Can Opendoor Scale?

/Opendoor, the original iBuyer and undisputed category leader, is laser-focused on scaling nationally and proving that it has a winning model.

Why it matters: Opendoor needs to demonstrate to investors that it has a credible path to profitability, and that as it grows it isn't just losing money faster. It needs economies of scale.

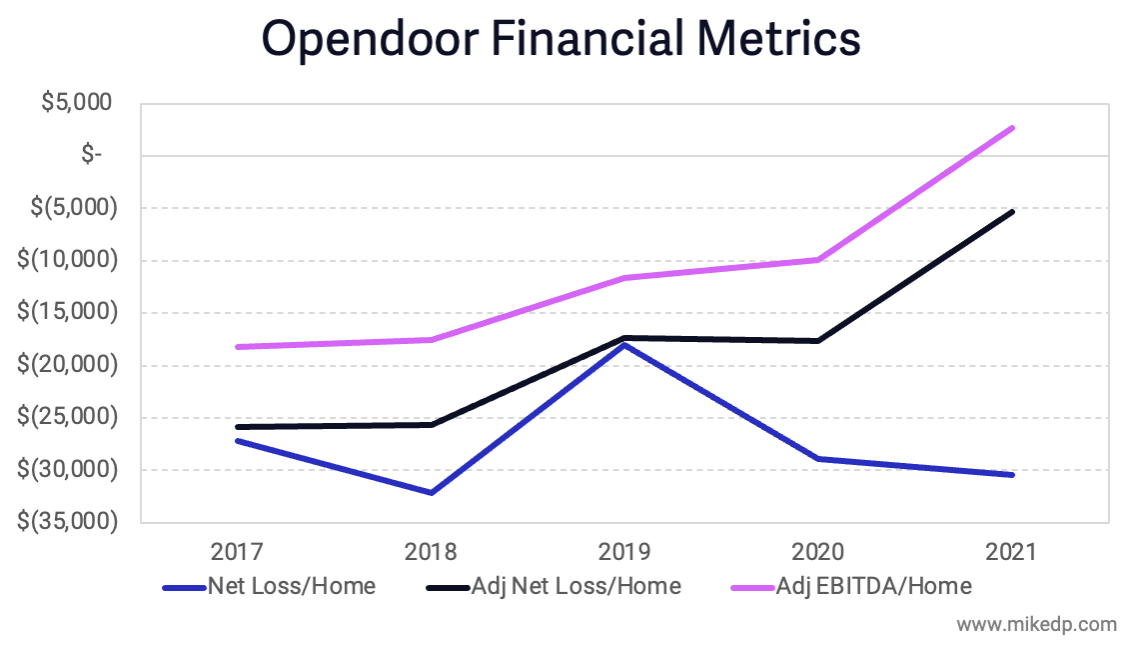

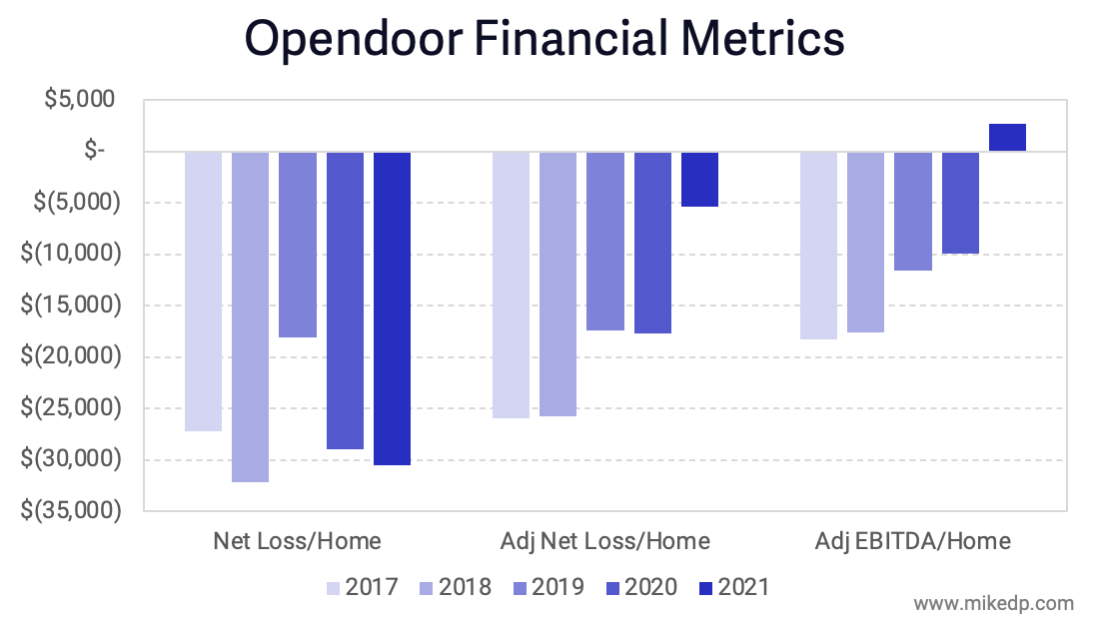

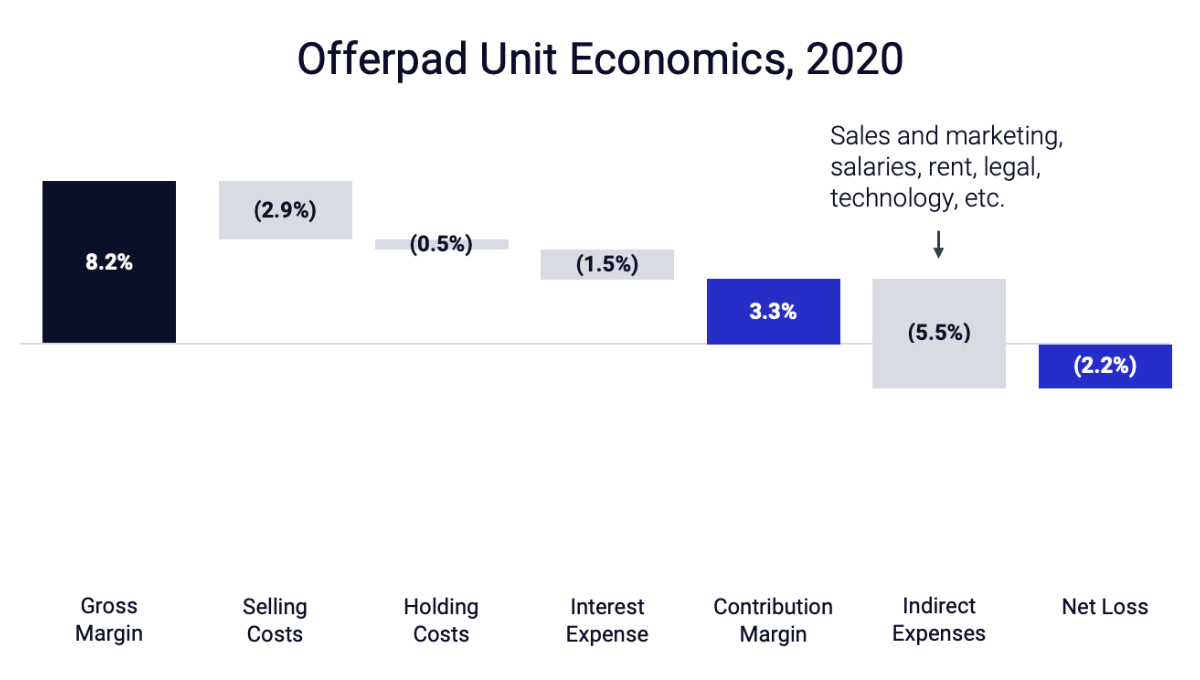

Opendoor reports a variety of financial metrics:

Net Loss is the total GAAP loss for the business.

Adjusted Net Loss backs out stock-based compensation expense ($536 million in 2021).

Adjusted EBITDA additionally backs out interest expense related to the purchase of homes ($140 million in 2021).

Now is not the time to debate the validity of each metric; let's consider all three. And to best illustrate economies of scale, let's divide each by the total number of homes sold in a period of time.

Improvement over time is clear. The key years are 2019 and 2021, when Opendoor sold a similar amount of homes: 19,000 in 2019 and 21,000 in 2021.

Opendoor's key metrics improved significantly between 2019 and 2021, with Adjusted EBITDA positive for the first time ever.

The exception is Net Loss, which bloated from $536 million of stock-based compensation expense related to its IPO.

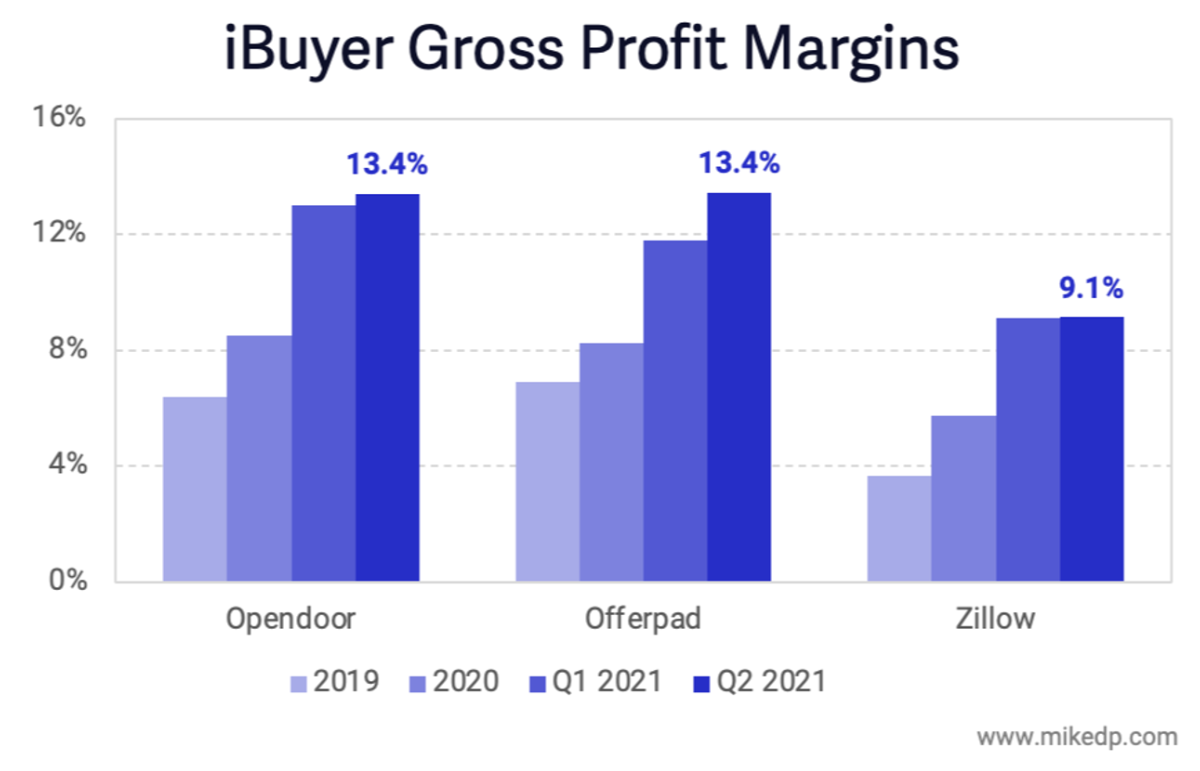

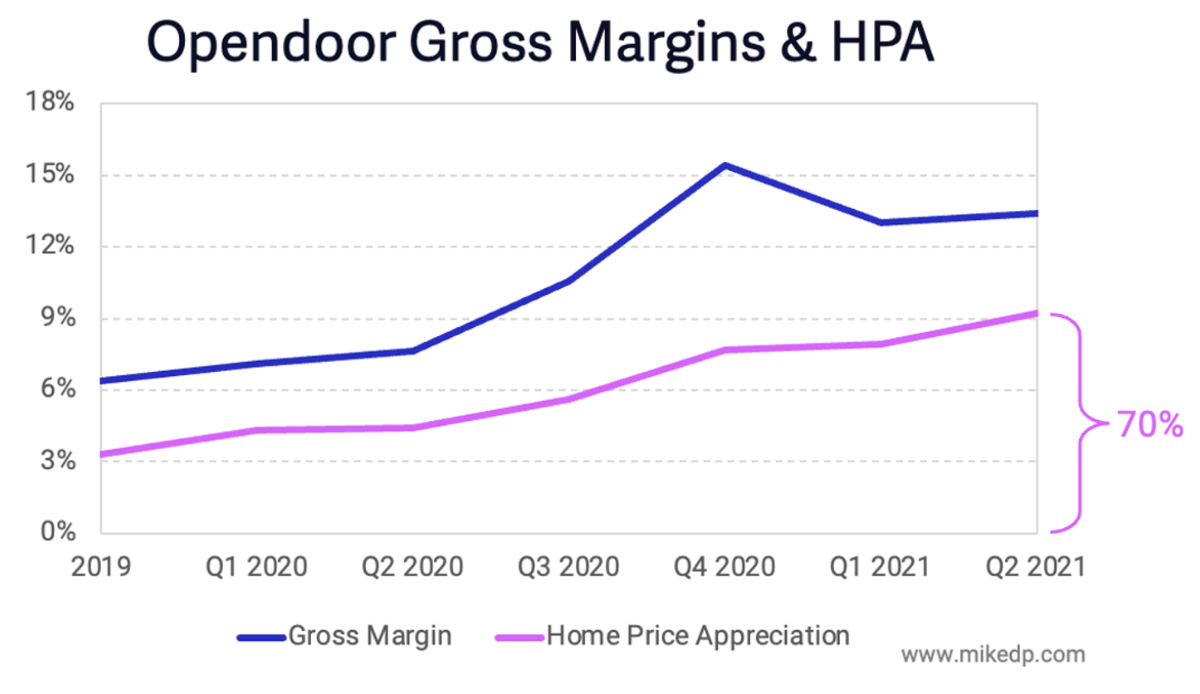

Yes, but: Opendoor benefited from record-setting home price appreciation in 2021, resulting in unusually high gross profits and contribution margin.

Let's consider an alternate reality, where contribution margin in 2021 was a slightly more modest five percent (instead of 6.5 percent).

The result is still an improvement from 2019, an important sign of Opendoor's ability to lose less money per home as it scales.

But it's still losing money. While economies of scale are improving, the business remains unprofitable.

The bottom line: The evidence suggests that Opendoor can scale, both operationally through a challenging market, and economically as it realizes efficiency gains.

If durable profitability is the goal, reaching it depends on further economies of scale, attaching adjacent services, and a favorable macro environment -- all of which are uncertain and only some within Opendoor's control.

Coming Soon: The 2022 iBuyer Report. I'm putting together a new, ~200 slide, evidence-based look at the evolving world of instant home buyers. Pre-order today and save 10%.