Ecosystem Disruption in Mortgage Looking Exceedingly Traditional

/Last month, Australia's #1 real estate portal, REA Group, announced the $244M acquisition of mortgage broking business Mortgage Choice. This is the latest move by global leaders Zillow and REA Group to spend hundreds of millions of dollars expanding into mortgage through the acquisition of broker-heavy, 20 year old traditional mortgage businesses -- and not technology companies.

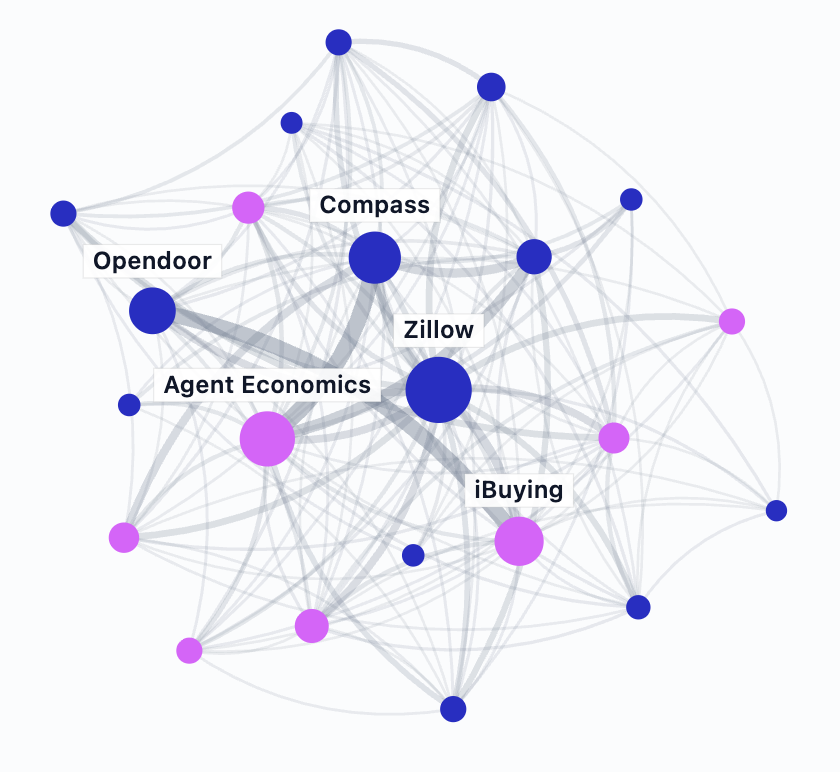

Real estate portals are moving closer to the transaction, and there is a battle brewing in adjacent services. For portals, it's a path towards revenue growth and a seamless customer experience. For new models like iBuying, it's the only path to profitability.

But: mortgage is hard. The underlying economics demonstrate how difficult it is for portals to grow these businesses. Financial services is still a small segment of REA Group's entire business, representing less than three percent of total revenue. It is, however, profitable, with margins just under 40 percent. But overall revenue growth has stalled and moved backwards since the acquisition of Smartline.

By comparison, Zillow's mortgages segment (which includes Mortech and its mortgage lead gen business, in addition to the Mortgage Lenders of America broking business), has seen strong revenue growth but is much, much less profitable.

Zillow acquired Mortgage Lenders of America (MLOA) in June 2018, which was followed by a modest revenue uplift. However, it appears the driver of FY20 growth was the pandemic and record low mortgage rates in the U.S.

Zillow's mortgage business was unprofitable leading up to the MLOA acquisition, and subsequently became much more unprofitable. It wasn't until the massive growth during the pandemic that the segment eked out a profit.

The evidence suggests an underlying business that is expensive to run and difficult to make profitable. Getting adjacent services right and running a successful mortgage broking business -- and in REA Group's case, growing it -- is hard work.

For all the money being invested in this space and the hype around a digital ecosystem, it's noteworthy that the real estate portals see their path to growth via traditional brick-and-mortar brokerage businesses, and not high-flying, scalable tech solutions. Mortgage is not an industry that can be disrupted with technology alone.