Compass’ Cash Crisis Closes

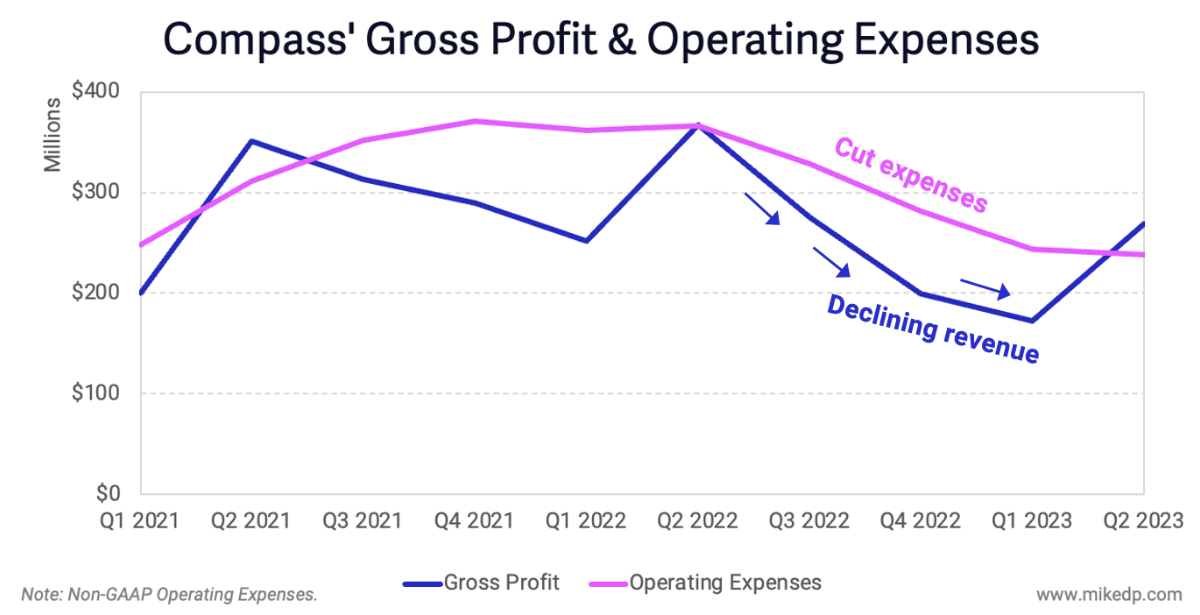

/After 15 months of cost cutting, Compass is free cash flow positive, making more money than it spent in Q2 2023.

Why it matters: With a high cost base and dwindling cash reserves, Compass was forced to cut operating expenses as it pivoted to a profitable, sustainable operation – which it has done.

Dig deeper: I first wrote about Compass' cash burn problem in May 2022, and it's been a busy 15 months.

Over the past year, the company has cut expenses by about 35 percent – or $500 million – through three rounds of layoffs.

Compass’ annual operating expenses have dropped from $1.45 billion to $950 million, with a goal of getting down to $900 million by the end of the year.

A declining market is an especially challenging time to achieve profitability.

As of Q2 2023, Compass’ trailing 12 month revenue was $5 billion – down from $6.7 billion a year ago.

Which means cost control is the only realistic option available to get cash flow positive.

Compass’ cash balance has stabilized at $335 million – and, in fact, has increased for the first time in years.

Management clearly has confidence in the business: in July, it repaid the outstanding $150 million draw from its revolving credit facility.

What to watch: Compass isn’t entirely out of the woods yet, but it’s on a much more solid foundation.

This past quarter is the high-water mark for revenue; from here seasonality kicks in with progressively lower revenue for the next nine months.

It’s likely that cash flow will remain relatively flat for the rest of the year – the question is whether it will limit the company’s ability to invest for future growth (M&A and organic).

The bottom line: Compass’ turnaround has been an instructive case study in managing a business through a turbulent market.

Like many businesses, the company was caught flat-footed last year when the market changed, but it executed a necessary turnaround to sustainability.

The broader lesson is around adaptability – it matters less how you got to where you are, and more how quickly you can adapt to a rapidly changing environment.