iBuyers Turning Obfuscation of Profit into an Art Form

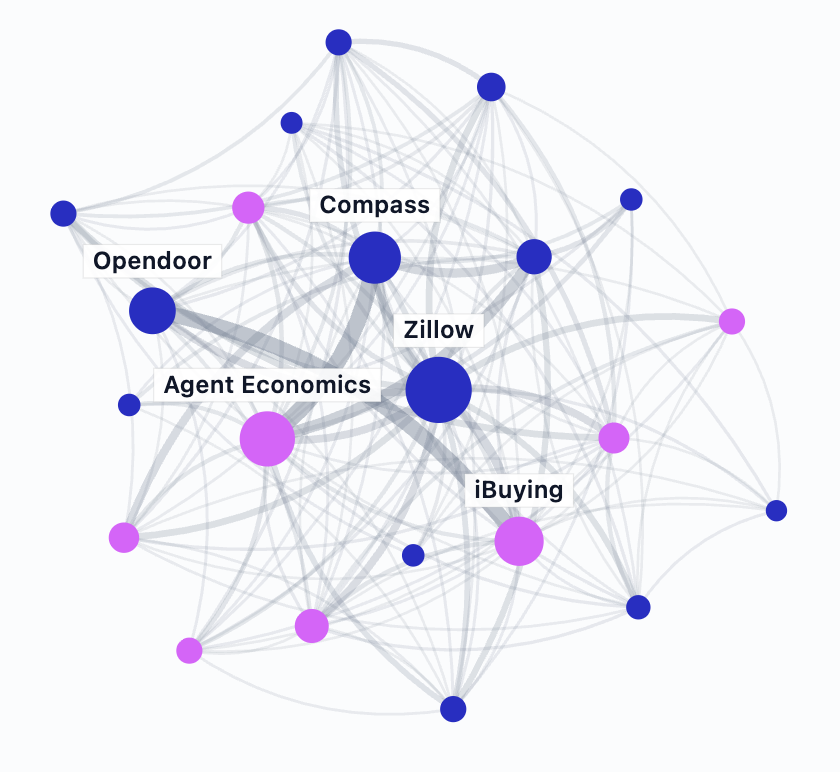

/A casual investor could be excused for confusing iBuying with a profitable business. Zillow's latest shareholder letter claims, "Average return on homes sold before interest expense was a gain of $21,830 per home," while Opendoor's investor presentation highlights "positive unit economics" with a contribution margin of $11k/home.

Both statements are factually correct. However, the figures provided are cloaked in asterisks and notes. Opendoor and Zillow are emphasizing unit economics of iBuying that exclude tens of millions of dollars of expenses -- ranging from salaries to marketing to technology -- that are necessary to operate the business.

It's the equivalent of an immaculate conception version of iBuying, where transactions magically occur without employees, customers materialize out of thin air, and technology is freely available for all.

When all indirect costs are included, profitability quickly drops into the negative for both companies.

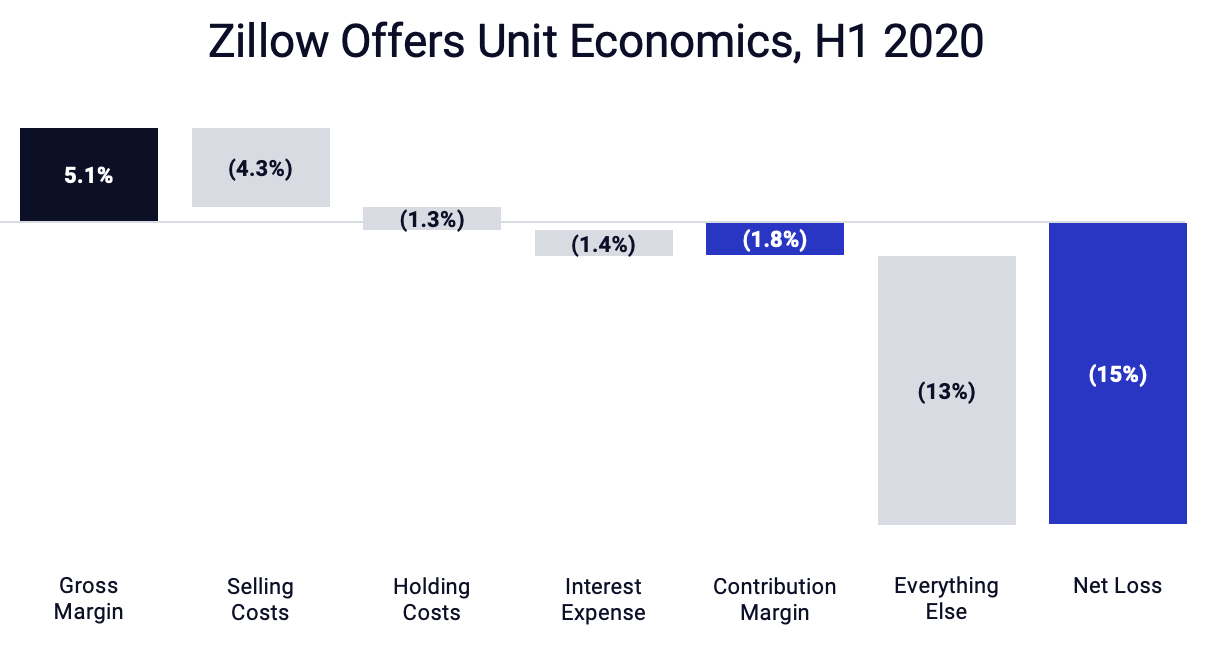

Zillow's average return on homes sold before interest expense is a gain of around $22k per home, but after all expenses are included, the net loss per home is $72k. Tracking this number shows the true unprofitability of the business over time.

Both companies are unprofitable, losing roughly $300 million each in 2020. When all expenses are included, each company is losing tens of thousands of dollars per home. Opendoor is losing less money per home than Zillow, in both 2019 and the first nine months of 2020.

The profitability measure each company highlights is Adjusted EBITDA, which presents its own challenges. The "I" in EBITDA stands for "interest," which means that Zillow and Opendoor are excluding their collective interest expense from the calculation. Interest expense is a large and necessary component of the iBuyer business model, and amounts to tens of millions of dollars each year.

In 2019, Opendoor's interest expense was $105 million, which is not included in its only visual profitability measure. To find the true net loss (over $300 million), readers need to scroll to the very last slide in Opendoor's investor deck, in the appendix.

Turn On The Lights

One of Zillow's corporate values is to "Turn On The Lights." To quote: "We believe that information is power, and we’ve made it our business to increase transparency in real estate and within our company. Our purpose is to unlock information and empower our people, customers and partners to make better decisions."

I agree: information is power, and transparency is powerful. It leads to better decision making. Much of my work is aligned to the necessity of transparency.

iBuying is a new business model fueled by billions of investment dollars. The first question on many people's minds is, "Is it profitable?" Not when necessary expenses are excluded, but the entire business model.

My request is simple: talk about profitability. Don't shy away from it. Don't make readers flip to the appendix or supplementary financial tables and do a series of calculations to get their answer. Turn the lights on.