Opendoor Recalibrates to a New Environment

/Opendoor is rapidly recalibrating its business to a new environment: operating expenses have been cut in half while purchase volumes are down to levels not seen since the pandemic.

Why it matters: A sustainable future for Opendoor revolves around tight cost control and operational efficiency, reducing customer acquisition costs through partnerships, and finding the right balance between offer quality and purchase volumes.

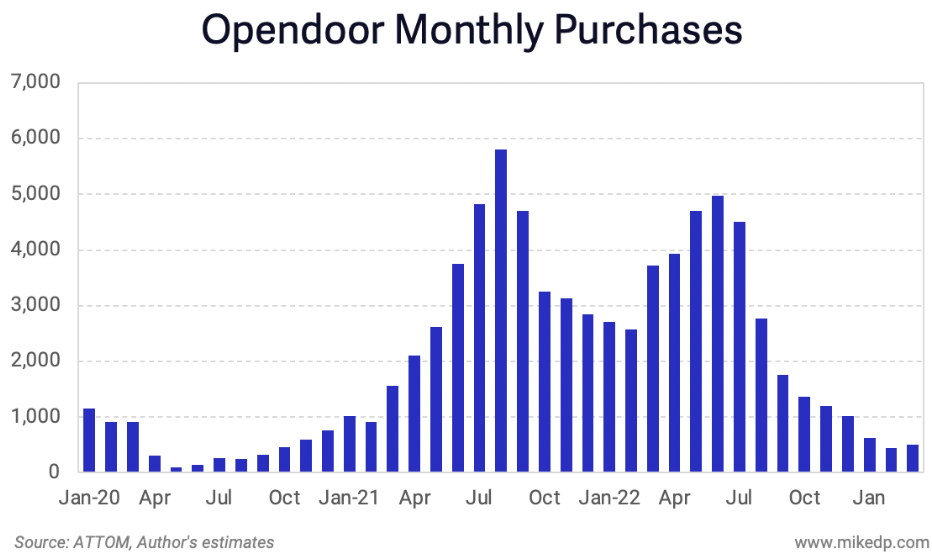

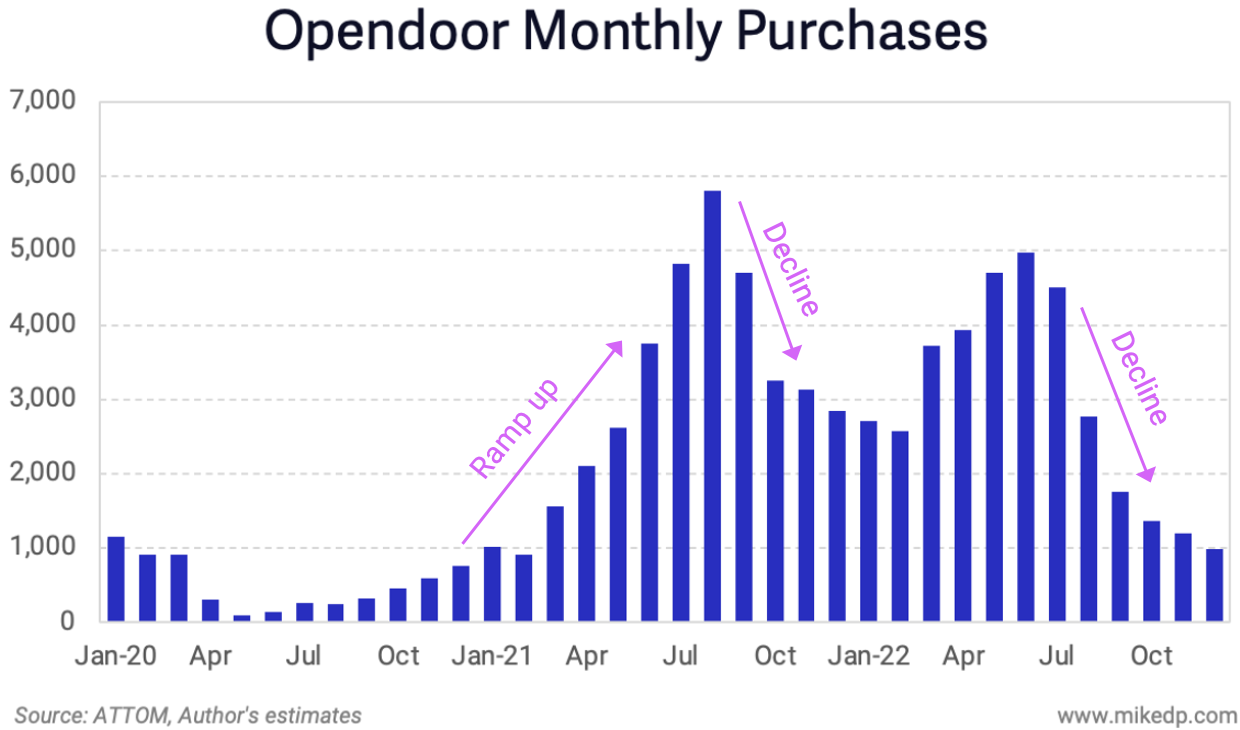

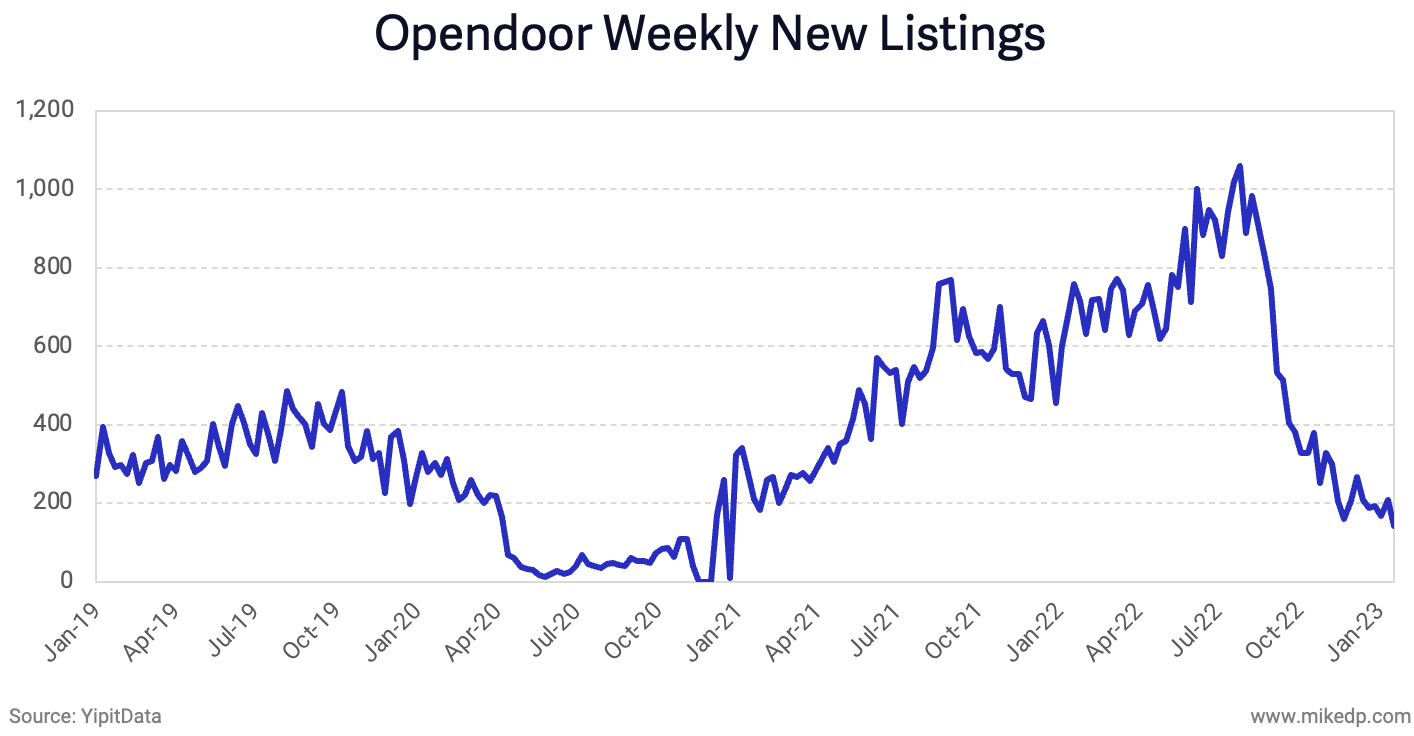

Opendoor’s monthly purchases have dropped eightfold, to levels not seen since the early days pandemic.

The company has gone from purchasing 160 homes per day in June 2022 to purchasing less than 20 homes per day during the first three months of 2023.

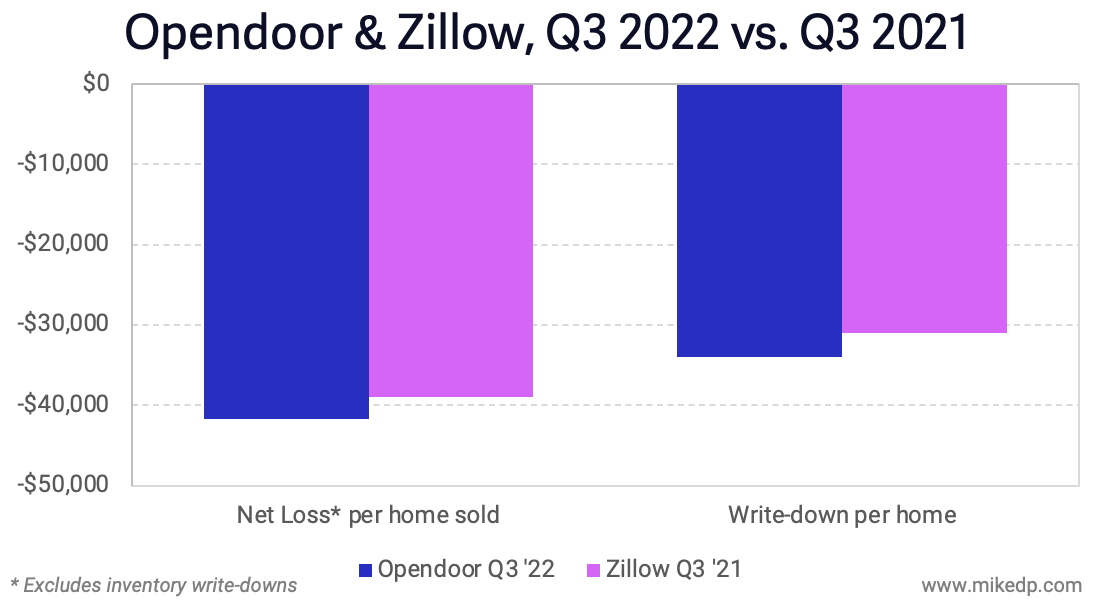

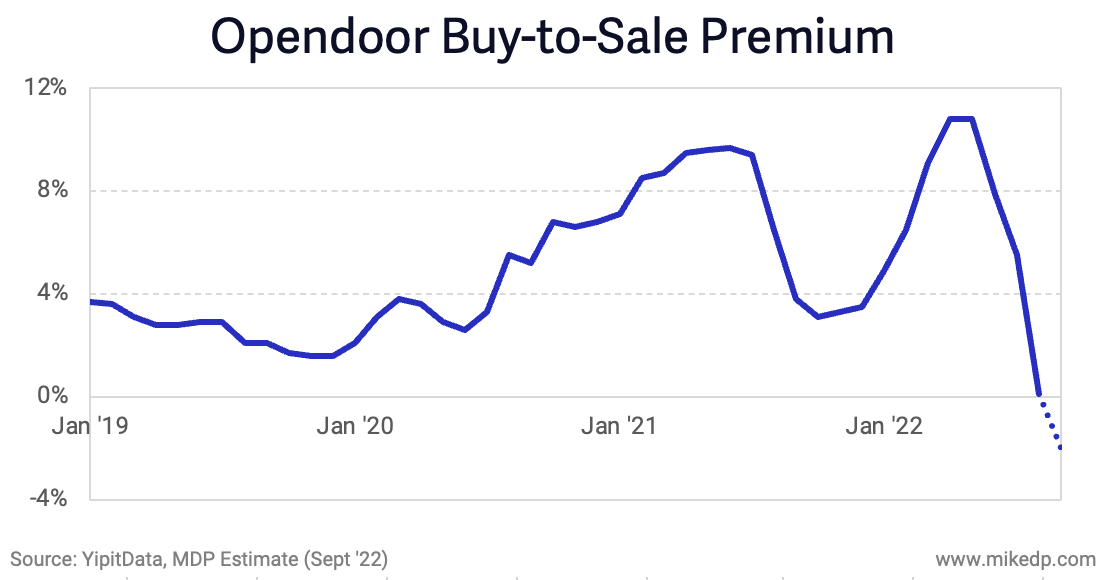

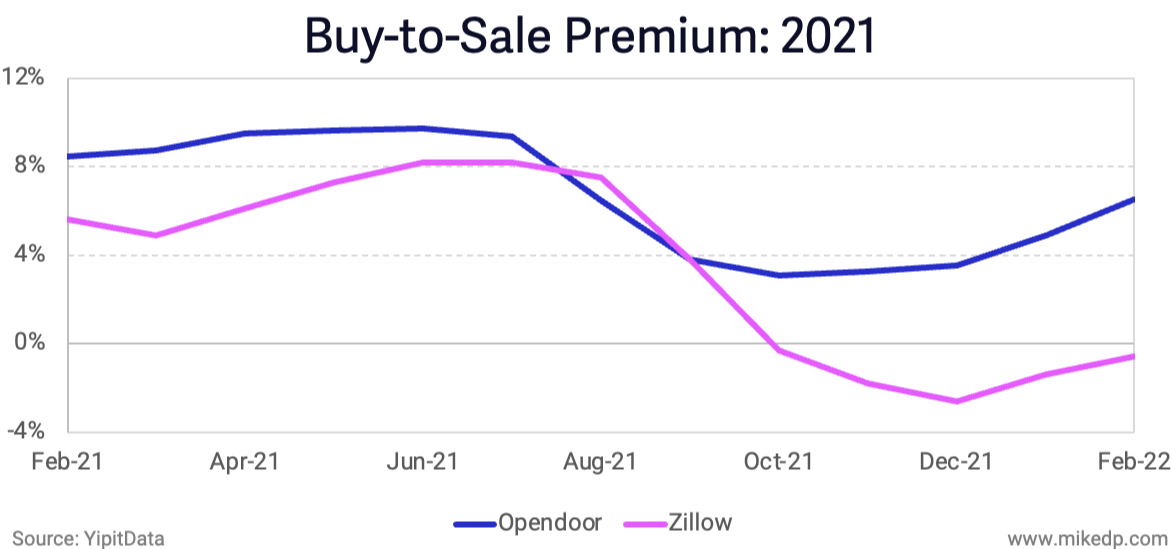

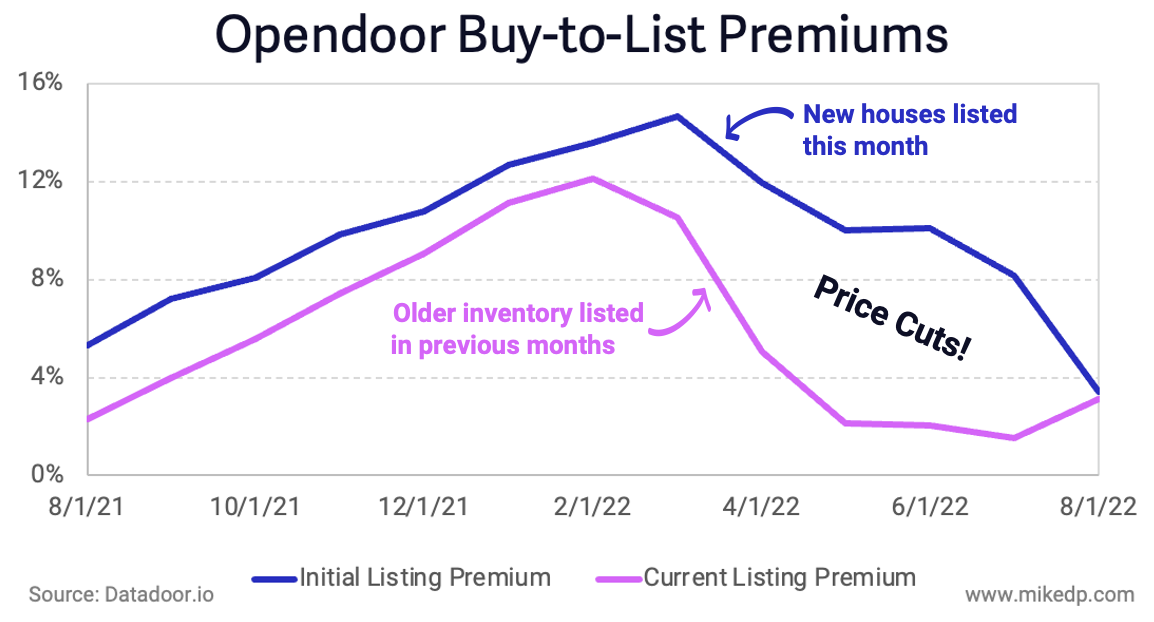

Opendoor is purchasing fewer homes by choice – and doing so by offering less competitive offers to homeowners (offer quality).

This creates a greater “spread” and improves Opendoor’s ability to resell the homes for more on the open market, giving it a buffer against future market uncertainty – and exposure to profitable upside.

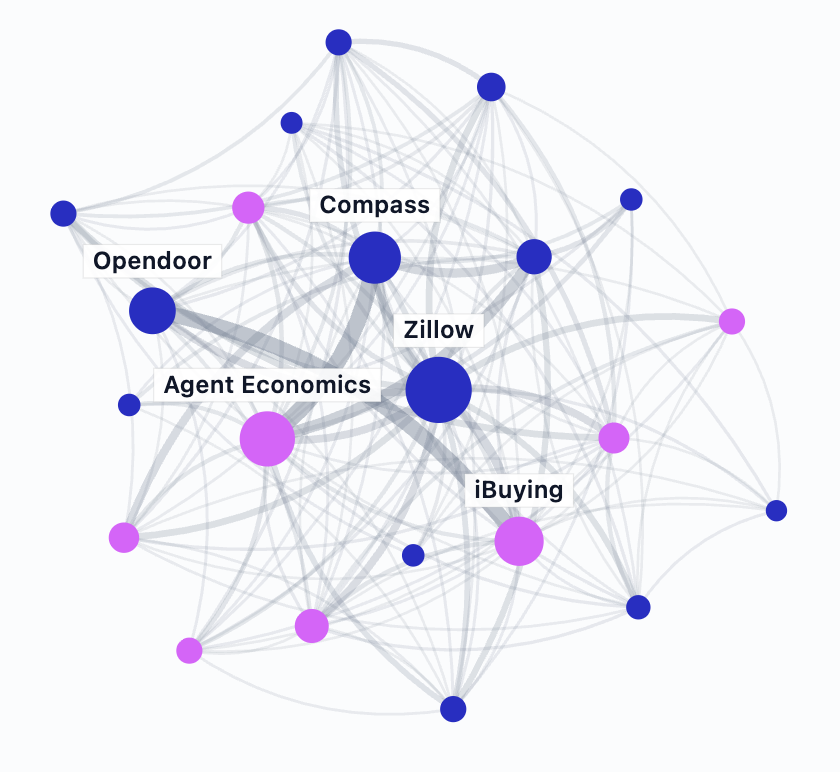

For example, in the Zillow + Opendoor seller options marketplace, Opendoor’s cash offer is usually considerably lower than Zillow’s estimated market value.

This quarter, Opendoor invented a helpful new financial metric, Adjusted Operating Expenses, which excludes variable costs related to selling a property: broker commissions, holding costs, and transfer fees and taxes.

What it reveals is Opendoor’s fixed operating expenses, a helpful measure when thinking about cost control, expense management, and operational efficiency.

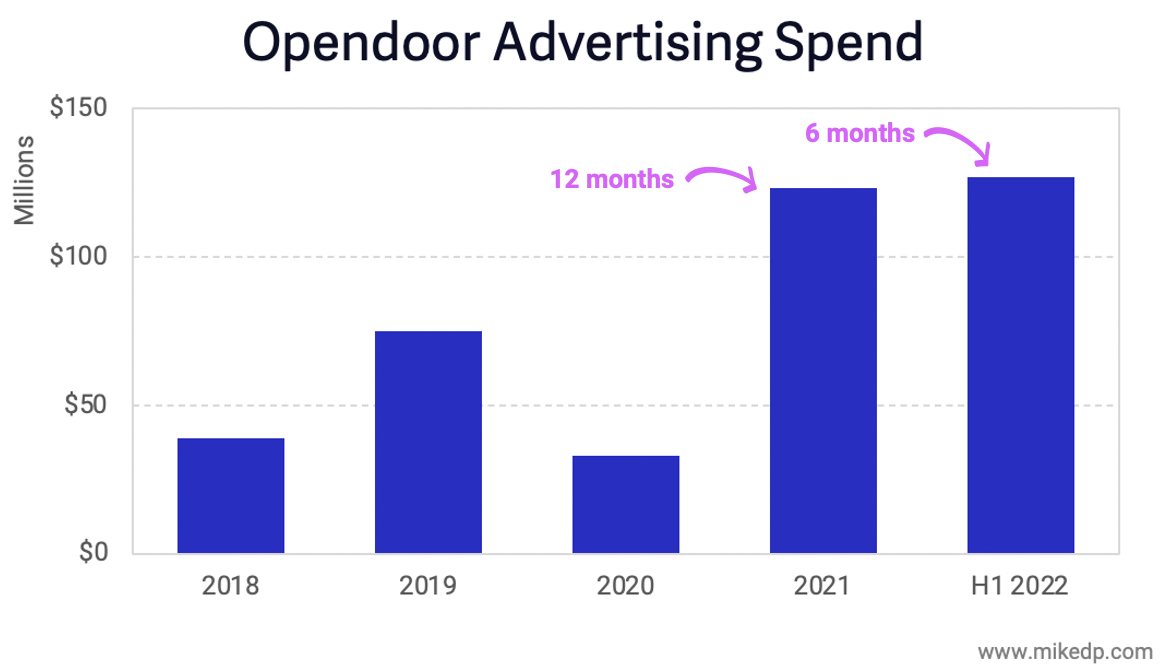

The net result is clarity around Opendoor’s recent cost-cutting: fixed operating expenses are down $100 million, or 50 percent, from Q2 2022, driven through a reduction in advertising spend, layoffs, and other cost-cutting measures.

Opendoor invested $200 million in advertising during 2022, including a significant shift to brand marketing (Opendoor’s marketing team visited my class this semester).

But in a shifting environment, Opendoor has slashed its advertising spend by half during the first quarter of 2023 compared to the same time last year.

A side effect of this shift is skyrocketing customer acquisition cost (CAC), as measured by total advertising spend divided by the number of homes purchased in a period.

Compared to 2022, Opendoor’s CAC has tripled to $16k during the first quarter of 2023 – a very unsustainable number in the long term, but one reflective of sustained brand marketing coupled with markedly fewer purchases.

The bottom line: With $1.3 billion in cash, Opendoor has the time and space to retreat, regroup, and realign the business to not only stem its losses, but position itself for future growth.

The evidence shows that Opendoor is making significant changes to become a more efficient operation.

Just cutting expenses at the current purchase volumes is not a sustainable strategy – but it is an important first step as the company reorients for the future.