Opendoor's pivot to agents

/According to a report on Inman, Opendoor is launching a new preferred agent partnership program where it is co-listing a growing portion of its for sale properties with partner agents.

Why it matters: This is a significant pivot for Opendoor, aligning it closer to agents in a major way. It signals that working with the traditional industry -- rather than trying to disrupt it -- is an important part of its growth strategy.

Working with agents

Opendoor's new preferred agent partnership program brings the company much closer to agents. As opposed to the company's hallmark of buying and selling direct to consumers, with a do-it-yourself open home model, this latest move represents a big pivot.

Before this program was announced, the way Opendoor sold its homes was fairly uniform: it would list direct without an agent, offer self-guided tours, brand everything Opendoor, and not pay seller agent fees since it was selling direct. But things have changed:

An unknown question is how Opendoor is compensating co-listing agents. There are three possibilities, listed in order of likelihood:

The agent receives a referral fee (likely 1 percent) for representing Opendoor.

The agent receives a fixed fee ($1,000) for representing Opendoor.

The agent receives no direct compensation, but benefits from potential leads while hosting open homes.

Why the pivot?

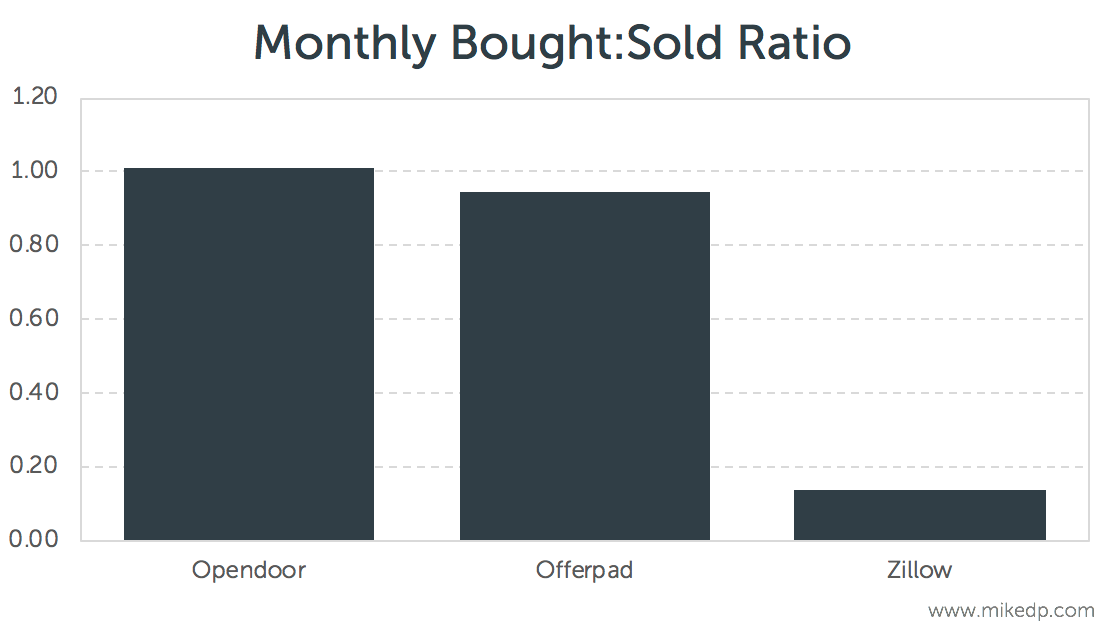

This is a big move for Opendoor, and it would only make a change if there was a business benefit.

Opendoor is moving towards an agent-centric model, where it's co-listing and co-branding with a traditional real estate agent (and the traditional process it is aiming to disrupt). That's a non-trivial shift. And assuming Opendoor is compensating co-listing agents as outlined above, there's a significant economic shift as well.

Opendoor is in the business of buying and selling houses. So any pivot must enhance that capability, leading to two possible reasons for the change:

Sell more houses, faster.

Attract more agents representing sellers (buy more houses).

For a co-listing arrangement to make business sense, it must enable Opendoor to buy or sell more houses. Either its existing process isn't quite where Opendoor wants it to be, or there's an external reason to cozy up to agents...

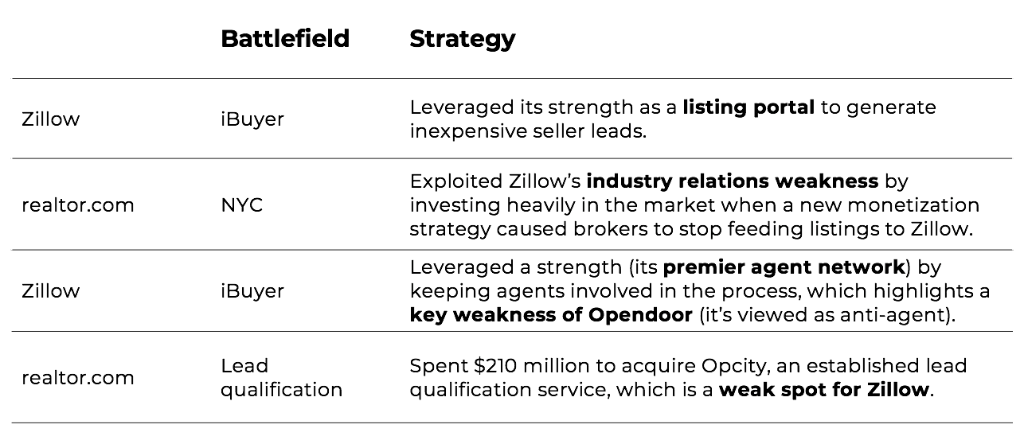

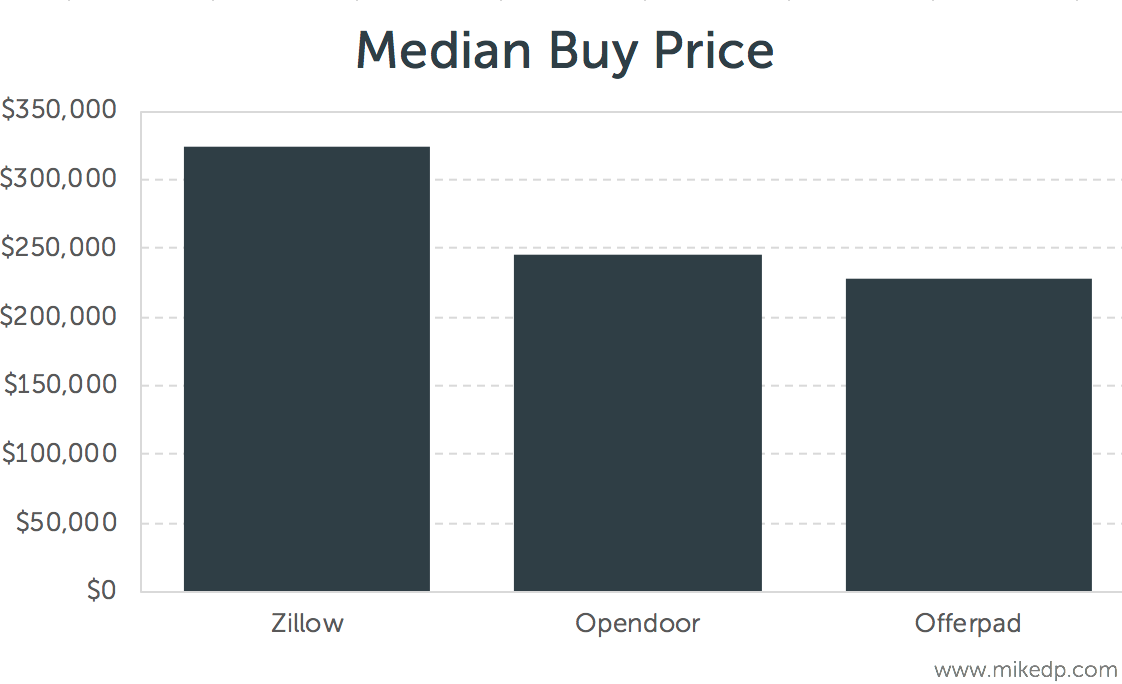

The Zillow factor

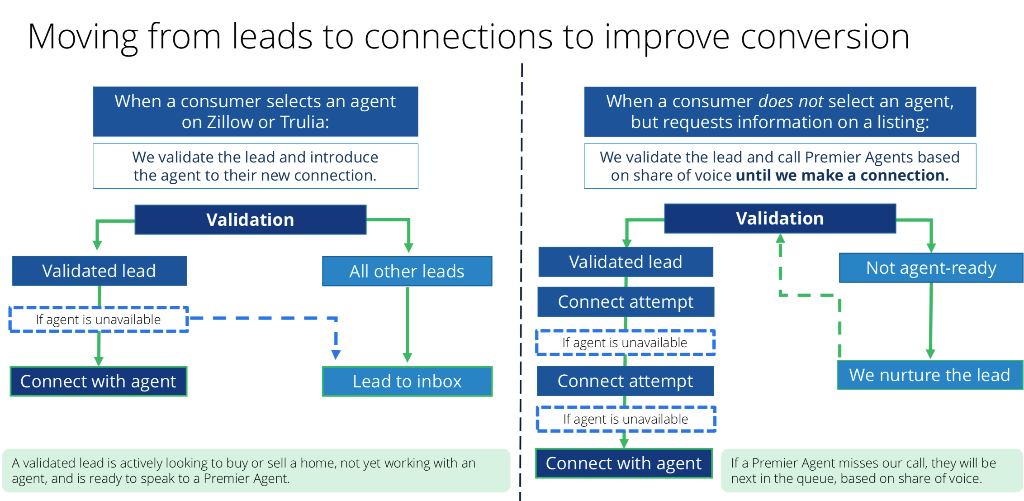

There's one other factor to consider, and that's the relatively recent arrival of Zillow to the iBuyer game. As a reminder, Zillow's angle is to include agents in each step of the process, using its premier agent network to represent all sides of the transaction.

Opendoor's latest move puts it squarely at parity with Zillow in terms of agent involvement and the value proposition for agents.

Now, if you're an agent, the benefits of working with Opendoor are the same as working with Zillow. For Opendoor to make this degree of change, and give up image and economic value in order to appeal to agents, it must really want to work with agents!

Strategic implications

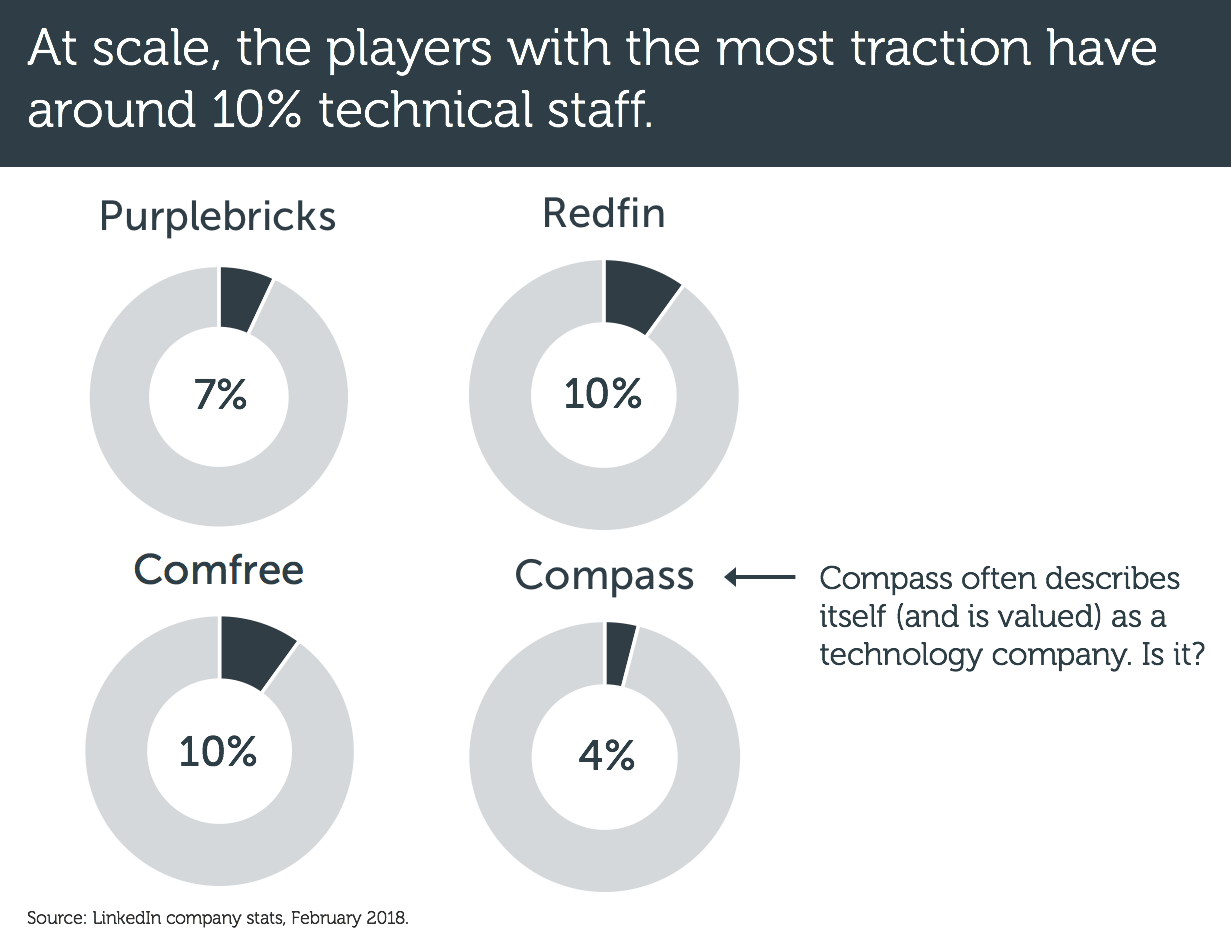

There's a long history of would-be real estate disruptors that attempted to disintermediate the traditional industry, only to change their minds and pivot back.

It's hard to go against real estate agents. There's just so many of them, and psychologically consumers want to keep using them. Many disruptors start with anti-agent tendencies but eventually come back to the fold. It's easier and more profitable to work with the industry than against it.

This is not a full-scale retreat on Opendoor's part; far from it. But it's the strongest signal yet of the importance of agents to its current growth strategy.