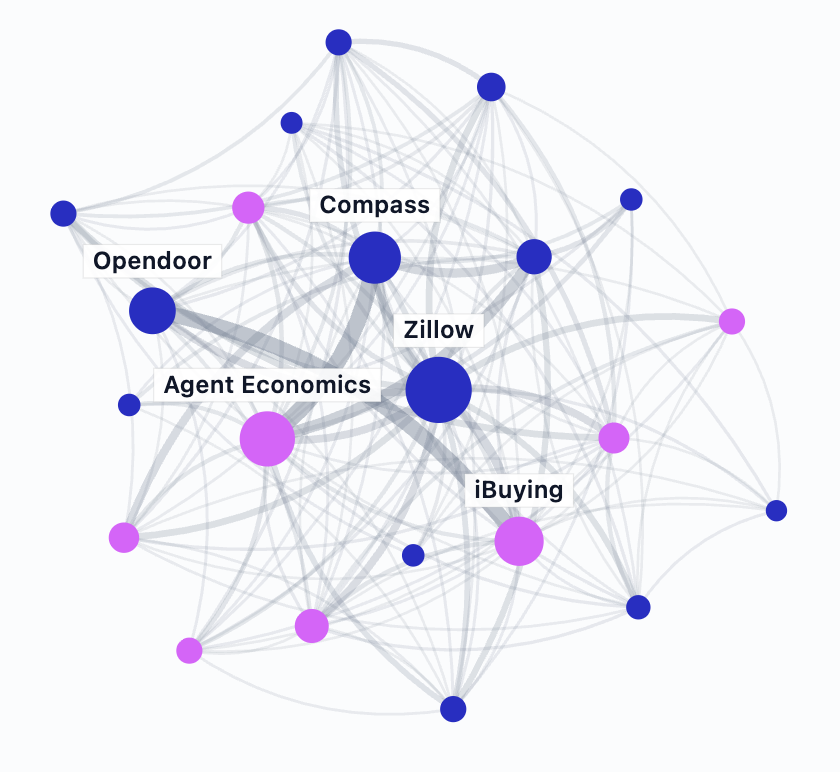

'Go Big or Go Home': Opendoor's High-Stakes Game of Disruption

/Opendoor recently posted its Q4 financial results, revealing mega losses alongside early signs of a possible turnaround.

Why it matters: In 2022, Opendoor experienced an absolutely devastating test of its business model – a worst case scenario event – and survived.

The damage was brutal in terms of financial losses, but the company is still around and operating, whereas most companies would have succumbed to this type of existential event.

Behind the numbers: Opendoor posted a net loss of $1.4 billion in 2022, on top of already sizable historical losses.

Opendoor, and many other venture-funded disruptors, are burning billions of dollars to grow new business models – and the lack of profitability just doesn’t matter.

The most noteworthy fact is that Opendoor lost $1.4 billion in 2022 and is still operating (albeit with a new CEO).

Cash is king: Manufactured financial metrics aside, Opendoor has plenty of (but not unlimited) cash reserves.

Opendoor ended 2022 with $1.3 billion in cash, cash equivalents, and marketable securities – down from $2.2 billion at the beginning of the year.

That’s cash burn of $934 million – massive losses, but a scenario that Opendoor was able to weather without raising additional capital (or going bankrupt).

Like many companies, Opendoor is racing to cut its operating expenses as quickly as possible.

In November, it laid off about 18 percent of staff, and just recently announced that it had reduced its run-rate expenses by approximately $110 million.

Operating expenses are trending significantly lower – a positive sign for a company looking to conserve cash (note: sales, marketing and operations flex up and down based on the number of home sales).

The focal point upon which the future of the business rests is when Opendoor will turn the corner and stop selling homes for a loss.

Homes that Opendoor purchased in Q3 and Q4 are performing much better, with positive gross margins.

Yes, but: The first homes to sell always have the best gross margins – over time, with price reductions, gross margins fall – as expertly illustrated by Datadoor.io.

What to watch: Cash, cash, cash – Opendoor’s future as a going concern rests on its ability to fund loss-making operations.

With $1.3 billion in the bank and the worst behind it, the company appears to have plenty of runway.

The bottom line: Opendoor is playing a high-stakes game of disruption.

With billions in the bank and billions in losses, the company is living by the creed, “go big or go home.”

After experiencing its single largest challenge in a challenging history, Opendoor persists – which may be the biggest takeaway from a brutal year.