The Portal Traffic Wars & The Mother of All Metrics

/On my recent podcast, Redfin’s Joe Rath and I discussed the Mother of All Metrics – close rate – and its critical importance to online leads and real estate.

Why it matters: Close rate is especially relevant in Portal War ‘24; traffic is top of the funnel, but close rate – which correlates to lead quality – will guide the investment decisions of potential customers.

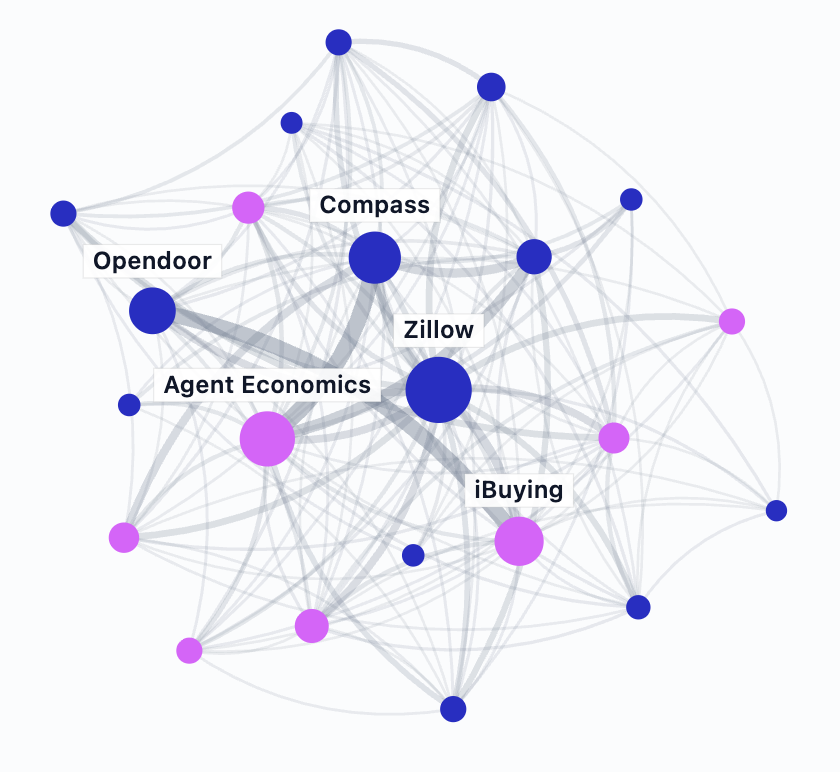

Dig deeper: Homes.com has become a serious contender in the portal space, with similar traffic to realtor.com and Redfin, and once Apartments.com traffic is included (CoStar Resi), it surpasses both.

After a few years of crazy, Zillow has reestablished its commanding traffic lead over realtor.com; its position as #1 is clear.

For more about a leading portal’s competitive advantage, read my strategic analysis: Millions More Buyers.

During the last quarter of 2023, all portals experienced a seasonal decline in traffic.

Compared to the previous quarter, that decline was fairly even across the board – surprisingly similar for Zillow, realtor.com, and Redfin – at 13 percent.

Homes.com and CoStar’s residential network were down a smaller degree at 11 percent, most likely benefiting from a sustained marketing blitz.

Homes.com’s meteoric rise in traffic is the result of CoStar’s massive advertising spend.

For perspective, across its entire network in 2023, CoStar outspent Zillow by 4x, or $412 million, or more than 2x Zillow and Redfin combined.

It’s clear that CoStar is very, very serious about its investment in residential portals.

What to watch: lead quality.

I've spoken to some early customers and it's too early to make a call about the quality of leads generated by Homes.com.

So if you’re using Homes.com as an advertising channel, reach out and share your experience!

The bottom line: Traffic is just a number – ultimately, each portal is a business that must turn traffic into leads, and leads into money.

Homes.com is coming to market with a new business and monetization model, and it needs to prove that it can deliver a strong return on investment to its agent customers.

Traffic is an important first step in the process, but in the end it comes down to lead quality, and that process will take time.

Note on data: Collecting traffic data for Homes.com and CoStar’s residential network relies on a combination of assembling clues, triangulation, and making a few assumptions. Some of the numbers above are estimates based on public information.

Some of what’s known is that Homes.com’s average monthly uniques was 62M in Q3 2023, Apartments.com had 44M average monthly uniques in 2023, and CoStar’s entire residential network was 95M average monthly uniques in Q4 2023.