Portal Wars: Australia

With CoStar’s acquisition of Australia’s #2 real estate portal, Domain, the Portal Wars have expanded to a new market.

Why it matters: To set expectations, it’s important to understand the competitive landscape – in Australia, Domain and CoStar are up against an incredibly strong competitor: REA Group.

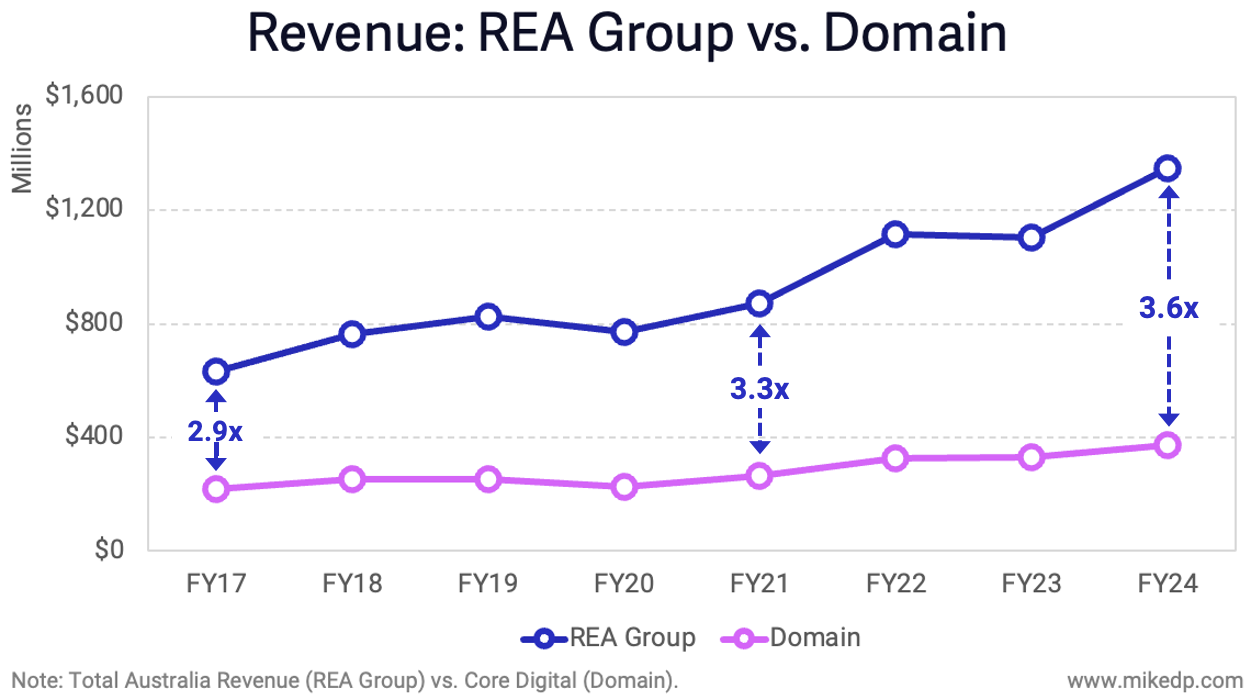

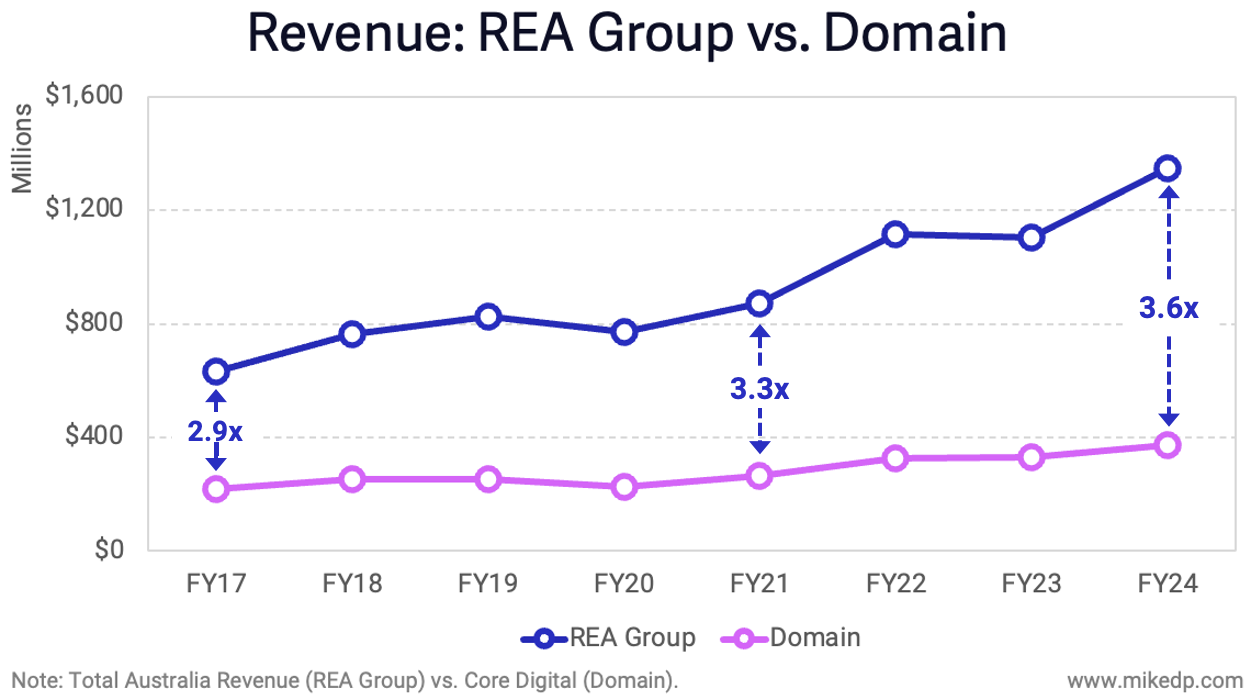

Over the past eight years, REA Group has maintained and expanded a commanding revenue lead over Domain: $1.3 billion vs. $374 million AUD in FY24.

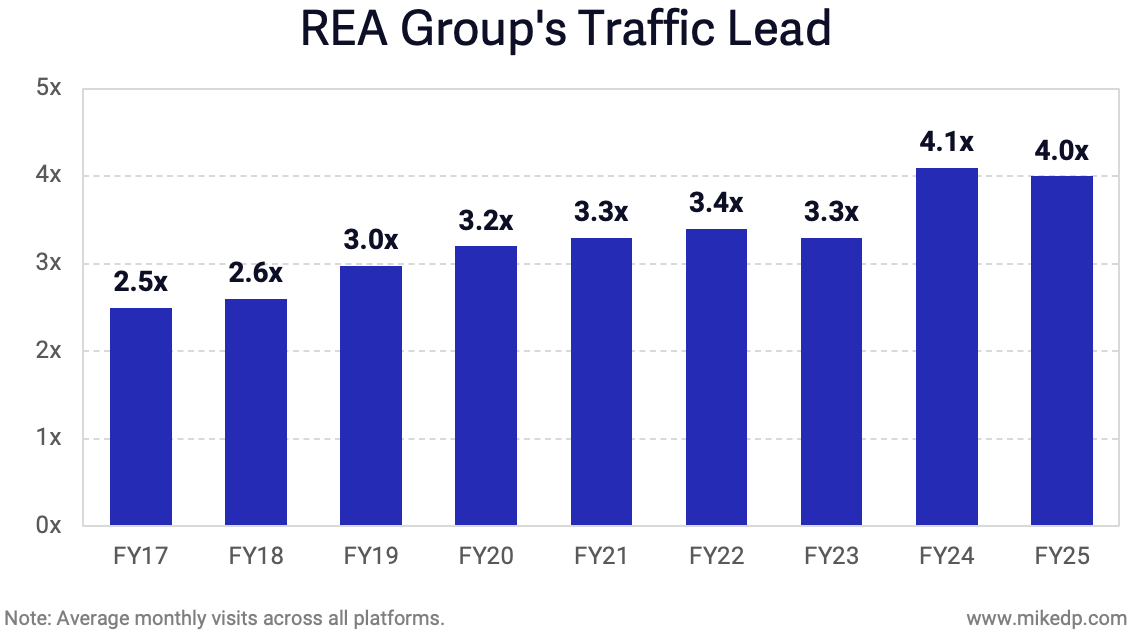

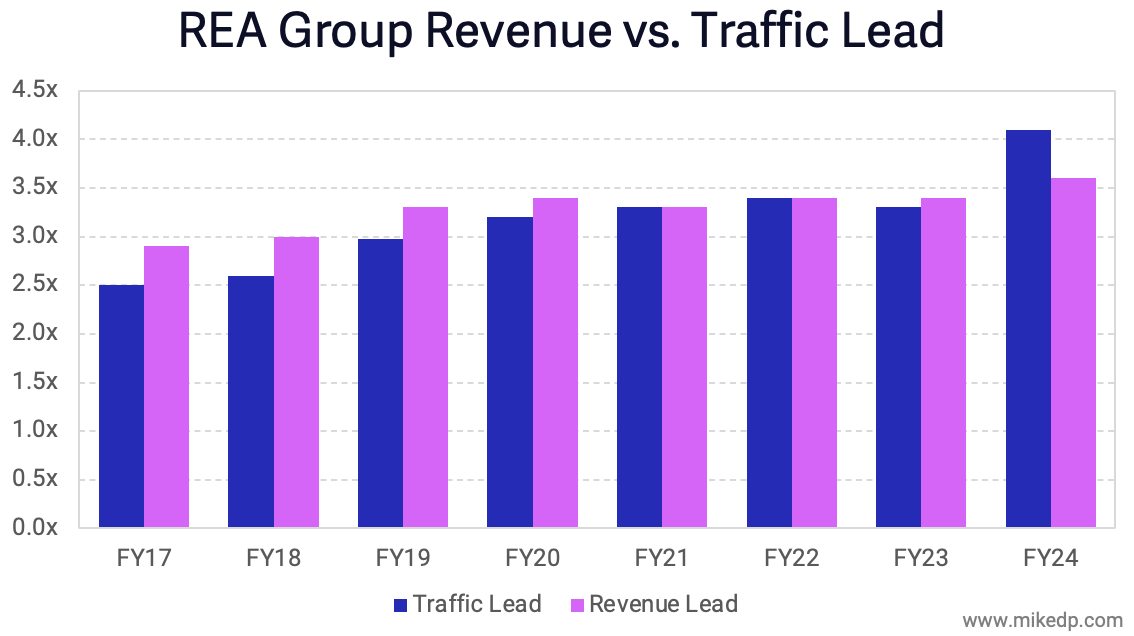

For portals around the world, revenue growth comes from traffic dominance; more consumer eyeballs leads to higher advertising fees.

REA Group’s commanding traffic lead has grown over time – in the world of portals, the strong tend to get stronger.

REA Group’s traffic lead is tightly correlated to its revenue lead; as traffic goes up, revenue soon follows.

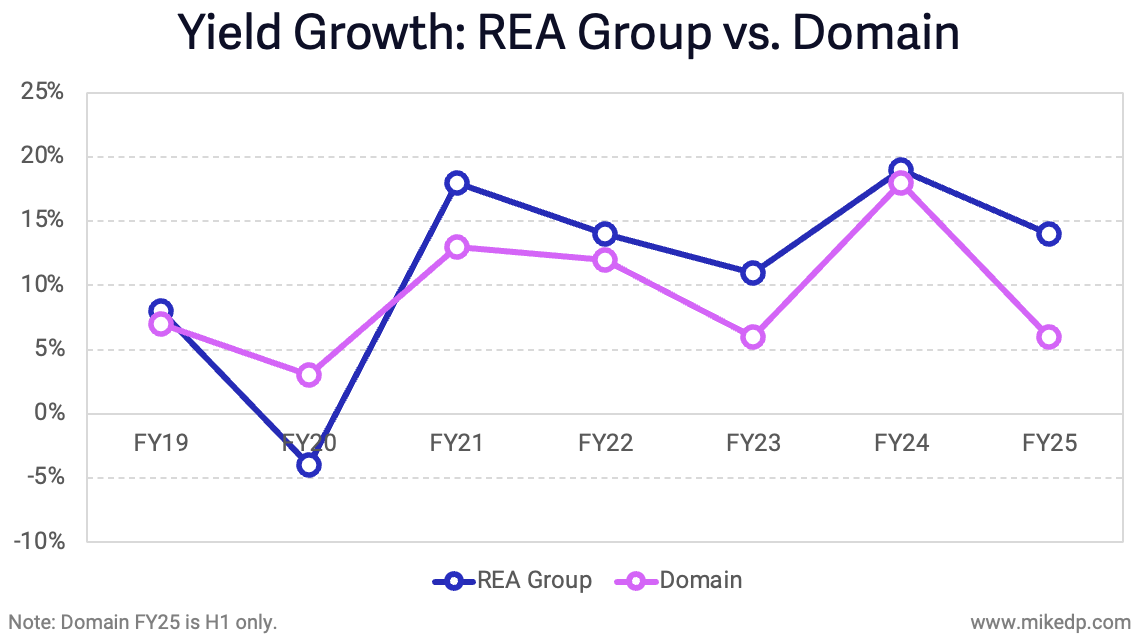

Interestingly, both portals have managed to increase prices, or yield, at similar rates over time.

For the Australian portals, yield is measured as the average revenue per listing (home sellers pay their own portal advertising costs).

REA Group has increased its yield an average of 15 percent per year over the past five years – demonstrating its incredible pricing power.

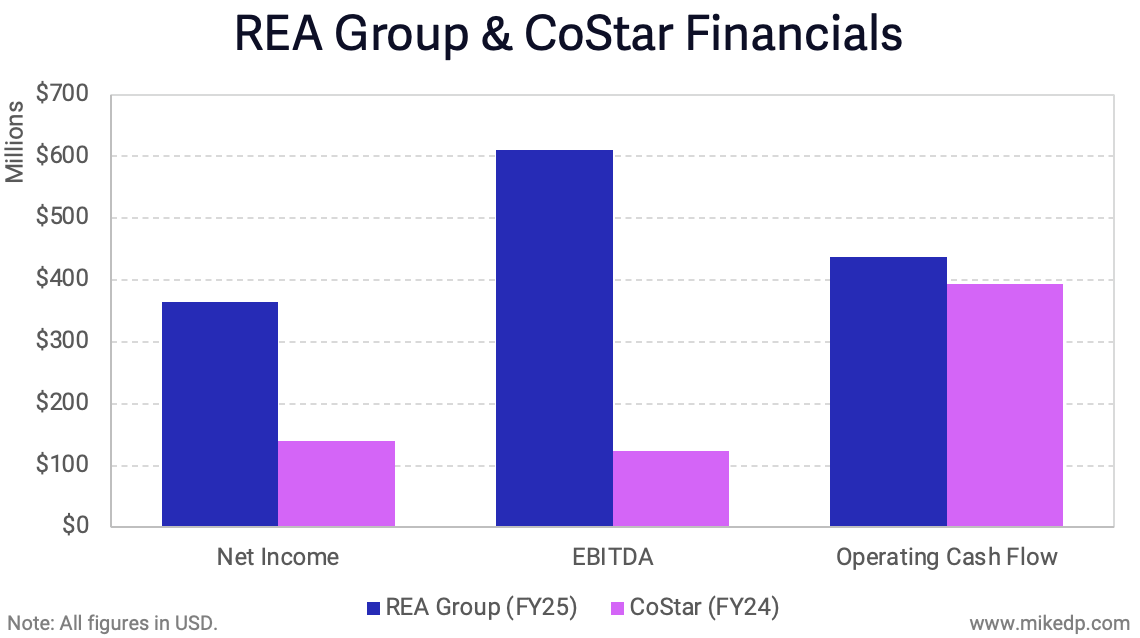

CoStar may be the larger company globally, but it is likely that REA Group will be able to bring more resources to bear locally.

With EBITDA of $615M and operating cash flow of $437M, compared to $123M and $392M respectively at CoStar, REA Group has deep pockets for any defensive or offensive plays.

Note: REA Group operates on an Australian financial year, a 12-month period that begins on July 1, hence the FY25 vs. FY24 comparison below.

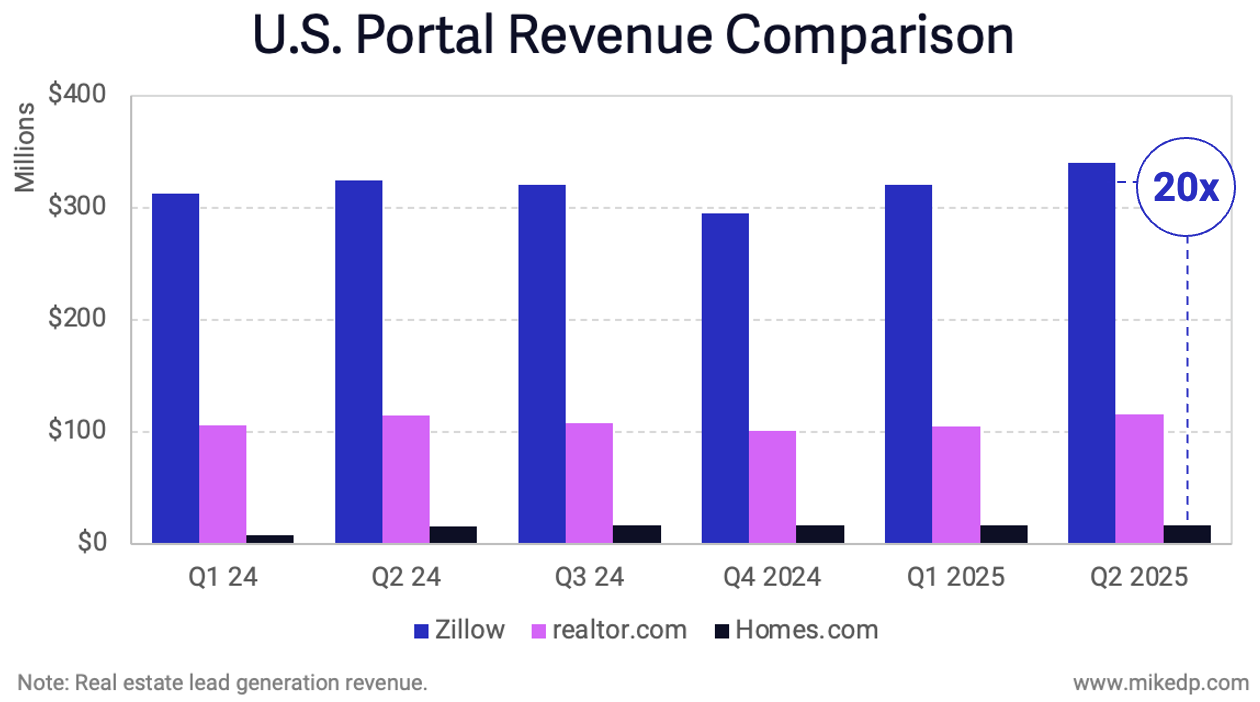

Competitively speaking in the U.S., it would be fair to say that CoStar’s Homes.com has had no discernible impact on Zillow’s business.

My research has shown that portal traffic is a non-zero-sum game, meaning traffic gained by one portal does not come at the expense of other portals.

And the same appears to be true regarding revenue: Zillow has maintained a 20x revenue lead over Homes.com for the past 18 months.

The bottom line: Australia is the third market where CoStar has acquired a residential real estate portal – and like the others, it claims to be going for the #1 spot.

REA Group is one of the strongest portals in the world, measured financially (cash flow) and competitively (traffic and revenue lead).

It’s unlikely that CoStar and Domain will seriously challenge REA Group’s dominance, but that doesn’t mean Domain can’t be run (and grown) as a solid, profitable business in its own right.