The Rise of Power Buyers

/Following the rise of iBuyers during the past decade, 2021 has seen the emergence and rapid growth of Power Buyers -- companies empowering buyers with services like cash offers, bridge financing, and trade in programs. Like iBuyers, these companies are transaction-focused, but most critically, target buyers instead of sellers.

Power Buyers leverage their balance sheets to purchase homes on behalf of their customers (turning offers into all-cash offers, or as part of a trade in program).

The focus on buyers is achieving a high product/market fit: Orchard and Homeward saw 150%+ growth in 2020 and over 300%+ growth into 2021. With high demand for housing and low supply, buyers need products to stand out from the crowd. Cash offers and trade in programs are providing that advantage.

The Mortgage Advantage

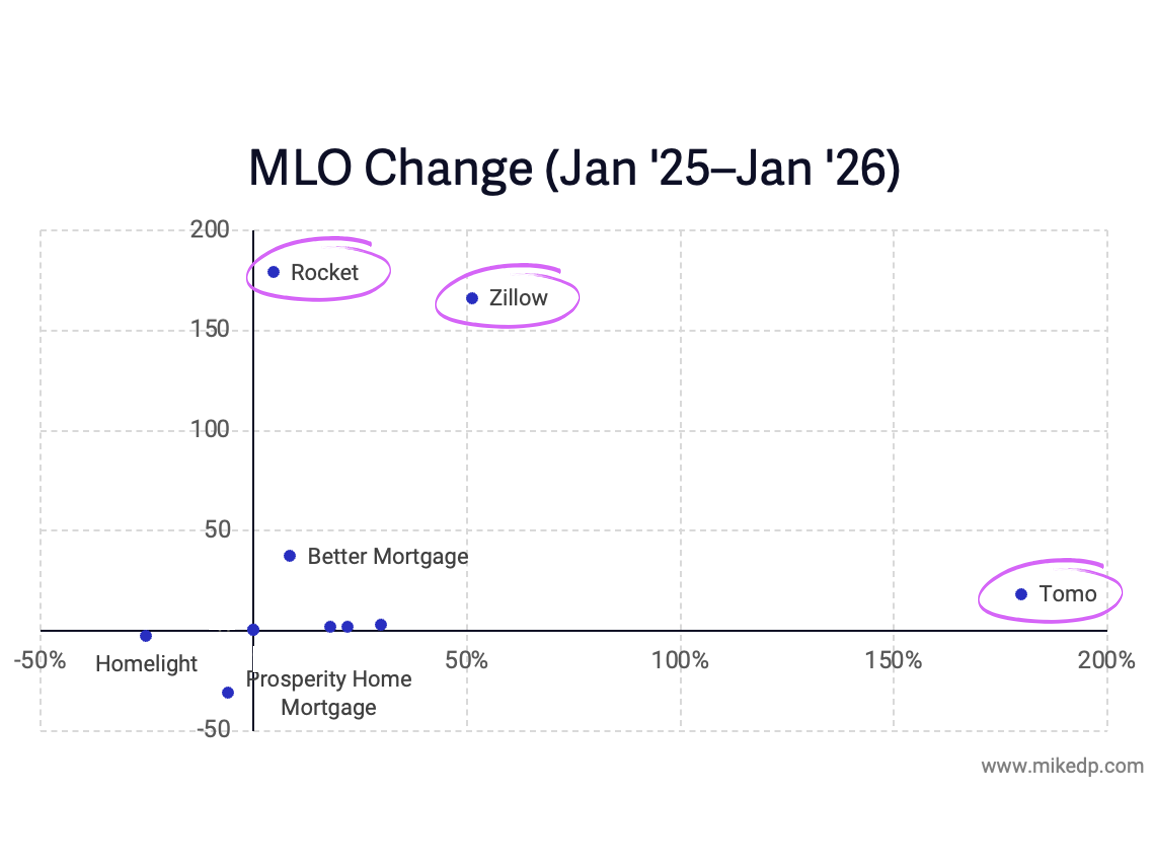

Financial products aimed at home buyers give Power Buyers industry-leading mortgage attach rates. That is in stark contrast to the major iBuyers, who have struggled to attach mortgage.

When it comes to attaching mortgage, it appears to be more effective to target buyers earlier in the process. Which is why the iBuyers are evolving their model to offer cash offer and trade in programs (ex: Opendoor's cash-backed offer).

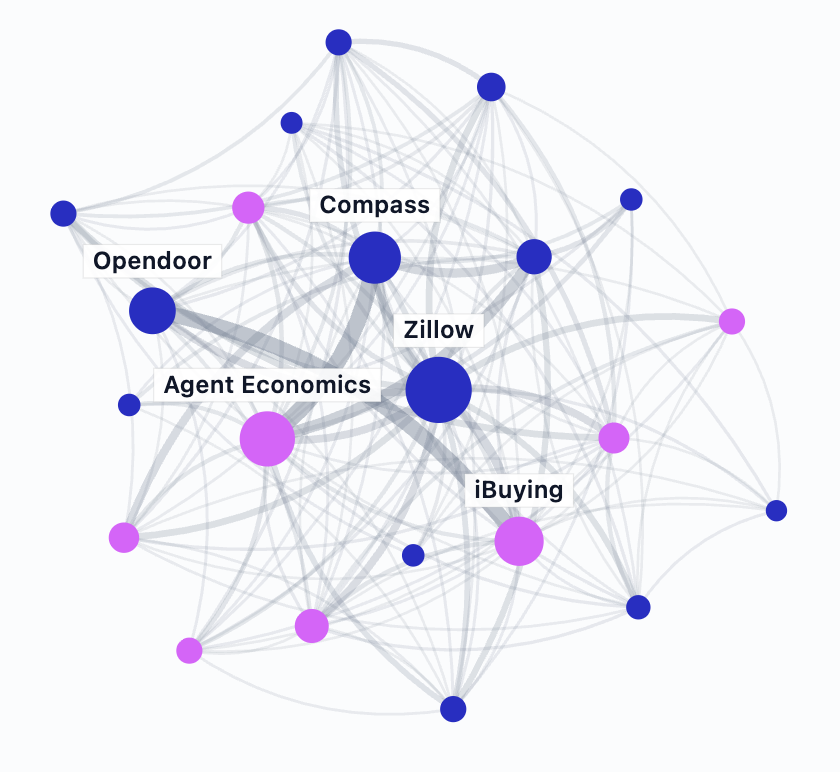

The shifting landscape is causing disruptors and incumbents to adjust their strategies. Many companies are responding to this shift in consumer demand by launching their own instant offer, cash offer, and trade in programs.

Digging Deeper into Power Buyers

There's a lot more to unpack in the world of Power Buyers. My latest free report goes into this topic in detail, and the following video provides a crisp overview.