Zillow, CoStar, and the Battle over Rentals

When the FTC sued Zillow over its rentals deal with Redfin, it caught many by surprise (except CoStar) – but it’s just the latest move in the Portal Wars' other battle: rentals.

Why it matters: While CoStar has made a tremendous amount of noise coming after Zillow and others, Zillow has quietly encroached on CoStar’s territory with its growing multifamily rentals business.

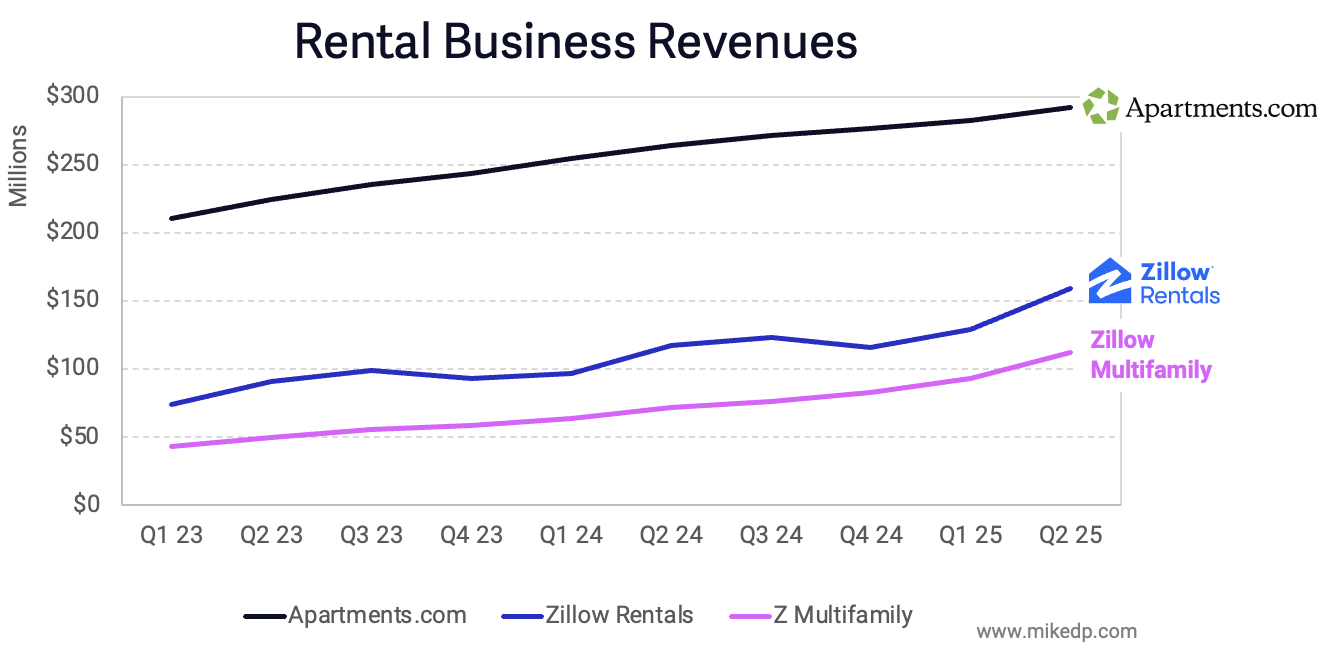

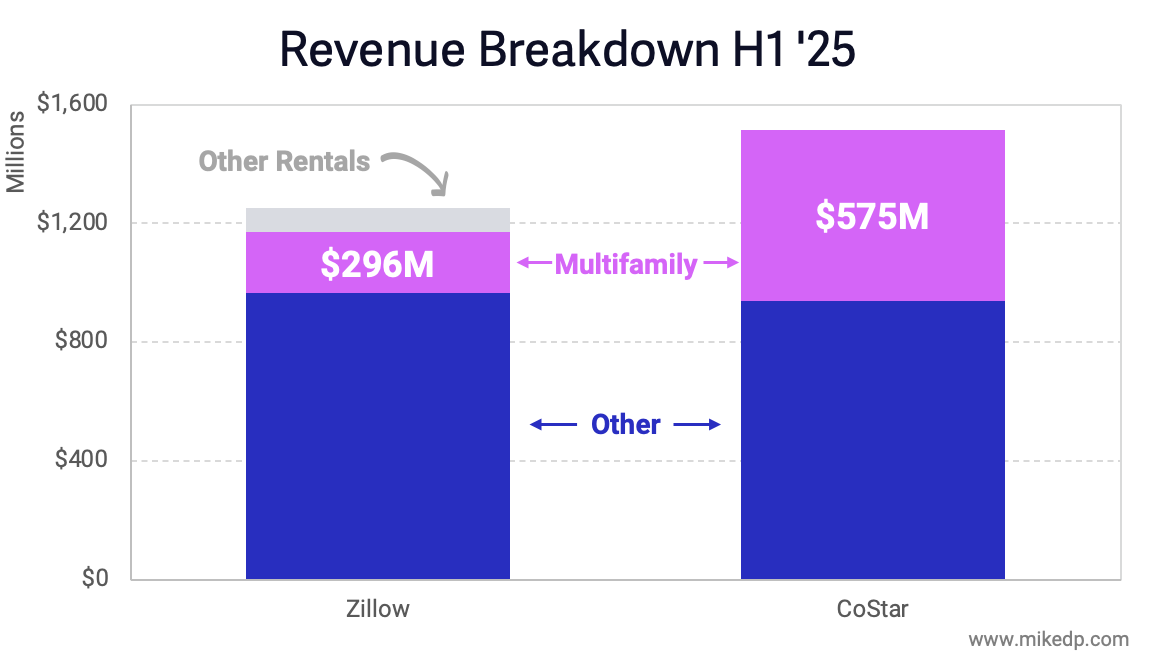

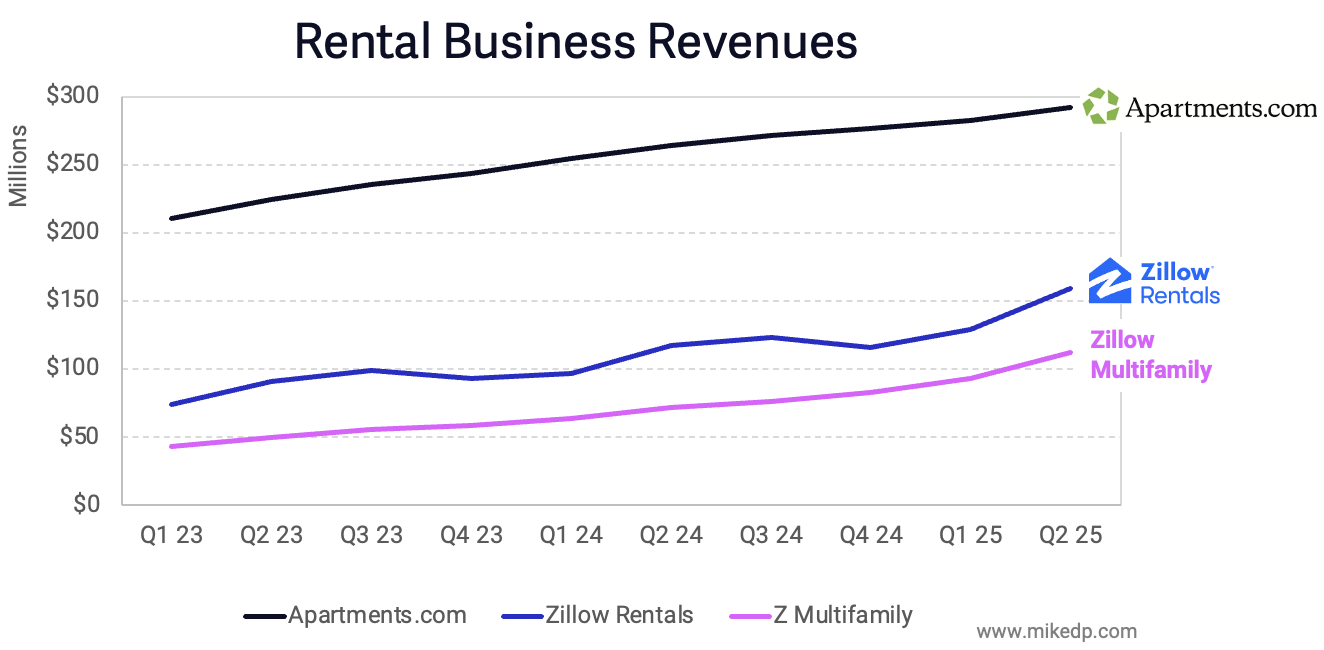

Rentals are a significant part of each company’s business: CoStar’s Apartments.com generated over $1 billion in revenue in 2024.

In the first half of 2025, Zillow’s multifamily rentals business generated about $200 million in revenue, accounting for 16 percent of total company revenue.

Meanwhile, Apartments.com generated over $570 million, acccounting for 38 percent of total company revenue – a significant and important business line.

Both businesses have grown considerably over the past two years.

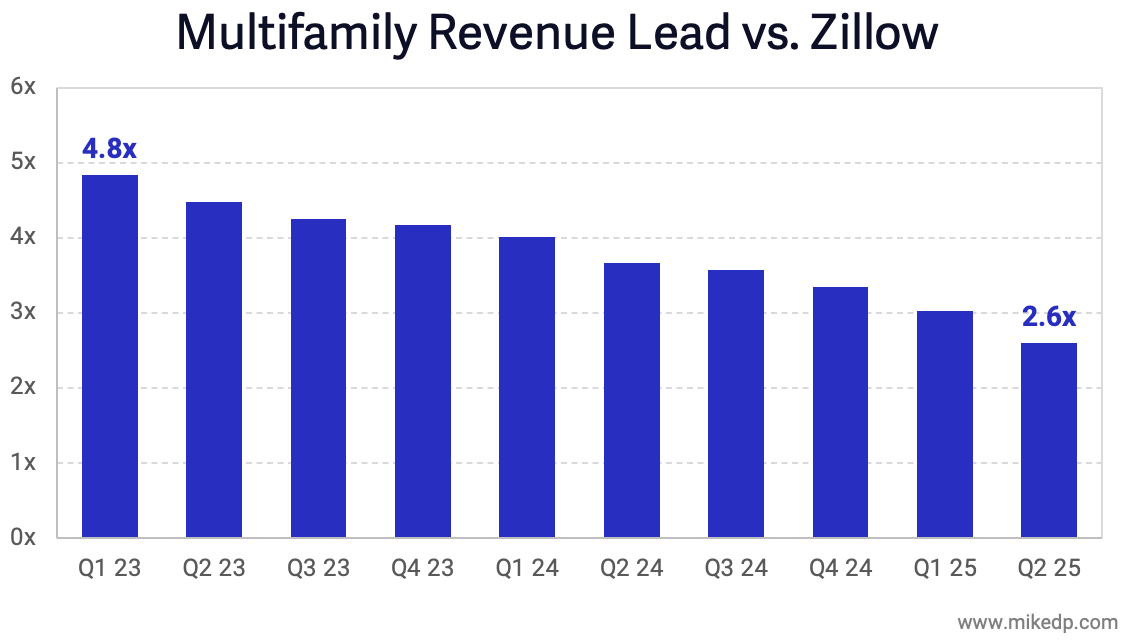

Apartments.com is the category leader in terms of revenue, but Zillow’s multifamily business is making significant gains (especially in the past year).

Note: Zillow’s multifamily business is just one segment of its overall Rentals business. I’ve reverse engineered public numbers to arrive at an estimated revenue breakdown.

Apartments.com’s revenue lead over Zillow’s multifamily rentals business has dropped from nearly 5x to 2.6x over the past two years – reflecting the significant gains made by Zillow.

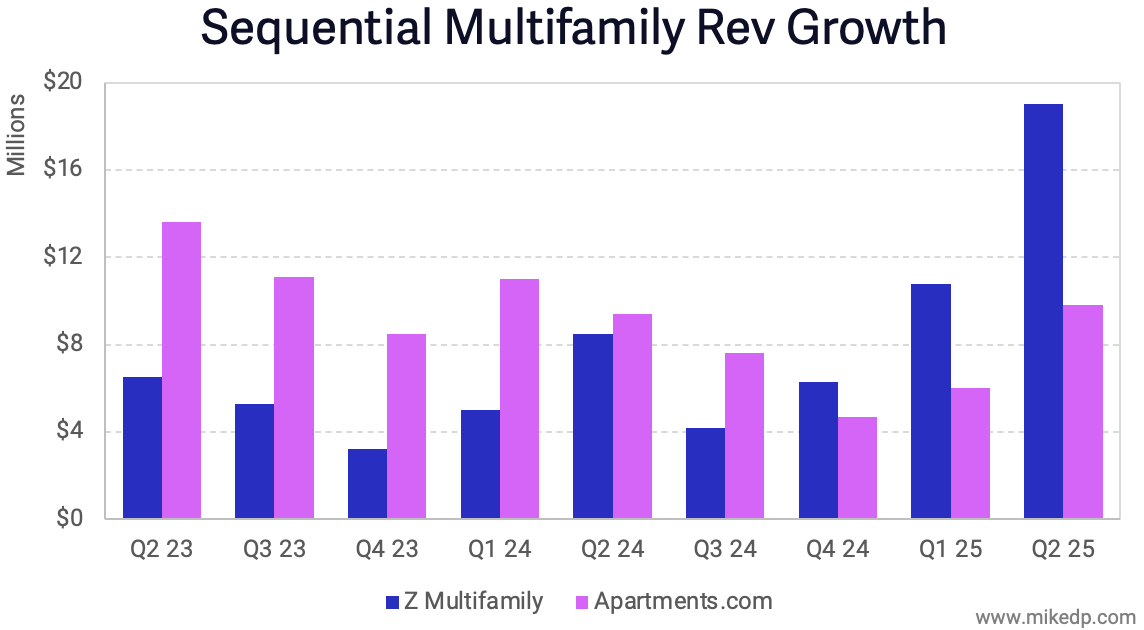

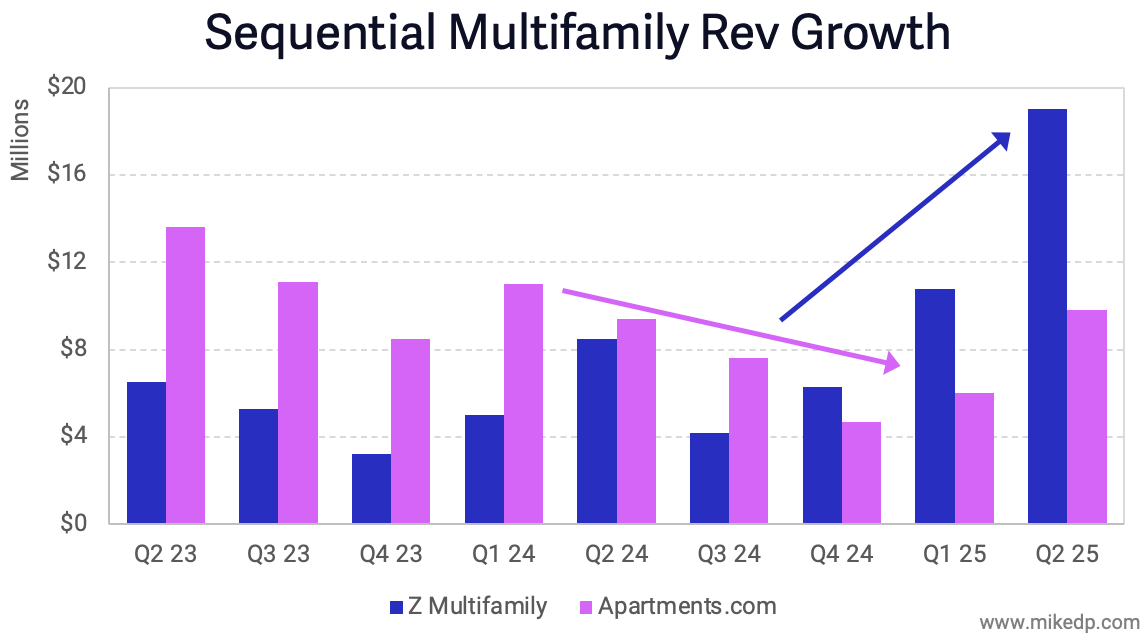

The businesses are growing at markedly different rates, as measured sequentially (from one quarter to the next).

On a percentage basis, Zillow’s multifamily business is outpacing Apartments.com, but it’s growing from a smaller base.

Apartments.com’s growth has slowed over the past year, a fact that CoStar attributes to “pivoting the Apartments.com sales force to support the Homes.com product launch in 2024.”

Looking at growth in absolute dollar terms shows a similar story.

Apartments.com’s growth has slowed (but with a recent uptick), while Zillow’s multifamily growth has rapidly accelerated in the past year.

And in the last quarter, Zillow's multifamily business grew revenue $19 million compared to Apartments.com's $10 million.

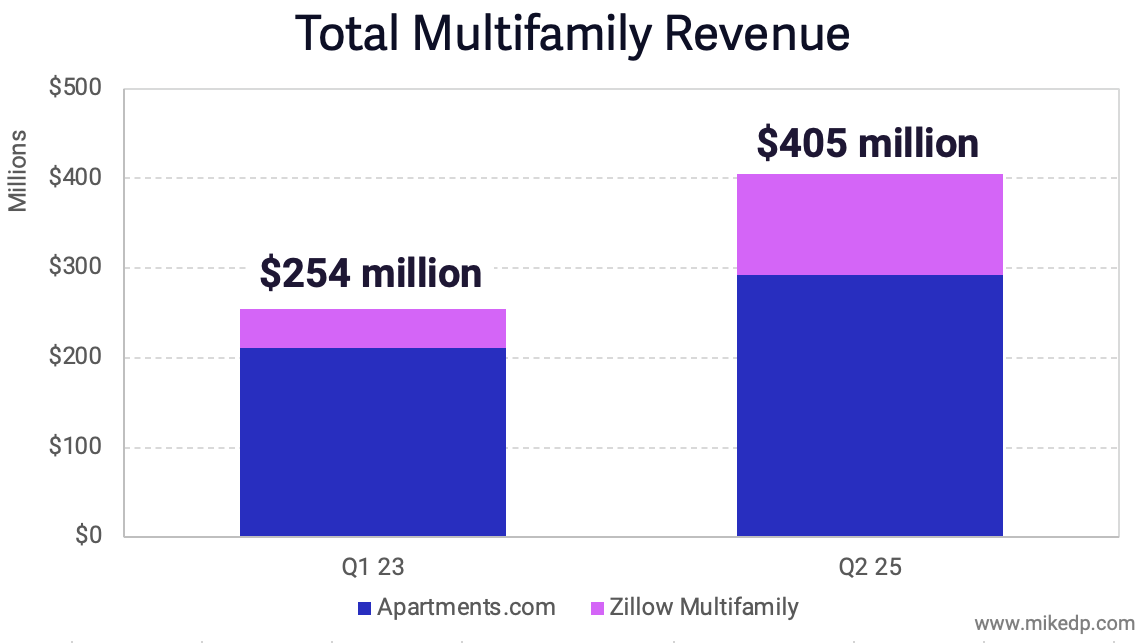

It would be easy to claim that Zillow’s growing multifamily business is negatively affecting Apartments.com.

And while it may be having a mild competitive impact, the truth is that like portal traffic, multifamily rental revenue appears to be primarily a non-zero-sum game – both companies are growing.

Total category revenue in just one quarter has jumped from $254 million in Q1 2023 to $405 million in Q2 2025.

The bottom line: The battle over rentals isn’t getting the same coverage as the portal wars, but that doesn’t mean it’s any less significant.

With the FTC suing Zillow to unwind its rental deal with Redfin (something CoStar speculated about back in February), and CoStar suing Zillow over multifamily photo copyright infringement, the long-simmering battle has finally ignited.

I’m sure CoStar isn’t cheering Zillow’s encroachment on its home turf, but aside from getting distracted by Homes.com, there’s yet to be a noticeable impact on its rentals business – but that doesn’t mean CoStar won’t fiercely defend it.