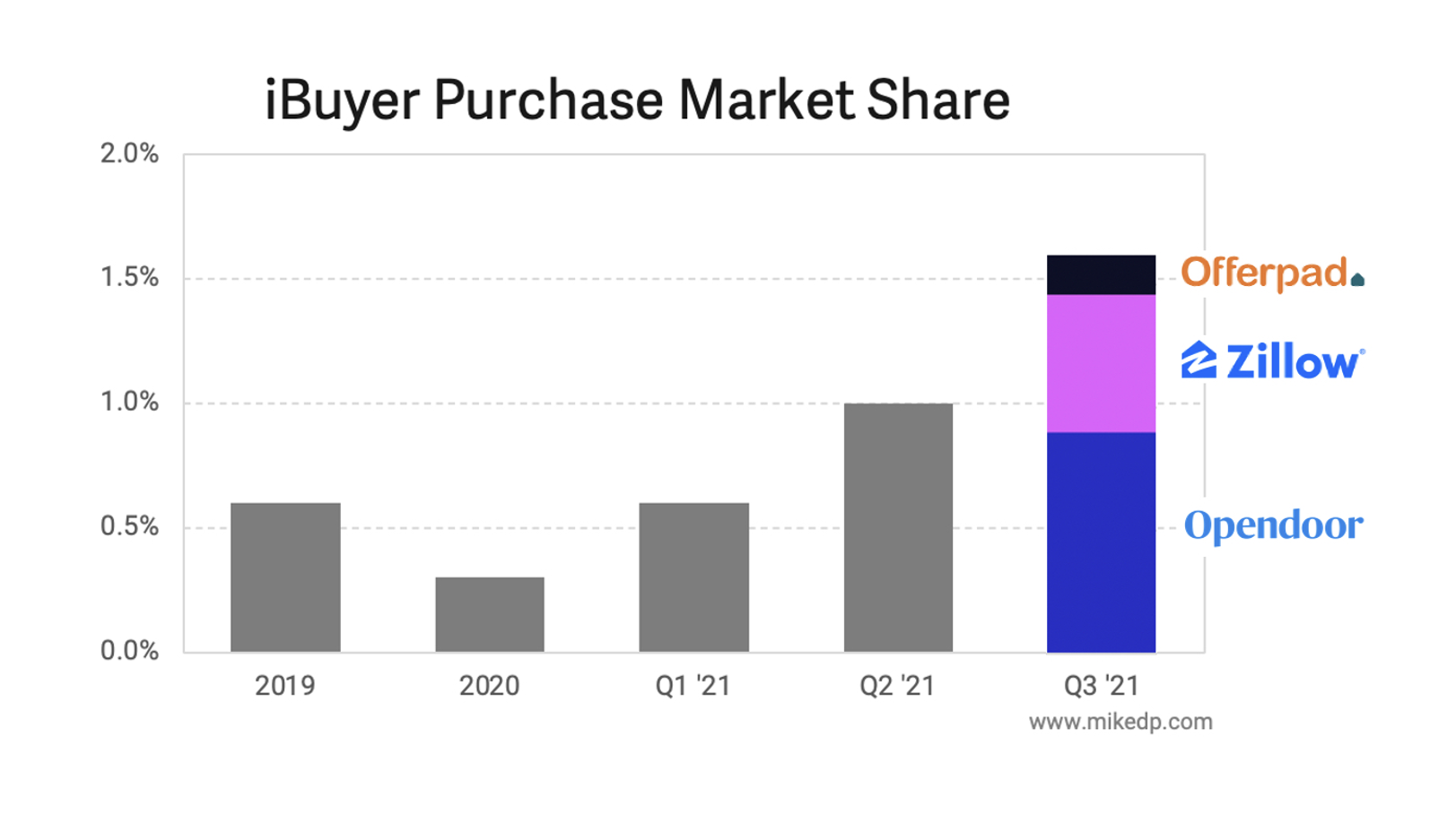

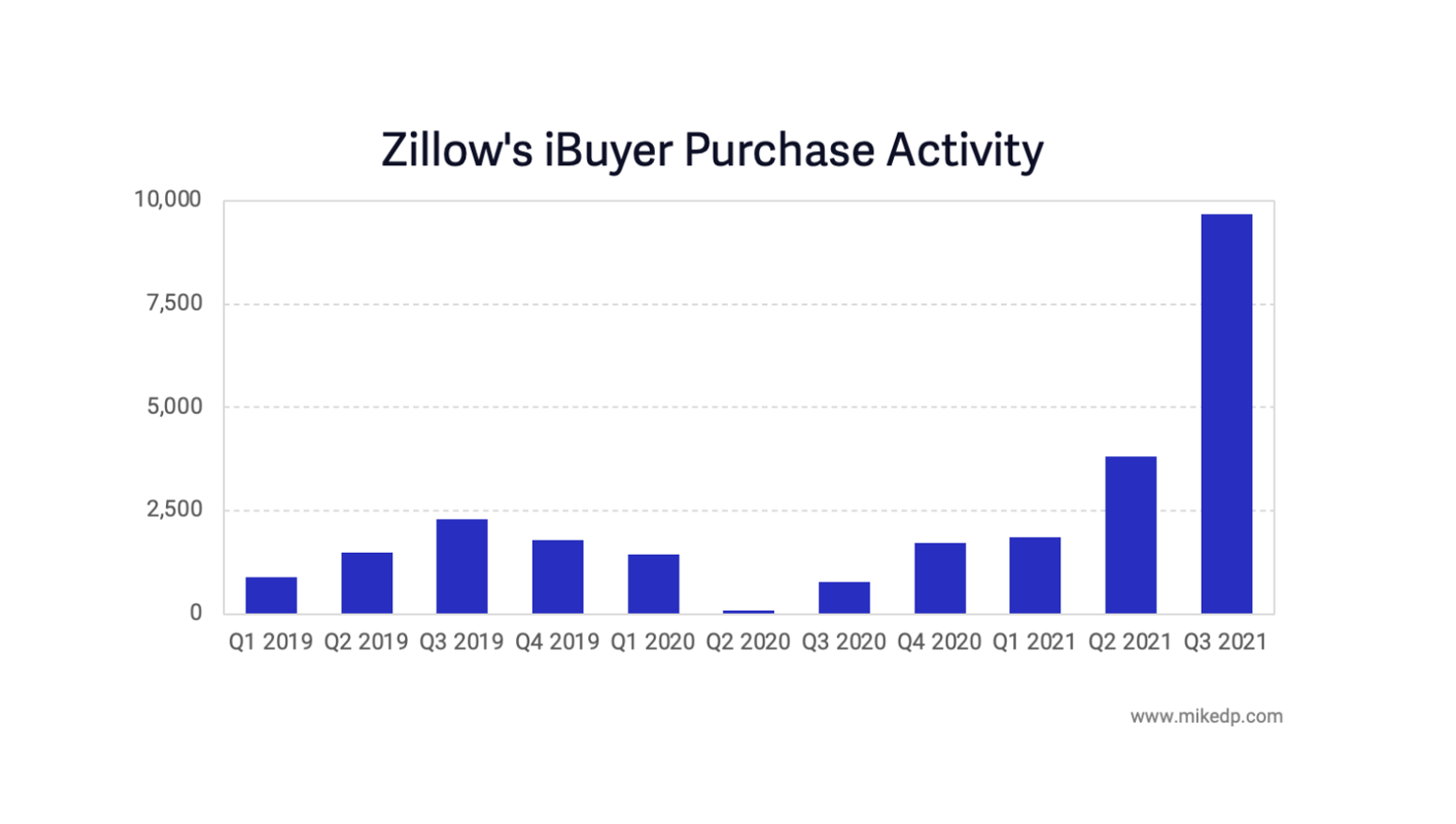

There is a second-tier of iBuyer companies, including Redfin, Perch, Knock, and others — but none have the national footprint, funding firepower, and transaction volumes of the leaders. Opendoor and Zillow account for roughly 86 percent of iBuyer transaction volumes.

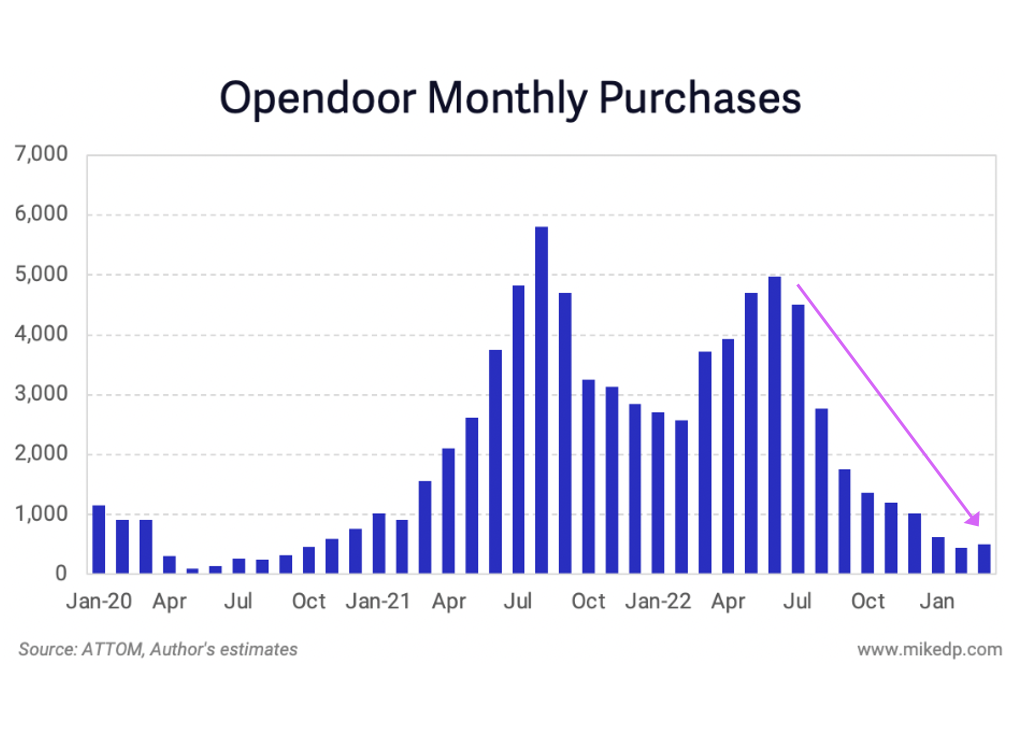

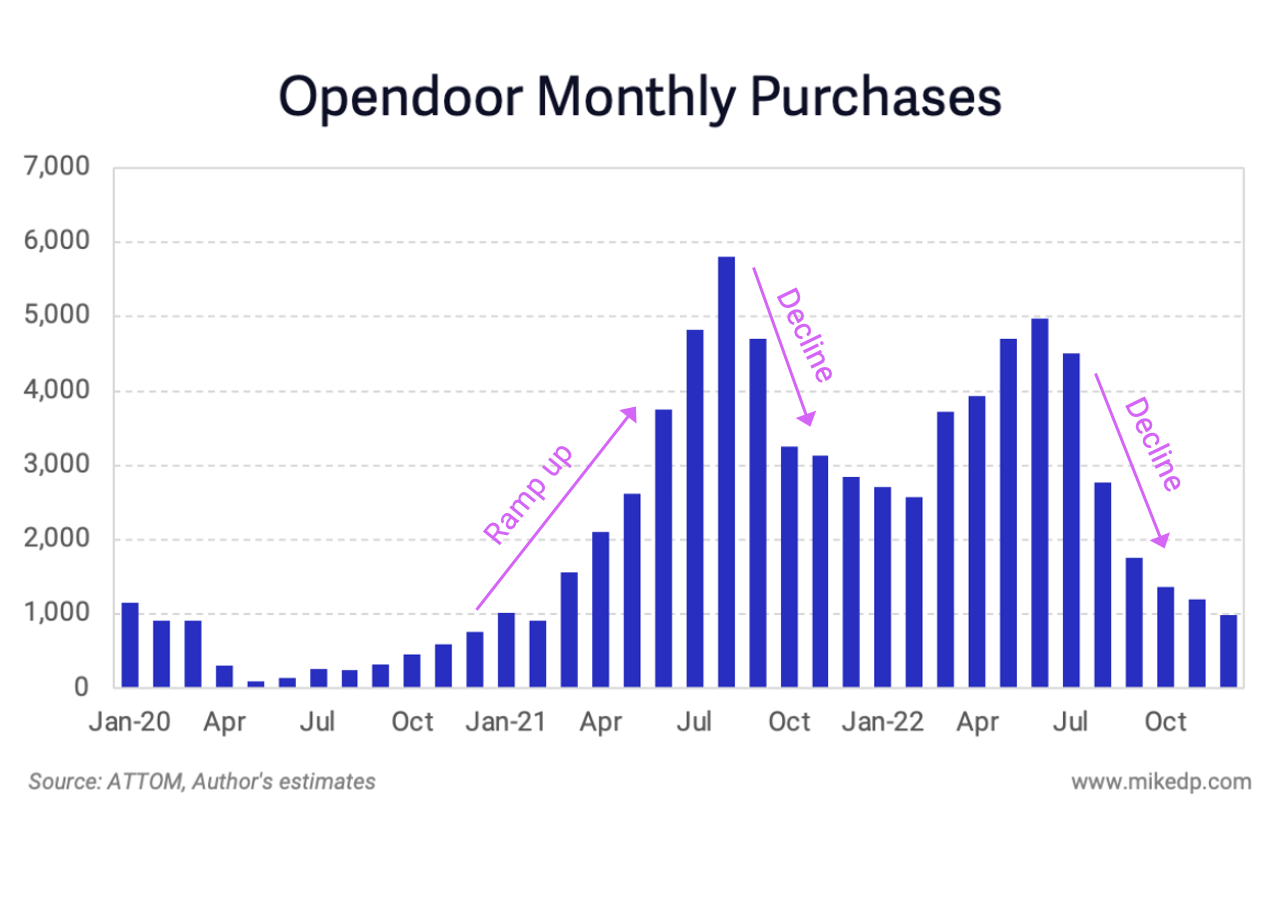

The largest iBuyer companies have differing strategies. Opendoor's entire business model revolves around buying and selling as many homes as possible. At scale, it becomes a powerful business. Zillow, on the other hand, may want to moderate its home purchases to achieve a scale where it maximizes seller leads.

Watch a video of me giving an update on iBuyers in 2020.

Do iBuyers Like Opendoor and Zillow Make Fair Market Offers?

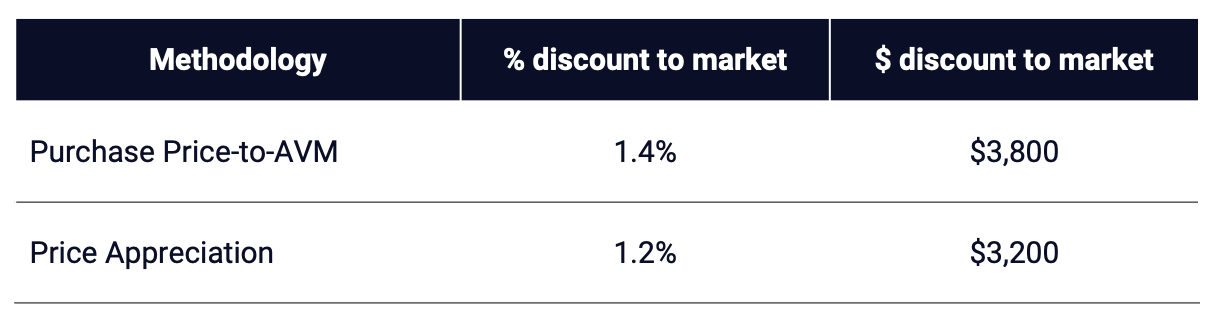

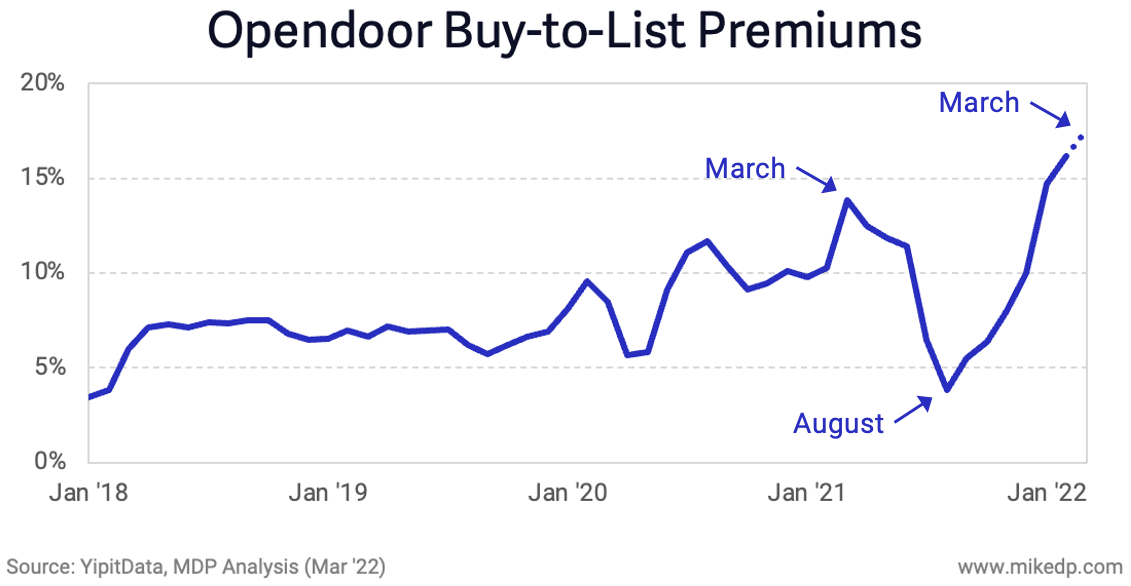

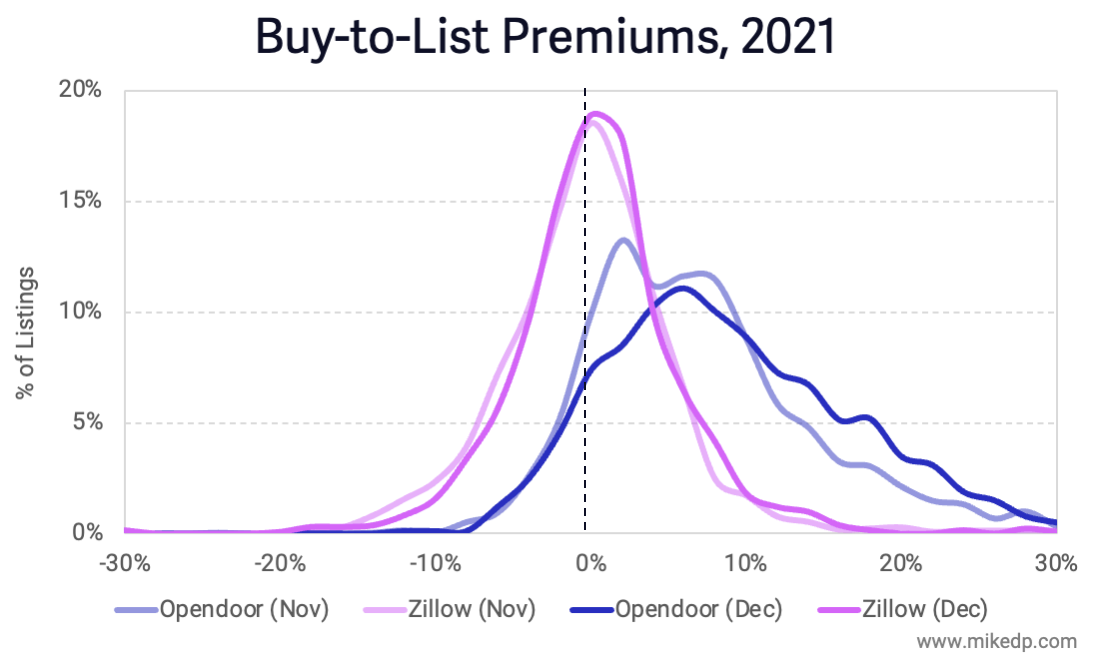

This research study addresses a fundamental question in real estate: Do iBuyers like Opendoor and Zillow make fair market offers on the homes they purchase? This has been a point of contention since the iBuyer business model launched, with opponents claiming that iBuyers purchase houses at well below market value, while iBuyers claim they provide consumers fair market offers.

The evidence in this research study strongly suggests that iBuyers are offering close to fair market value for the homes they purchase. Multiple methodologies based on independent, third-party data suggest a discount to market value of around 1.3 percent -- or $3,500 on a $270,000 house.

iBuying is Zestimate 2.0

When Zillow launched in 2006, its Zestimate was its claim to fame. The Zestimate was a lead generation tool that attracted consumers by giving them a starting point for determining what their home -- or any home -- is worth. It was online, it was fast, and it was easy.

I believe Zillow's guiding strategic principle is that it must be consumers' first destination in the home buying and selling process. Zillow's sustainable competitive advantage lies in its massive audience and strong position at the start of the consumer journey.

Watch a video of me discussing Zillow’s strategy.

However, the entry of iBuyers with a service that made instant offers on a home – online – was novel and compelling, just like the Zestimate in 2006. Suddenly, more and more consumers were beginning their home selling process not on Zillow, but on other web sites like Opendoor and Offerpad. This was a key existential threat for Zillow.

The iBuyer business model is Zestimate 2.0 – the natural starting point for determining your home’s value. What’s more accurate than an actual offer on your home?

The Value of Seller Leads

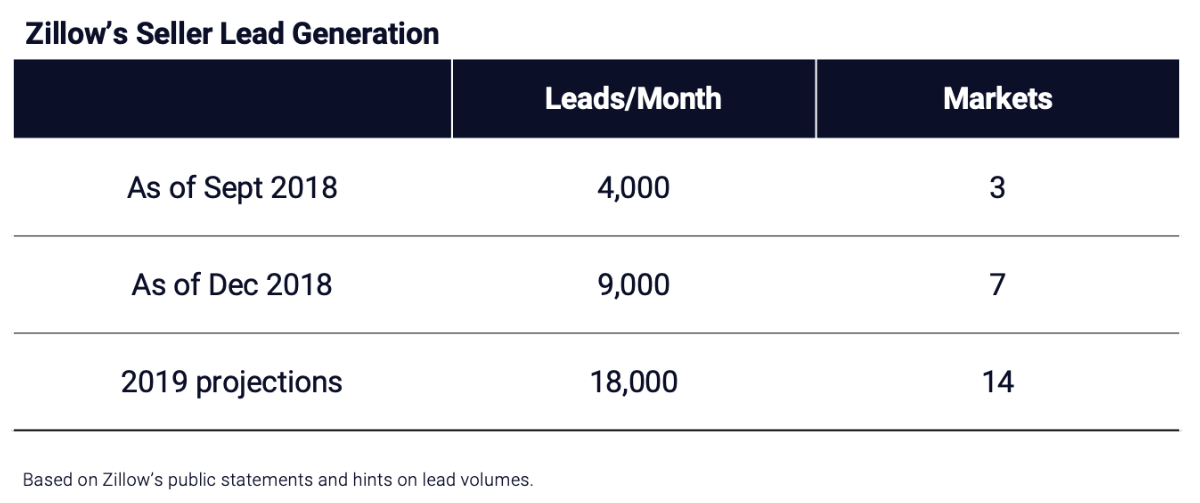

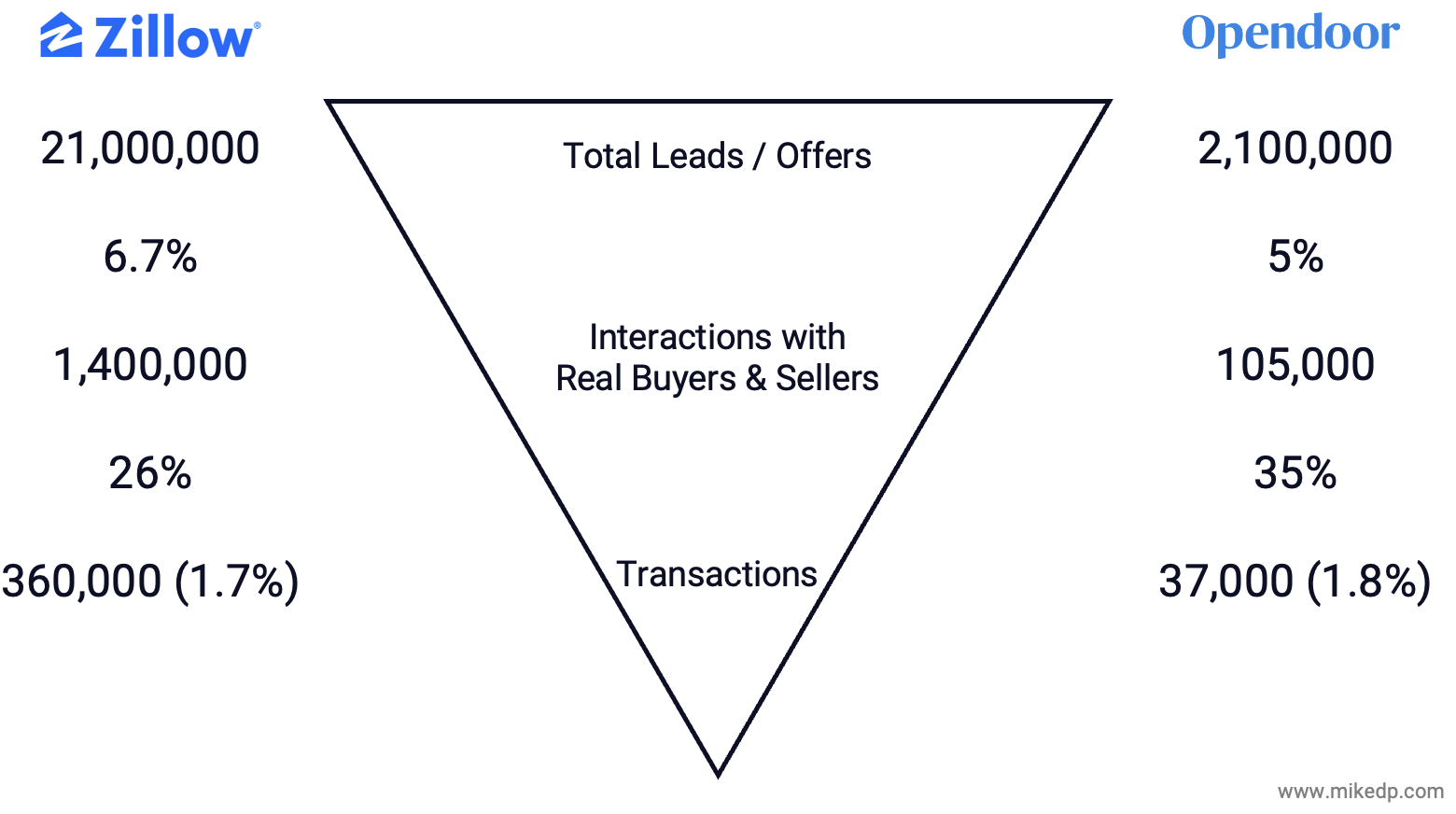

The iBuyer business model generates an incredible amount of seller leads: consumers that are interesting in seller their house. And if you’re thinking about Zillow and Opendoor as iBuyers and you’re not thinking about seller leads, you’re thinking about it the wrong way. Seller leads are the real billion dollar opportunity.

In 2018, Zillow said that since launch, nearly 20,000 homeowners have taken direct action on its platform to sell their home. Of those, it purchased just about 1 percent of homes (around 200). That leaves about 19,800 leads who remain interested in selling their homes.

If Zillow simply sold those leads at $100 a pop, they're worth nearly $2 million. But the real opportunity is giving those leads to premier agents in exchange for an industry-standard referral fee, about 1 percent, if the property sells (similar to the Opcity business model).

Here's the kicker: Zillow claims about 45 percent of consumers that go through the Zillow Offers funnel end up listing their home. That's a high conversion rate reflective of a high intent to sell; about 10 times higher than Opcity's conversion rate.

Zillow is a lead generation machine, and its recent foray into iBuying is no exception. If you're in the industry and your value proposition to agents is seller lead generation, there's a new game in town. Zillow will be able to generate a massive volume of seller leads with higher intent than almost any other source. If successful, this will have significant implications across the industry.

Strategic Analysis: The 2020 iBuyer Report

The 2020 iBuyer Report is a 150+ slide, evidence-based look at the world of instant home buyers. Unmatched in its breadth and depth, it explores behind-the-scenes, nation-wide data and presents an unbiased strategic analysis of the sector, the players, and the implications.

iBuyer articles, analysis and reports

Conference calls and webinars on Opendoor, Zillow Offers, and iBuyers

Zillow’s New Strategy: Insights, Implications, and Analysis was an evidence-based, 60-minute webinar on Zillow’s strategic shift to iBuying. I dived deep into the strategy, numbers, and implications of Zillow's latest move, in addition to fielding questions.

The iBuyer Intelligence Briefing was a 60-minute conference call on the latest iBuyer news, key insights, and strategic implications for the real estate industry. A deep dive to talk about what's going on and why it matters -- all with an evidence-based approach.

iBuying in Europe: Adapting a Winning Model was a behind-the-scenes, 60-minute conference call exploring the details of getting iBuying right in European markets, as well as how the model disrupts the selling and buying of homes.