Inside Compass — Part 1: Growth Strategies

/Compass is one of the world’s proptech unicorns. With a valuation of $4.4 billion and over $1.1 billion in venture capital raised, this self-styled technology-enabled broker is now the third largest U.S. brokerage by sales volume.

But how has it grown so quickly? What’s the secret to its meteoric rise, and what is it that investors see that justifies its massive valuation? This multi-part deep dive into Compass looks to provide evidence-based answers to those questions — and more.

Fundraising and growth drivers

Compass’ fundraising prowess sets it apart from its peers. It is one of the select few real estate tech companies that has raised over $1 billion in equity (Opendoor is another), and counts SoftBank as one of its investors.

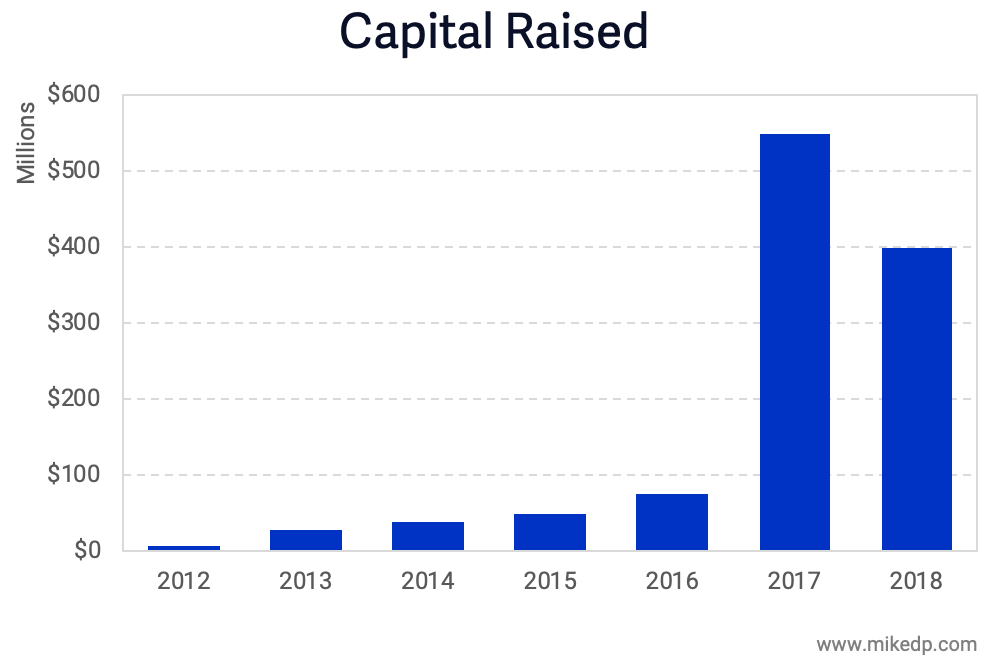

Compass raised its first capital in 2012, but it was not until recently that it started raising mega rounds: $550 million in 2017 and a further $400 million in 2018.

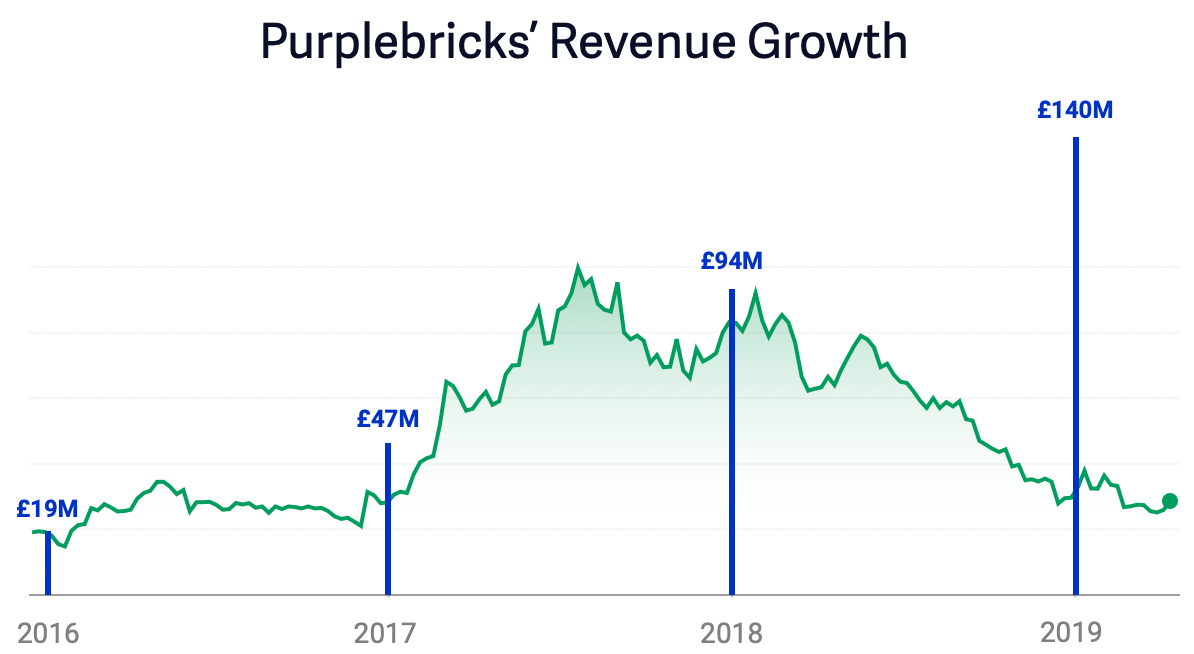

Compass has seen a corresponding increase in its revenue and transaction volumes. Revenue has consistently doubled over the past several years as the company has become the third largest U.S. brokerage in terms of sales volume. It completed around 35,000 transactions worth $45 billion in 2018.

Source: author’s estimates from numerous company statements.

In a relatively static world of real estate market share, Compass is clearly making an impact and seeing strong growth. And its growth strategy is as unique as its fundraising ability.

A New York Yankees growth strategy

Beginning in a big way in 2016 — after a $75 million cash infusion — Compass began a new strategy of growth through acquisition.

Over the years, several sports franchises around the world, including the New York Yankees, Real Madrid, and Chelsea Football Club, have executed a particular growth strategy based on their competitive advantage: access to capital. All three clubs are rich, have access to massive amounts of capital, and use it to buy the best players in the world.

Compass operates a similar strategy; its competitive advantage in the market is capital (over $1.1 billion of it). The Compass strategy is to deploy that capital by luring the best agents and brokers to its team. Like all real estate brokerages, agent count is the primary driver of revenue.

Compass employs a number of methods to attract the best talent: high commission splits, bonuses, marketing funds, and stock options. These financial factors are in addition to the softer benefits of the Compass brand, which is slick, modern, exclusive, luxury-focused, and comes with the promise of marketing and technology support (this will be explored further in Part Two: Brokerage or Technology Company).

Beginning in 2018, immediately after its massive $550 million cash infusion, Compass upped the game by acquiring brokerages wholesale. Instead of luring away only the star players, management decided it would be faster to simply acquire entire brokerages, which significantly accelerated the growth of Compass’ agent count (note the blue line in the graph below).

Since the start of 2018, Compass’ agent count has increased from roughly 2,000 to 10,000. Of those 8,000 new agents, around 4,200, or 52 percent, came from acquired brokerages. The remainder can be assumed to come from traditional, organic methods (recruitment of star agents and teams).

Steve Murray from REAL Trends, whose firm closely tracks and values U.S. brokerages, estimates that the acquisitions listed above cost Compass a total of between $220 and $240 million, paid in a combination of cash and stock. Compass has stated that it typically pays between four and six times a firm’s annual pre-tax earnings.

Assuming a total of $230 million spent to acquire fourteen brokerages with 4,200 agents, that’s a cost of $55,000 per agent. Quite an expensive — and effective — recruitment method.

Marketshare merry-go-round

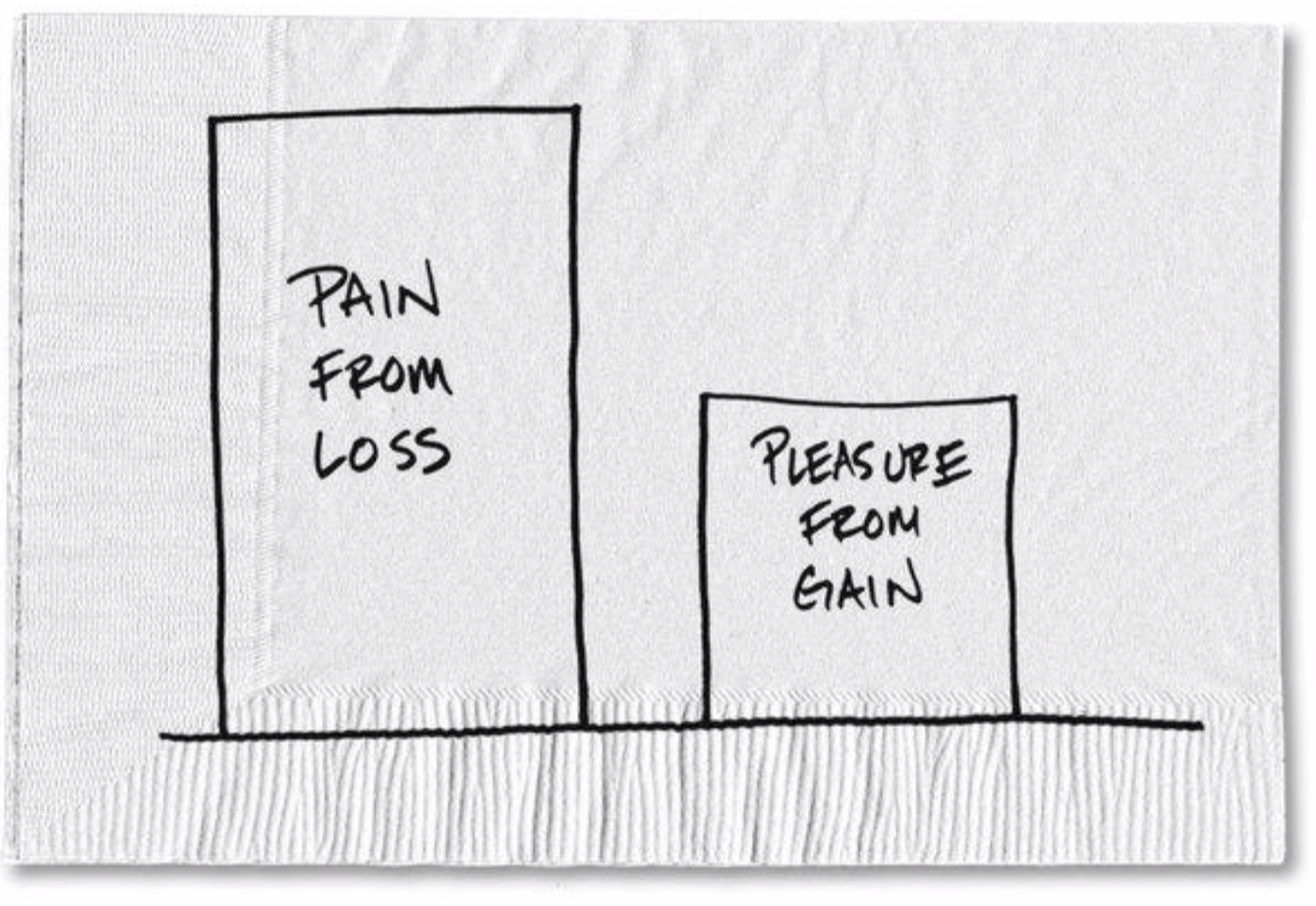

The real estate world revolves around agents. Agents generate revenue, and that revenue gets split between agent and broker. Each year, many agents change brokerages in an effort to increase their earnings through incentives like more favorable commission splits. It’s a recruiting tool.

This marketshare merry-go-round has been going for decades. There’s always a new player entering the market with a sweet deal to attract agents with the promise of earning more money. Today, that’s Compass and eXp Realty. But what about tomorrow? What’s to stop the next wave of players offering an even better financial proposition to lure agents to its ecosystem?

Compass has achieved a tremendous amount of growth in a relatively short period of time, and its competitive advantage is access to capital. It is parlaying that advantage into a massive agent recruiting tool at scale. But that advantage may not be sustainable nor unique; it’s possible for others to copy. Nothing is stopping a new or existing player from offering even more lucrative deals to attract agents.

Brokerage or technology company?

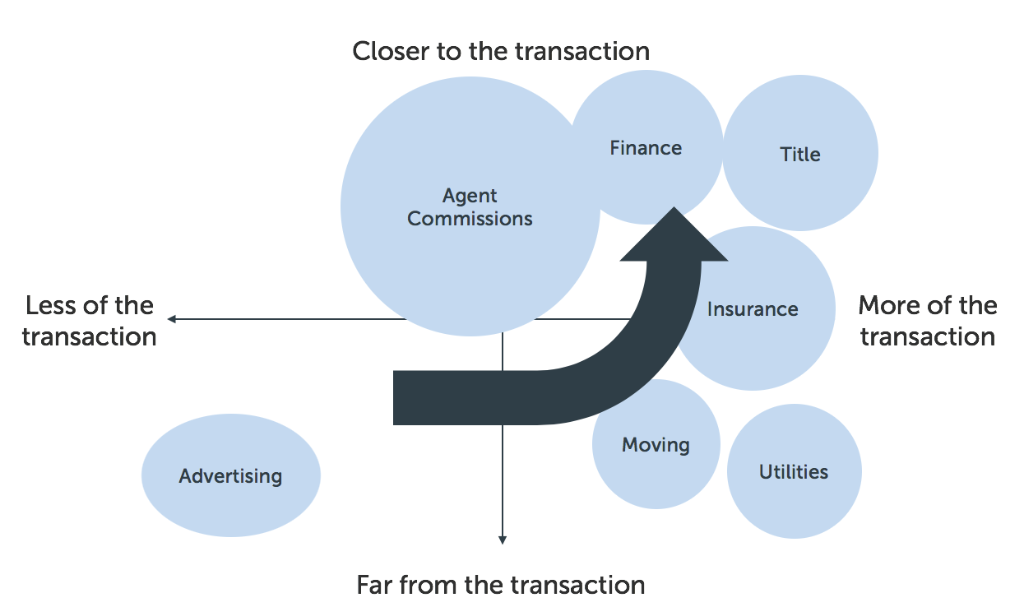

The vision, promise, and lure of Compass is that it’s a technology company, not a traditional real estate brokerage. And as a technology company, it will deploy tools unmatched by others in the industry. This potential competitive advantage will be key to attracting and retaining agents, and a cornerstone of the Compass strategy.

Using extensive data as evidence, part two of this series explores that singular, key question upon which this $4.4 billion company revolves: Is Compass a brokerage, or a technology company?

Inside Compass: A Strategic Analysis

My epic, five-part Compass analysis in one easy to read whitepaper. Download the free PDF and enjoy!

Also check out the rest of my strategic, evidence-based analysis of Compass.