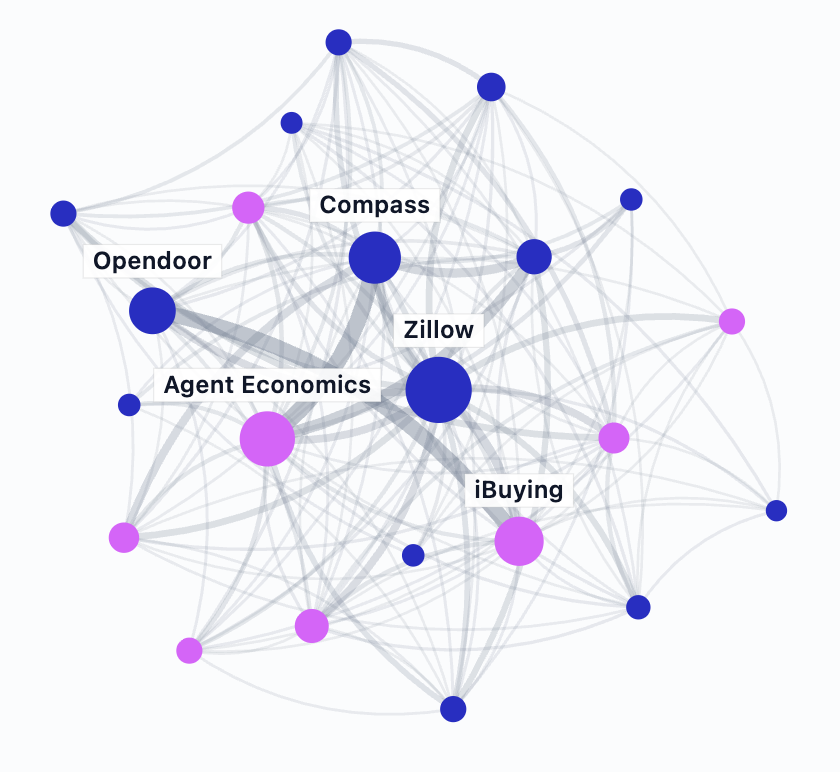

Further Cuts on Compass' Path to Profitability

/Compass continued to burn cash in the latest quarter, but also demonstrated a reduction in operating expenses as the company aims for breakeven in 2023.

Why it matters: With a historically high cash burn in a cooling real estate market, Compass needs to cut costs extensively to achieve profitability.

Furthermore, the company signaled further cuts to bring expenses in line with revenue in 2023.

Behind the numbers: Compass burned $76 million in Q3 2022, continuing a run of cash flow negative quarters.

Of that $76 million, there were one-time restructuring and litigation expenses of $40 million.

Compass ended the quarter with $355 million in cash.

Historically, Q4 and Q1 is where cash burn is highest, due to the seasonal decline in revenue.

Coupled with a cooling market, the next six months are going to be tough.

What they're saying: On its earnings call, Compass signaled that further cuts are coming:

”…we will be implementing additional cost reduction initiatives to get ahead of any future market declines.”

”We are committed to driving our non-GAAP operating expenses well below the low end of our range of $1.05 billion in 2023.”

Compass' initial cost reduction program was an effort to get annual operating expenses to a run rate of $1.05–$1.15 billion (down from $1.48 billion).

In total, the proposed cuts would represent an overall reduction in operating expenses of around 33 percent -- a very significant change.

Dig deeper: If breakeven in 2023 is the goal, working backwards reveals the various revenue estimates needed to achieve that goal.

Compass' first set of cuts suggested a five percent revenue decline in 2023, but the latest cuts suggest a deeper 14 percent drop in revenue.

The bottom line: All brokerages, Compass included, are entering the literal and figurative winter of real estate; the next two quarters are going to be tough.

With a historically high cash burn, Compass needs to cut faster and deeper than most other brokerages -- and it is.

The question for all brokerages making cuts remains the same: can it be done while still remaining attractive to, and providing the same value to, agents.