Redfin: High Debt, Low Cash, and Unprofitable

Redfin’s latest results reveal a worrying financial trend – and raise questions about the sustainability and viability of its business model.

Why it matters: A lot of debt, dwindling cash, and an unprofitable core business are a challenging collection of attributes for the business to deal with, which may force a larger strategic change.

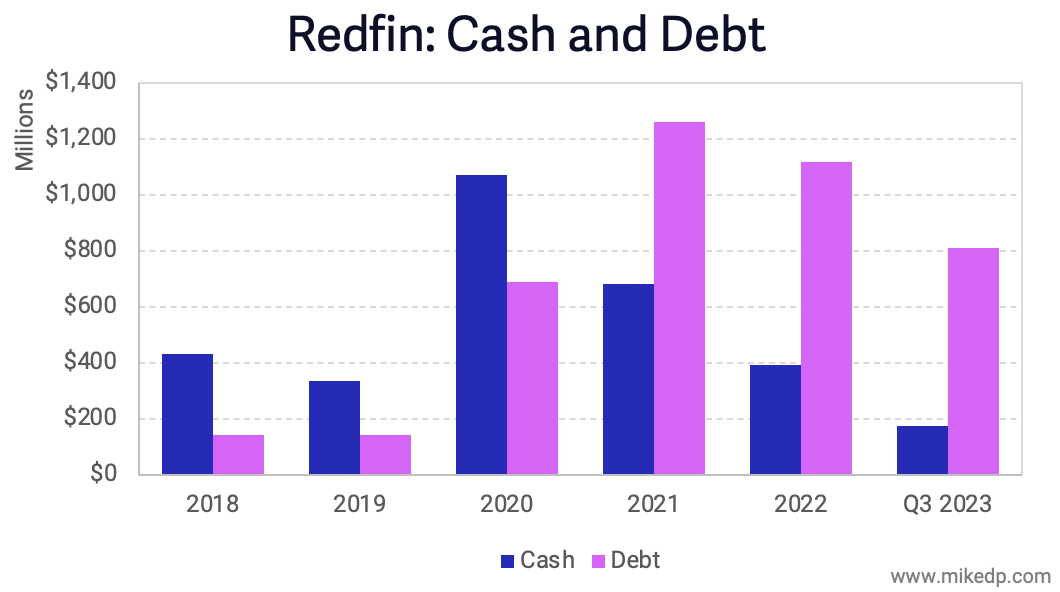

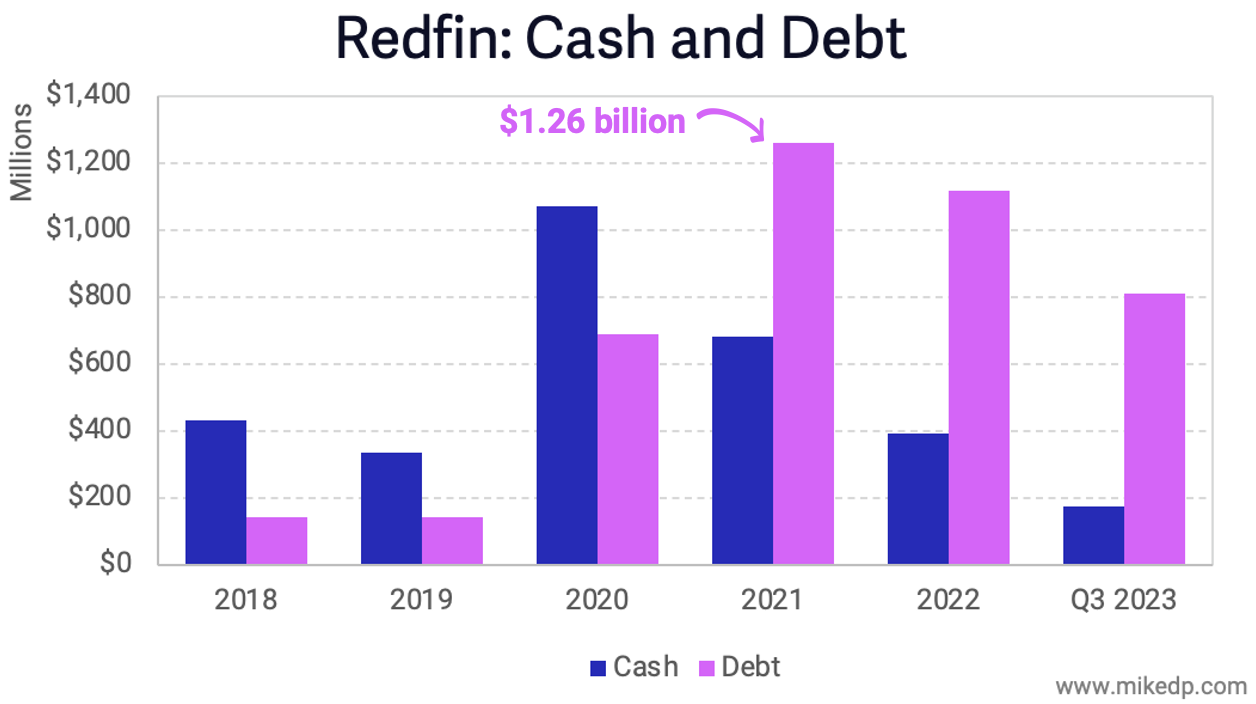

It all started with Redfin taking on a substantial amount of debt in 2020, eventually rising to $1.2 billion by 2021.

Redfin then made a pair of expensive acquisitions: In 2021, it bought Rentpath for $608 million, and then acquired Bay Equity Home Loans for $138 million in 2022.

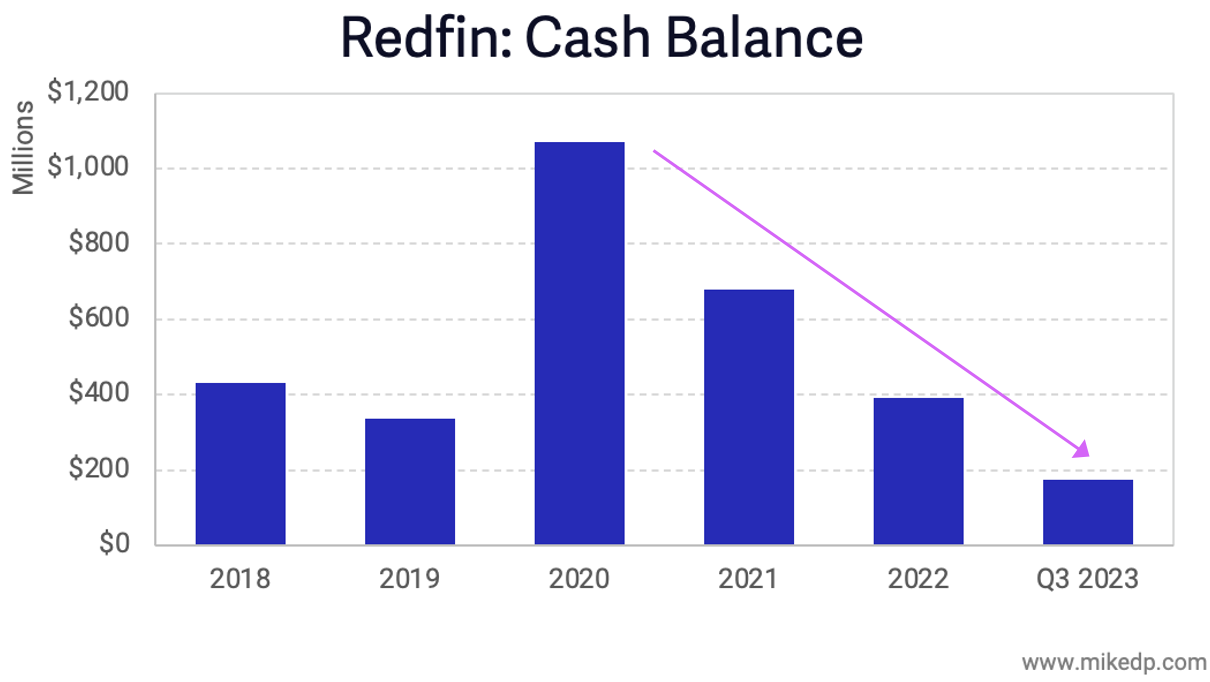

Since 2020, Redfin’s available cash balance (cash and liquid investments) declined sharply, from over $1 billion in 2020 to just $173 million at the end of Q3 2023.

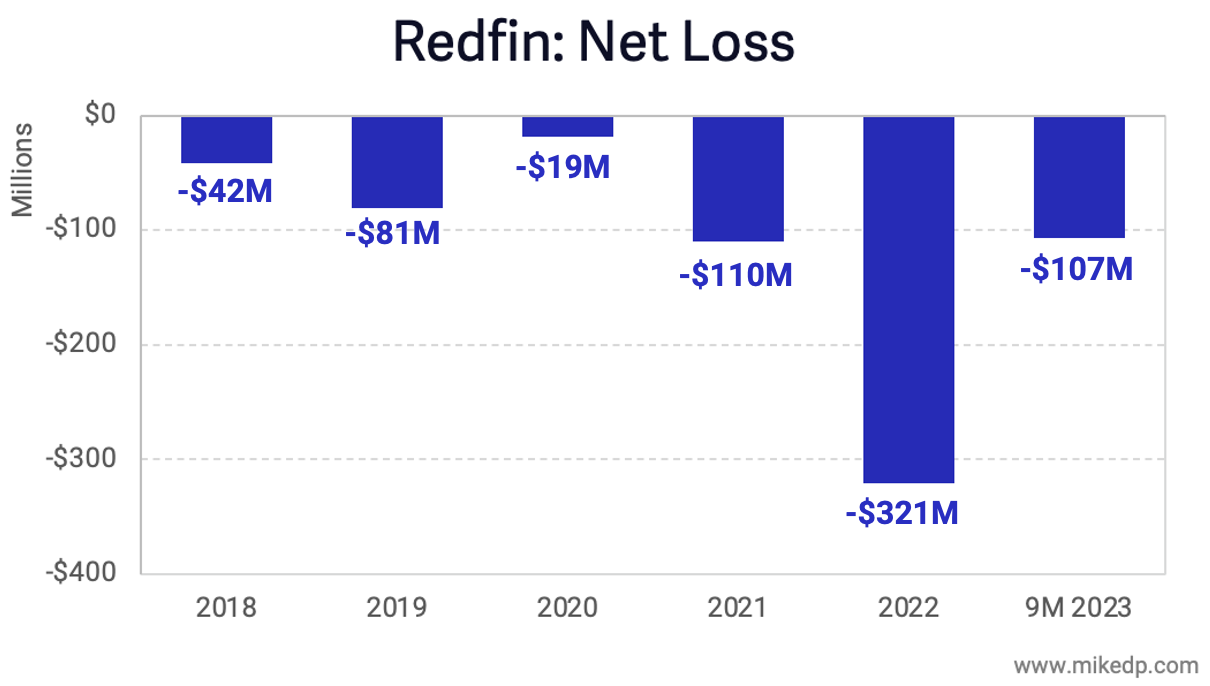

Redfin is using its cash to gradually repay its debt, but the challenge is that the business itself is unprofitable (as measured by Net Income/Loss).

Redfin has incurred a net loss since at least 2018 – it doesn’t appear that the business has ever been profitable.

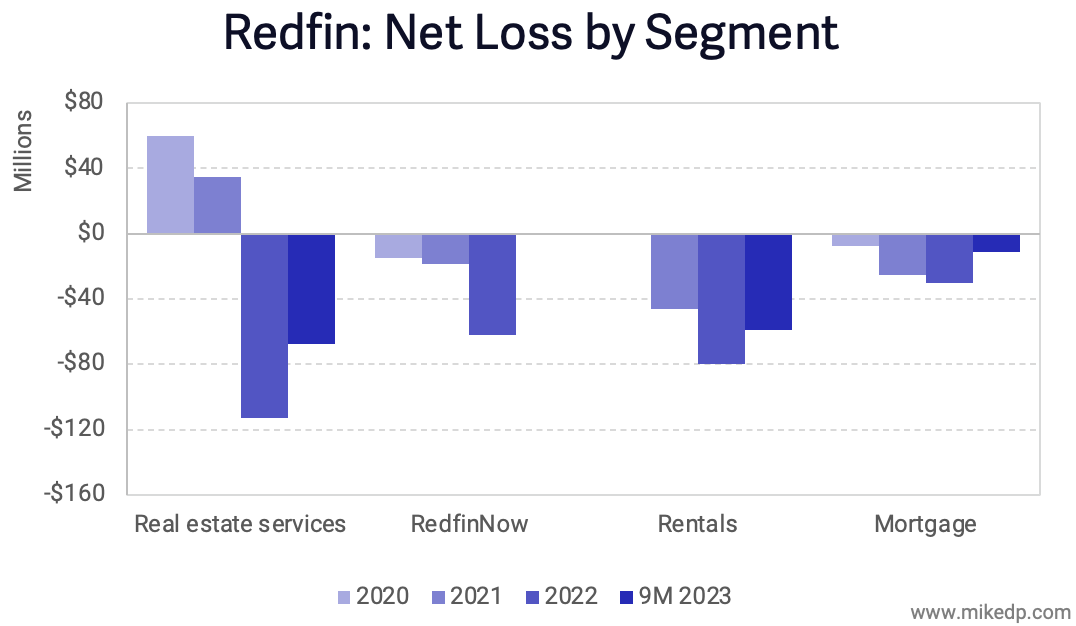

Over the years, Redfin has assembled a collection of unprofitable business lines.

Redfin’s real estate brokerage is unprofitable, its now-closed iBuying business, RedfinNow, was unprofitable, its rentals business is unprofitable, and its mortgage business is unprofitable.

To say Redfin’s problems are a direct result of the market would be incorrect – it’s not the market, it’s the business model.

Redfin’s brokerage is unprofitable, but not all brokerages are unprofitable – several are posting a positive net income, even in a very challenging market.

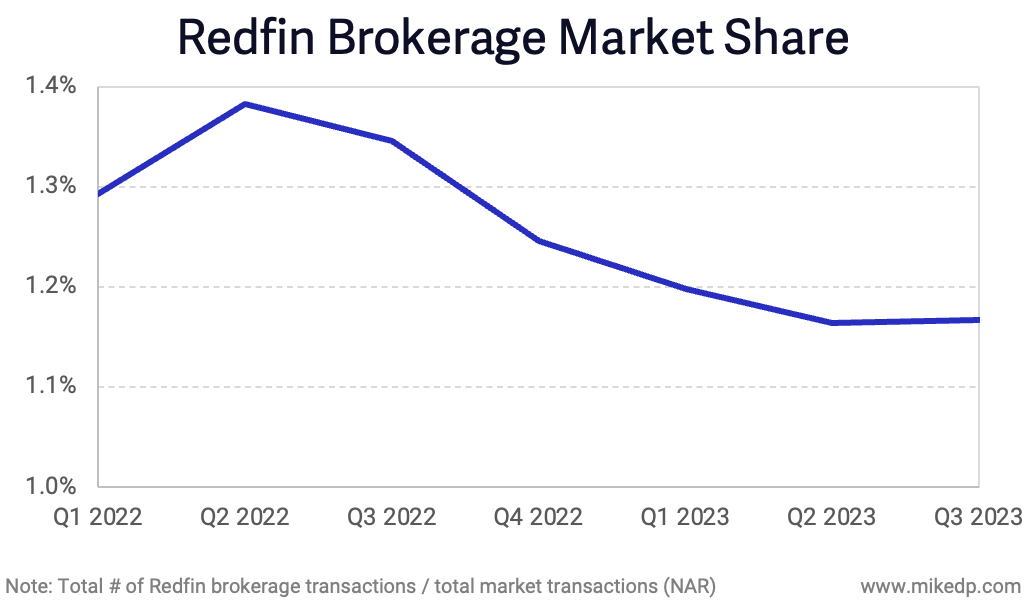

Redfin is losing agents and market share, but not all brokerages are losing agents and market share – several are increasing agent count and growing transaction volumes despite the down market.

This leads to a strategic dilemma: Redfin is significantly under-resourced in a challenging, competitive market.

Its web portal is up against Zillow and CoStar, who have billions in free cash available.

Its brokerage is up against the likes of Compass, eXp, and dozens of others that are able to attract agents with higher commission splits and structural cost advantages.

Its rentals business is up against Zillow and CoStar, again.

And its mortgage business…well, it’s just a very challenging time to be in the mortgage business.

The bottom line: A receding tide reveals, and the current market is highlighting Redfin’s various challenges.

Strategically, it appears that Redfin is overstretched with limited resources, and up against well-funded competitors with cost advantages, something it cannot compete with.

This is a galvanizing moment for the business; one way or another, something has to change.