A Strategic Analysis of the Compass v. Zillow Court Hearing

/Robert Reffkin, CEO of Compass. Courtroom sketch courtesy of Elizabeth Williams, used with permission.

Last week I attended the best industry event I’ve ever been to. Over a dozen executives from Zillow and Compass were “on stage” for three days, discussing private exclusives, home search competition, highlighting evidence, and revealing their internal strategic planning processes – all under oath and subject to cross-examination.

Why it matters: The Compass v. Zillow preliminary injunction hearing in federal court provided a valuable foundation to look at one of the most important power moves occurring in real estate: the battle over exclusive inventory.

The big takeaway: I’ll revisit this at the end, but regardless of this court case’s outcome, I don’t believe anything will change.

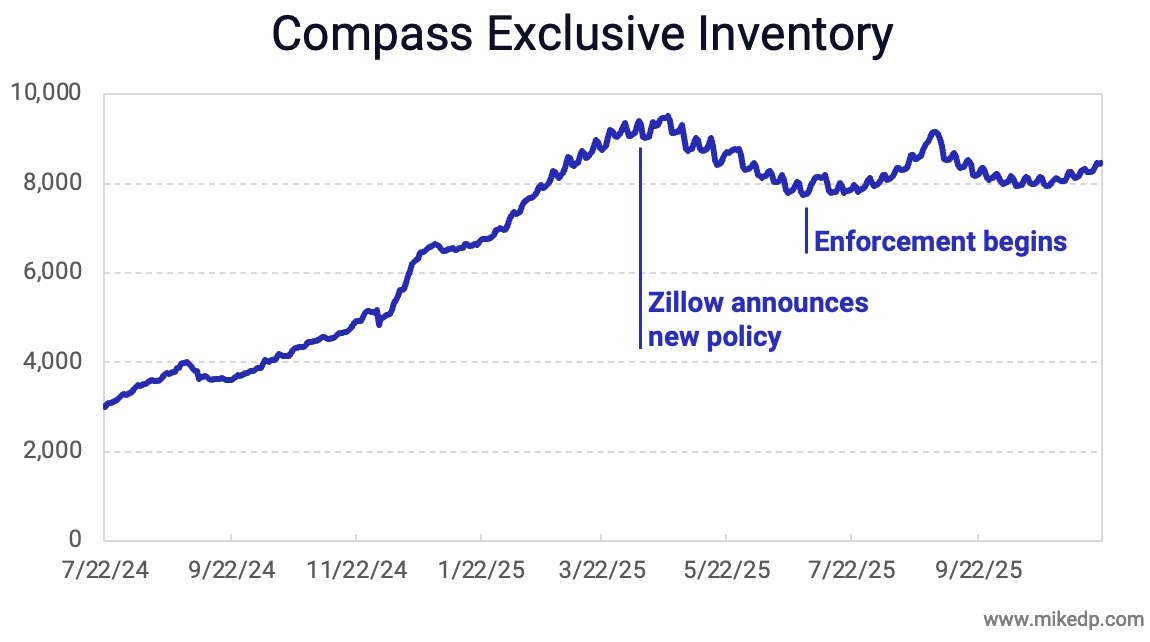

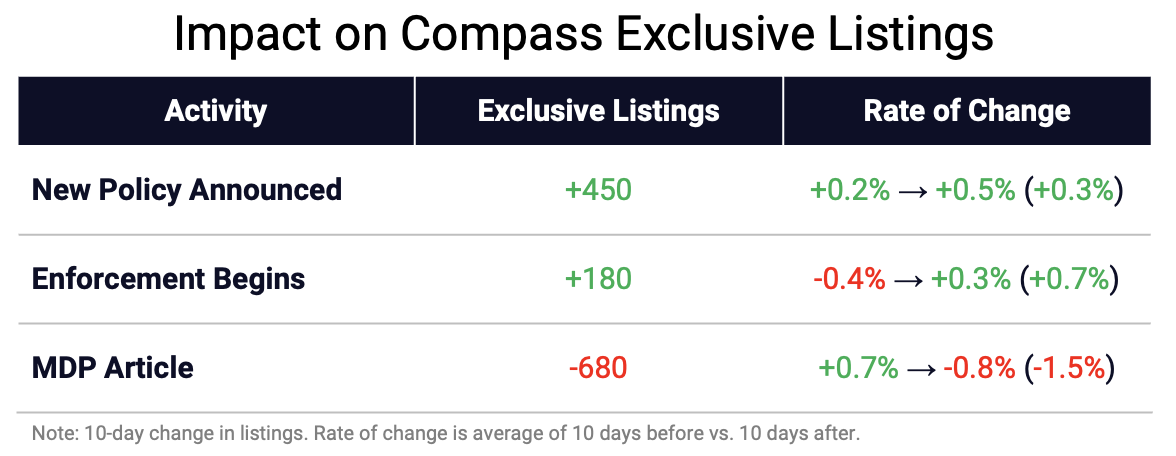

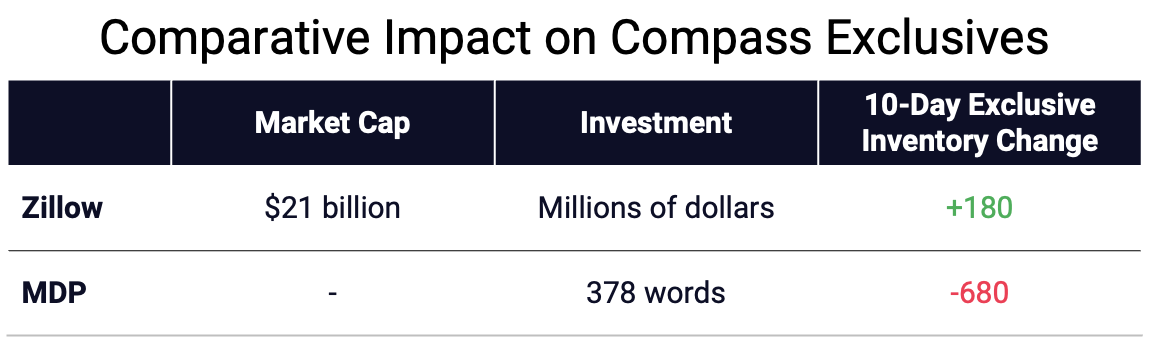

Throughout the past 12 months of passive and active opposition to Compass’s strategy, nothing has materially suppressed adoption of its exclusive inventory program.

Plus, there is so much grey area in real estate, I believe that if Compass, agents, or homesellers want to continue this practice (as they’ve done for decades), they’ll find a way.

The hype tends to outrun the reality with these things: remember how the commission lawsuits and NAR’s revised clear cooperation policy were going to “change everything?”

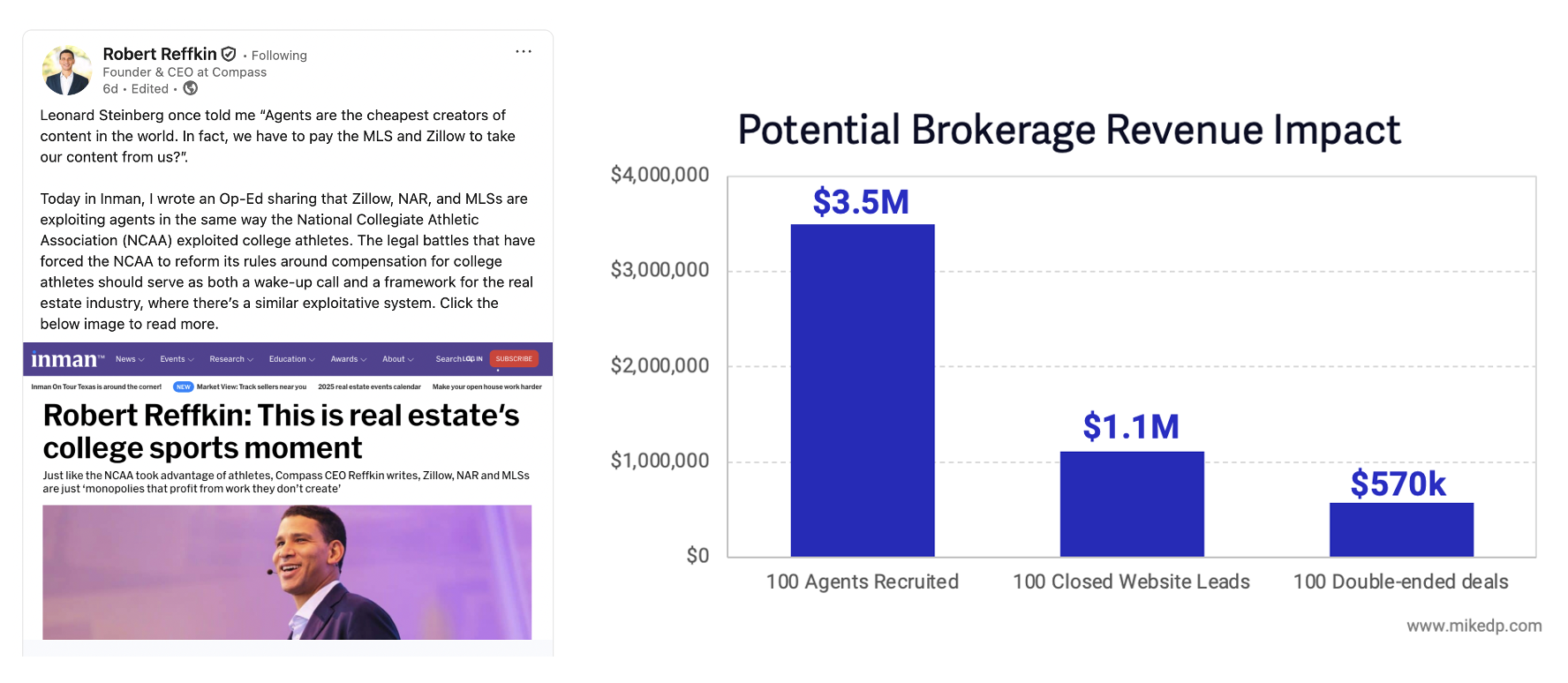

The court hearing and associated evidence made it clear that behind the pro-consumer positions, there were clear business motivations driving both company’s decisions and strategies.

Zillow saw the rise of private listing networks, led by Compass, as a threat and explored a variety of “hardline tactics” to induce agents and brokerages to continue putting listings into the MLS and, therefore, Zillow.

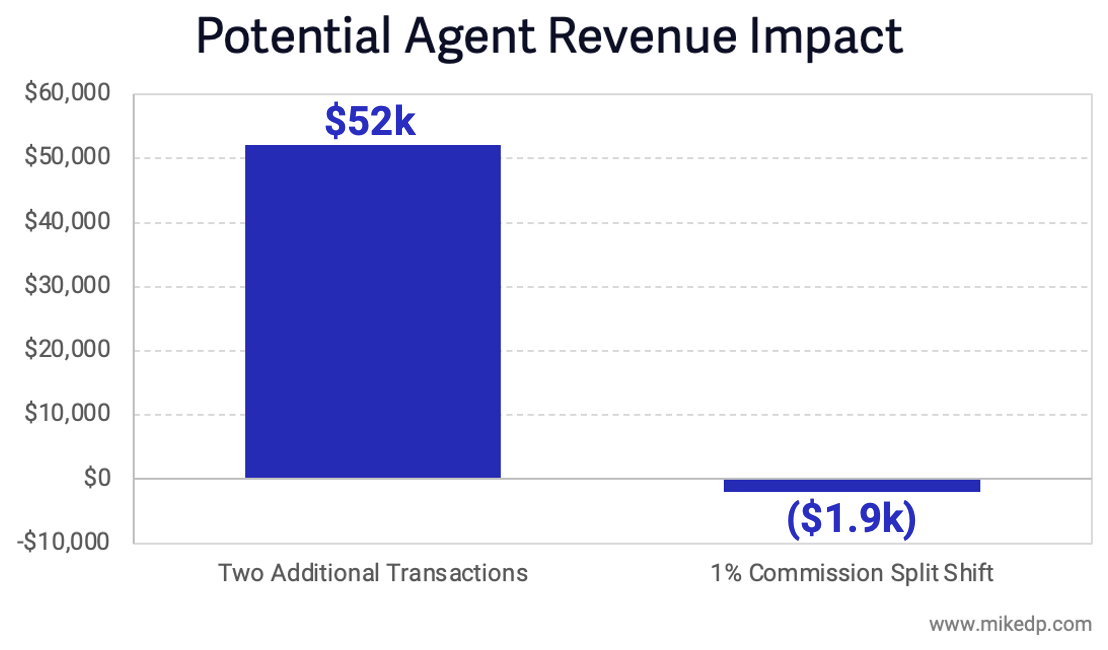

Compass was clear that its strategy is about competitive differentiation, giving their agents an advantage in the market, and if it's good for its agents, it's good for Compass.

Jeremy Wacksman, CEO of Zillow. Courtroom sketch courtesy of Elizabeth Williams, used with permission.

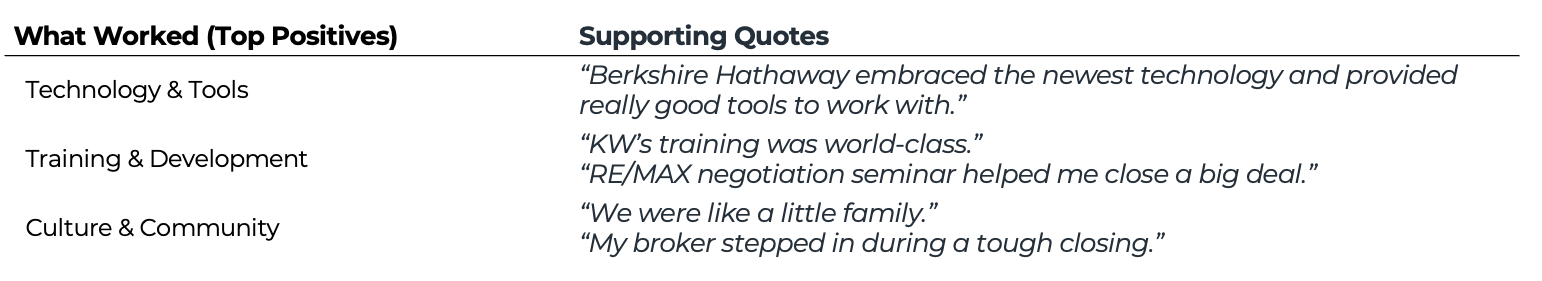

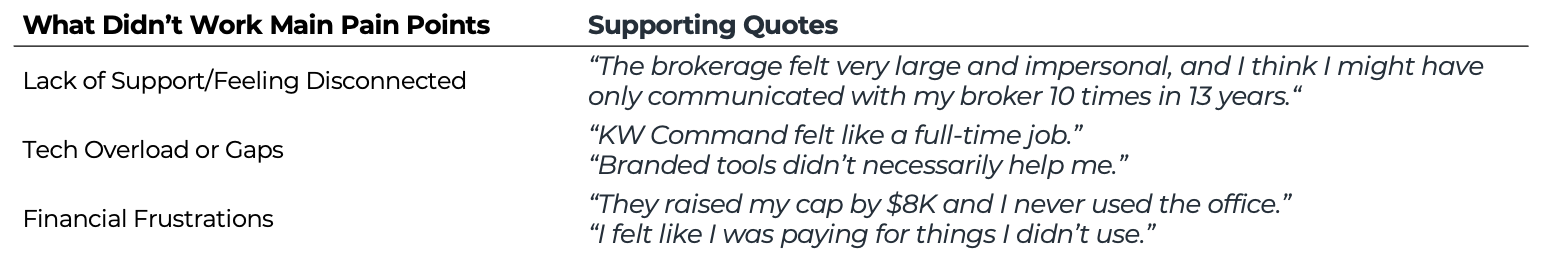

A number of subjective “soft” factors, and the importance they’ll play in this battle, emerged during the hearing.

Again, this is purely subjective based on texts, emails, and group documents – which all reveal insights into each company’s decision-making process – but it appears that Compass is acting with more agility and speed.

Compass also benefits from its offensive focus: it is dictating the course of events and maintaining the initiative, while Zillow is responding to events outside of its control.

Finally, and perhaps most importantly, comes communication: Compass’s core argument requires less cognitive load to understand due to its simplicity.

Zillow’s argument doesn’t have the same coherence nor simplicity: We’re against hidden listings. But if a listing is fully hidden, we’re ok with that. If it’s kind of hidden, we’re not OK with that, and as punishment we’re going to hide it from our site, too.

An example of a simple, positive, and powerful message for Zillow would be this TV commercial that Australia’s leading portal published in 2020.

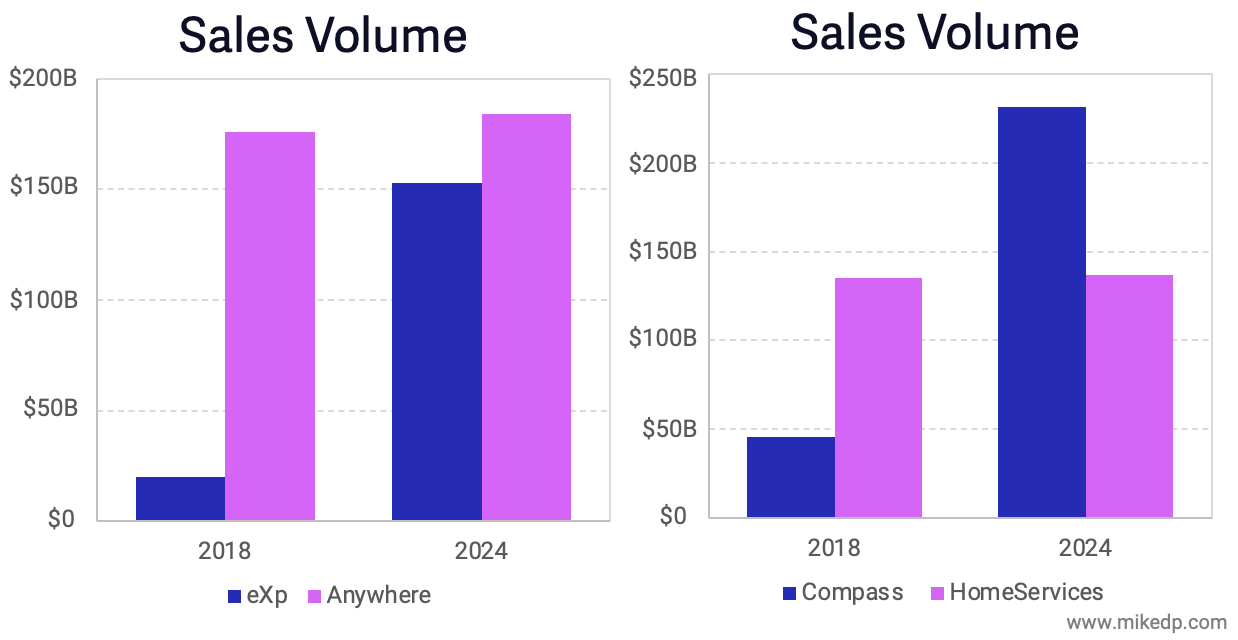

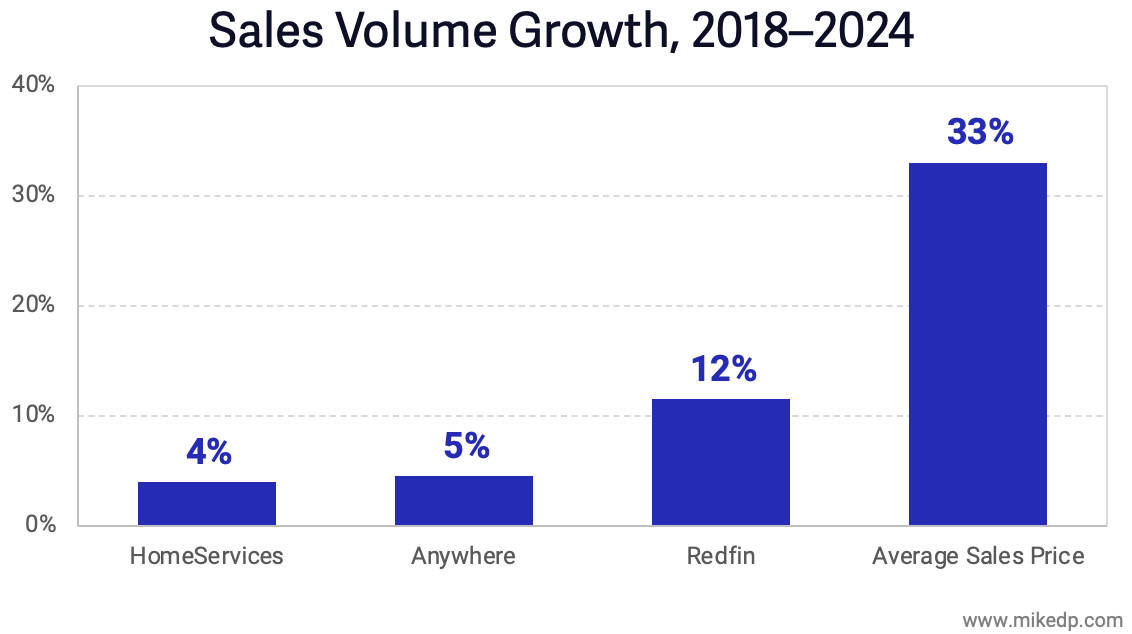

When considering the strategic implications of the trial and the relative positioning of each company, it’s important to look at the time factor: is each company’s position getting stronger or weaker over time?

Compass only gets stronger, primarily with the proposed Anywhere merger, giving it massive scale.

Zillow currently faces mounting legal pressure from a number of different lawsuits – all of which will consume time and money (and distract its executives).

Additionally, there appears to be a growing trend of MLSs setting their own rules around listings, as evidenced in court by the rising number of MLSs that allow coming soon listings of greater than 24 hours (in violation of Zillow's listing standards).

For my overseas audience, I want to take a moment to talk about the international implications of this battle.

Temporarily withholding inventory from the #1 portal is a growing trend in markets like Sweden and the U.K., largely a result of a decade of hefty price increases.

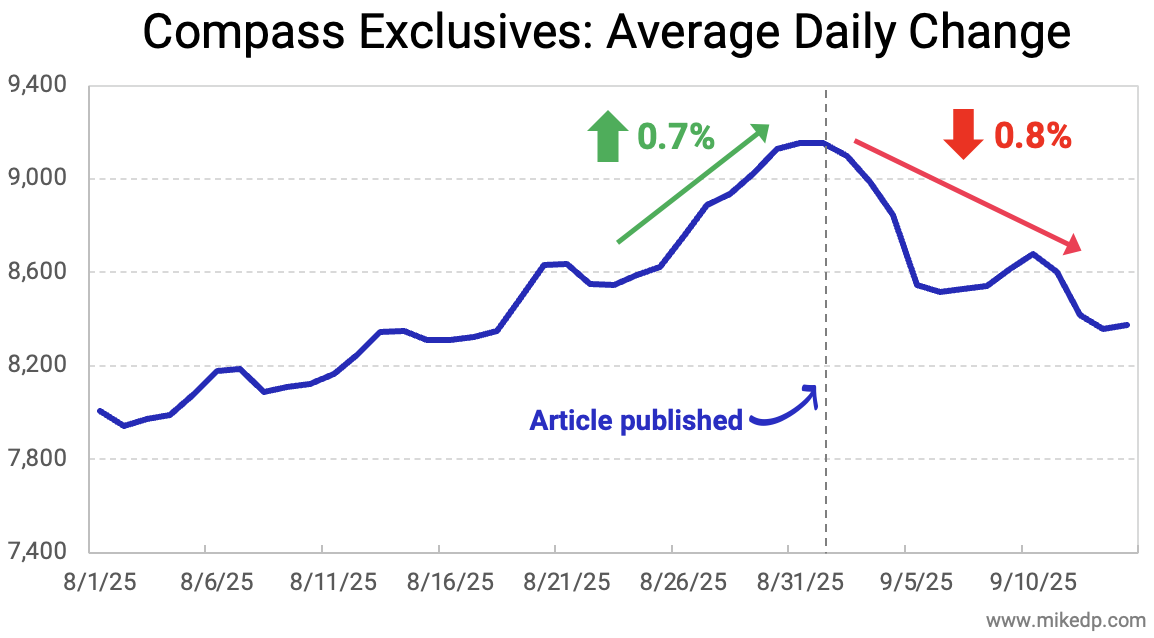

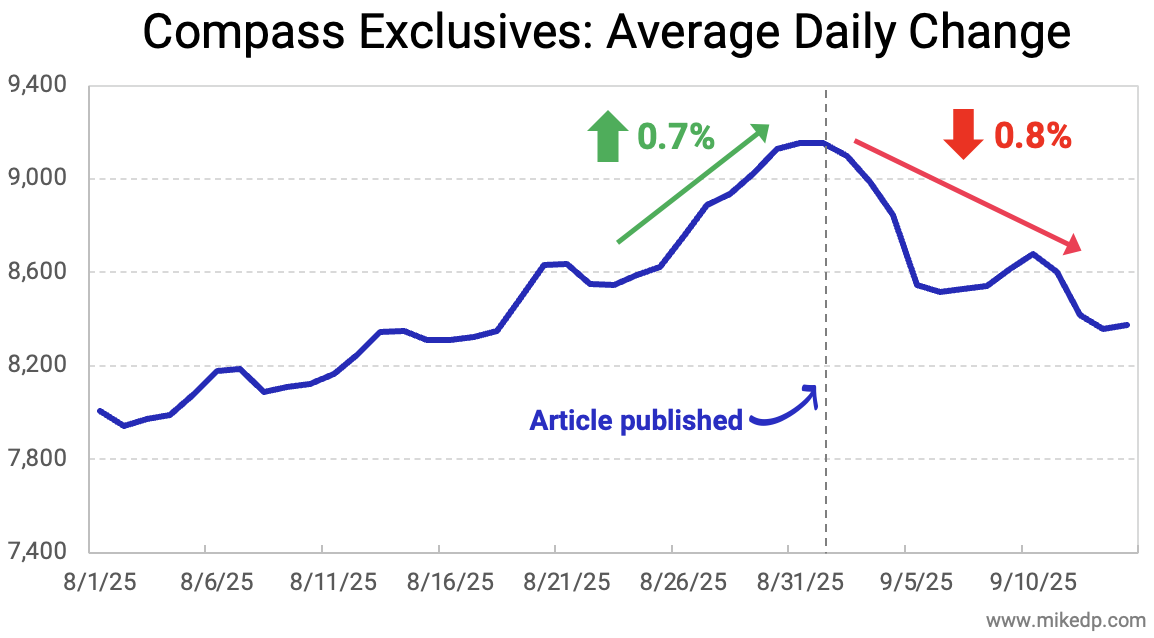

To date, it’s not clear that Zillow’s actions have been effective: Compass still has over 8,000 exclusive listings.

A more effective strategy for a #1 portal may be less punitive and focused on business partnerships: helping agents differentiate and grow (Zillow already has this product).

Having sat through several days in court, it’s clear that there remains plenty of common ground between Compass and Zillow.

Both parties agree that, in general, Compass is focused on agents and Zillow is focused on consumers – a complimentary mix.

Neither party really wants to hide listings; Compass is searching for an advantage that lets it differentiate while providing more value to its customers, and Zillow just wants to display all inventory for sale.

Earlier this year, both companies engaged in high-level negotiations around a potential partnership, and litigation aside, that opportunity remains.

The big takeaway: Regardless of the outcome of this trial, I’m not sure anything changes.

Consider that between the date Zillow announced its new policy and the start of the hearing, the number of Compass private exclusive listings, total listings, and agents are all up.

But the number of Coming Soon listings and the overall percentage of listings that are "exclusive" are down, but this may be seasonal – the point is that the total number of exclusive listings is still above 8,000.

This is important because Zillow’s policy wasn’t about containment, it was about elimination of private listing networks, and despite its best efforts over seven months, Compass’s network is as strong as ever.

The bottom line: This hearing was the culmination of a process that has likely consumed millions of dollars and many hundreds (or thousands) of hours spent interviewing witnesses, going through evidence, and compiling thoughtful arguments.

It revealed an unprecedented look inside each company’s strategy for one of the biggest power moves in real estate, one that will shape the landscape for years to come.

And while the hearing revealed a great deal, the outcome may not matter in the slightest – it’s what’s happening outside of the courtroom that will determine the future of the industry.