Zillow, Mortgage, and the Holy Grail of Real Estate

/Recently there's been a lot of noise around Zillow’s mortgage operation, including a pair of class-action lawsuits, but the company remains undaunted in its goal to build a bundled experience for consumers.

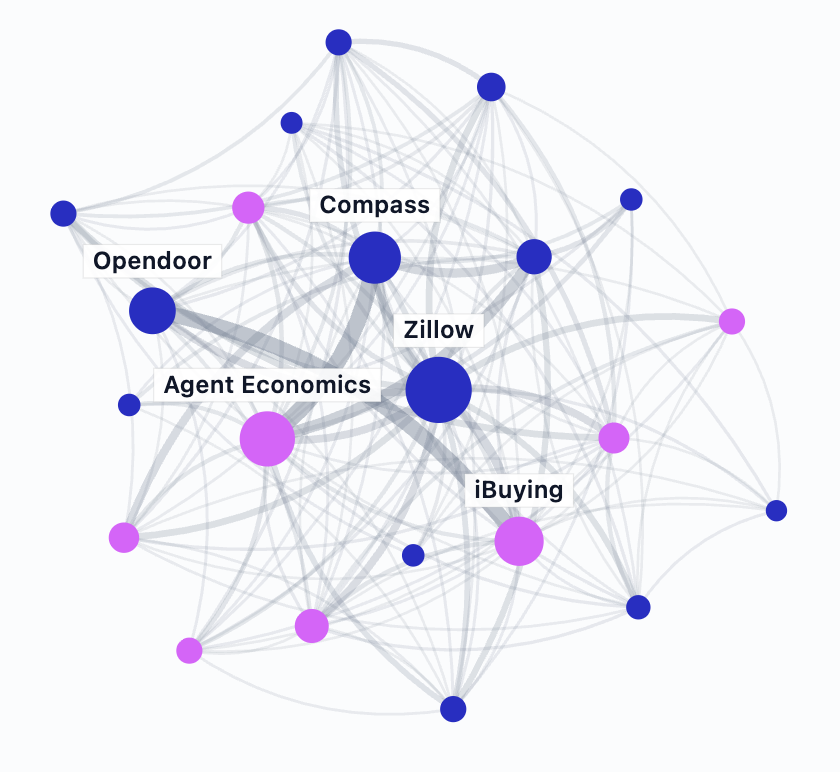

Why it matters: Mortgage remains one of Zillow’s largest revenue-generators for future growth, and a critical path on its search for the holy grail of real estate: the one-stop-shop ecosystem.

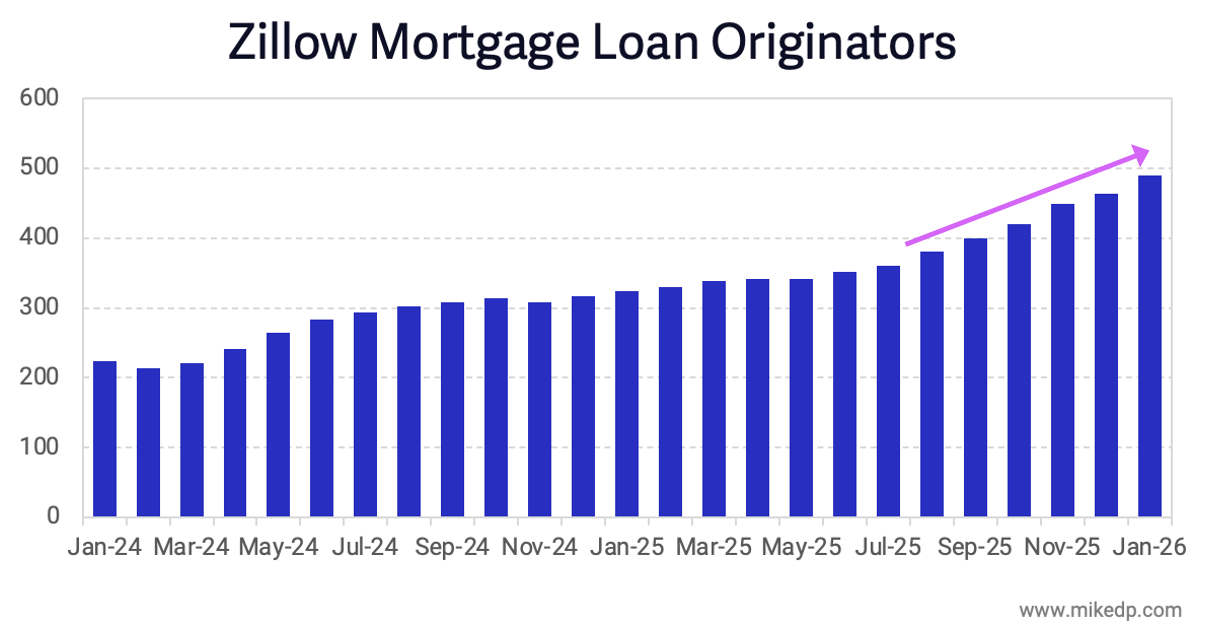

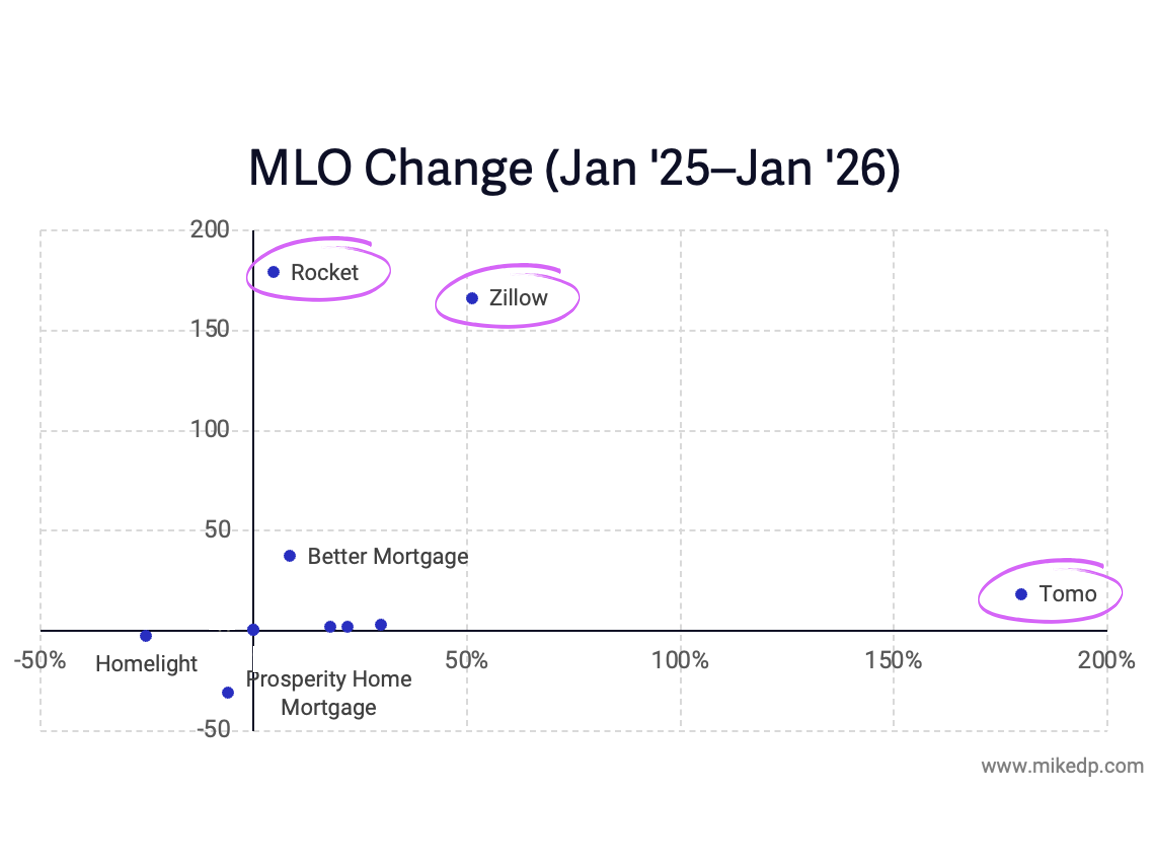

The number of mortgage loan originators (MLOs) that a company employs – actual human beings that process loan applications – is a reflection of the level of investment that company is willing to make, and a leading indicator of future business growth potential.

Zillow’s MLO count has been growing for years, but has increased even faster over the past six months.

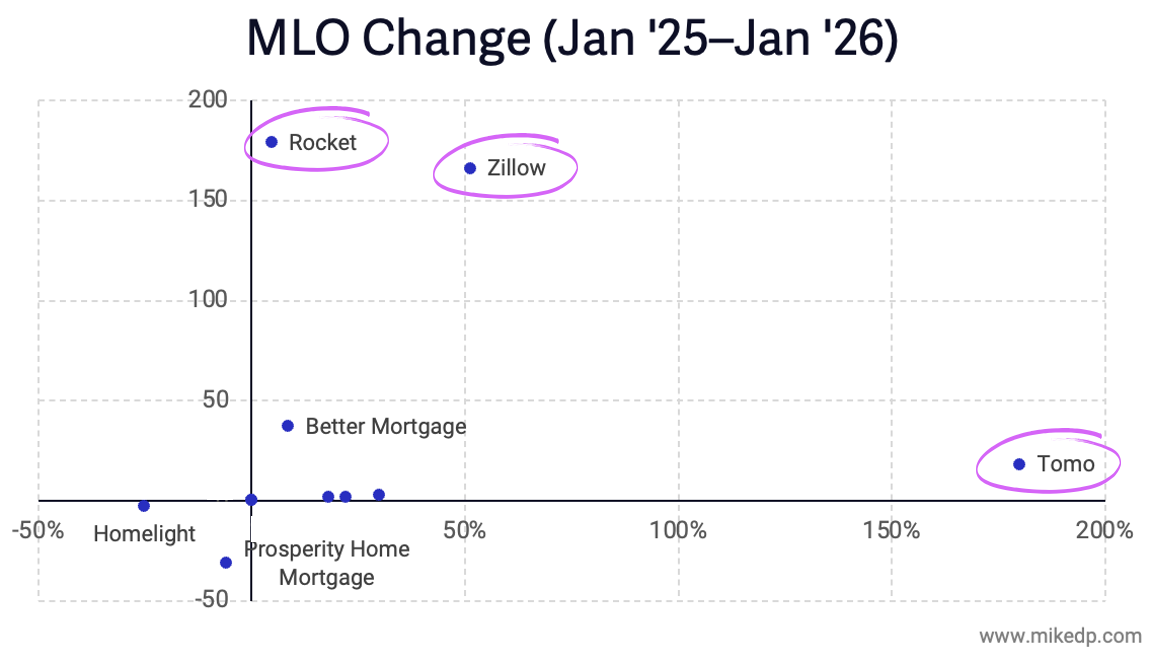

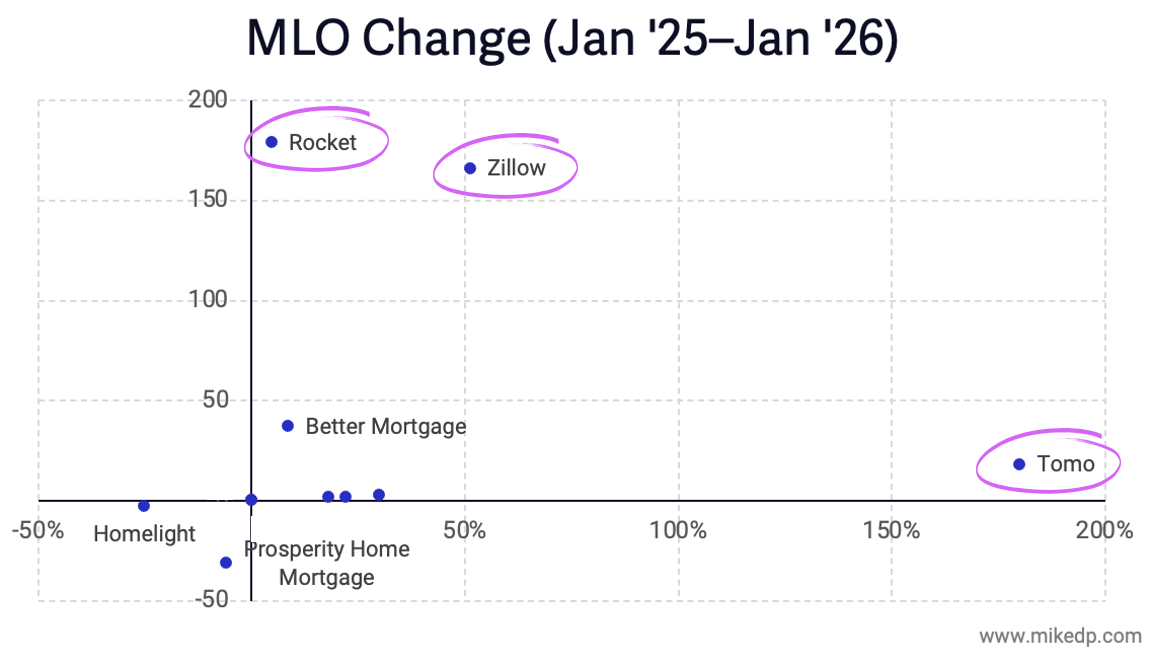

Over the past year, three companies stand out from an MLO growth perspective: Zillow, Rocket, and Tomo.

Both Zillow and Rocket are fully engaged in the search for the holy grail of real estate, combining home search with brokerage and mortgage services.

Tomo, a smaller company, has found strong product-market fit and is growing quickly.

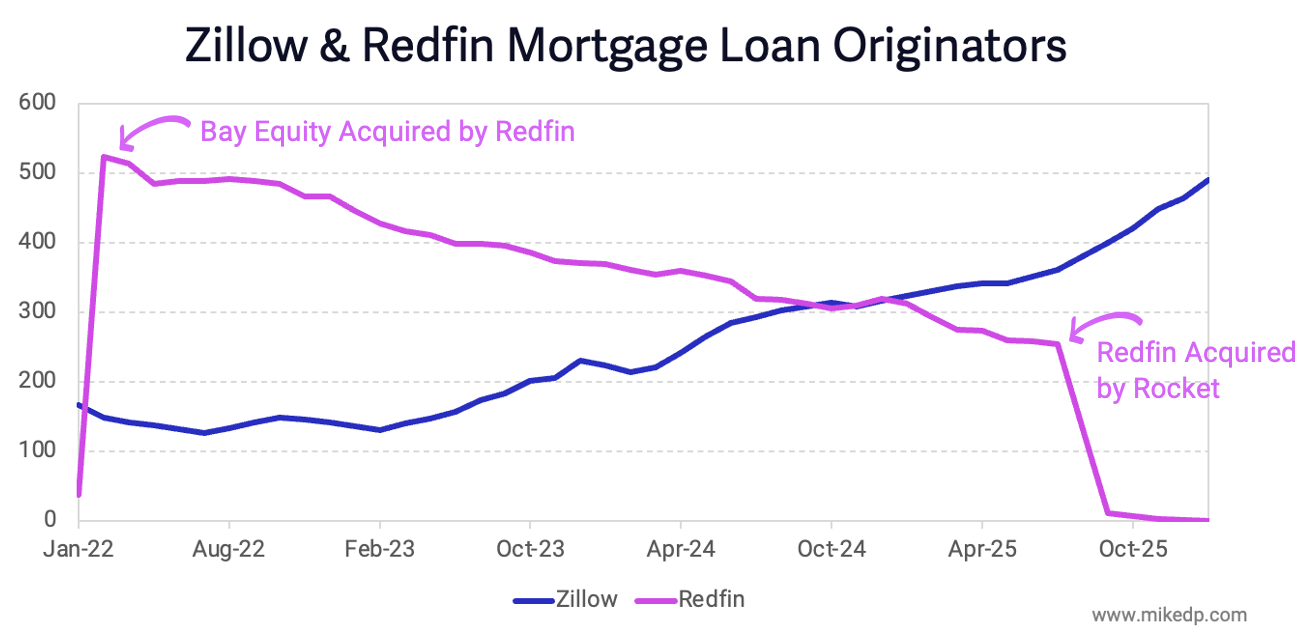

Comparing Zillow’s and Redfin’s adventures in mortgage illustrates an interesting build vs. buy comparison.

After four years of building its own mortgage operation, essentially from scratch, Zillow is nearly at the level of MLOs that Redfin was when it acquired Bay Equity in early 2022.

Time vs. Money: Acquire a mortgage company for $138 million, or build it from scratch over four years.

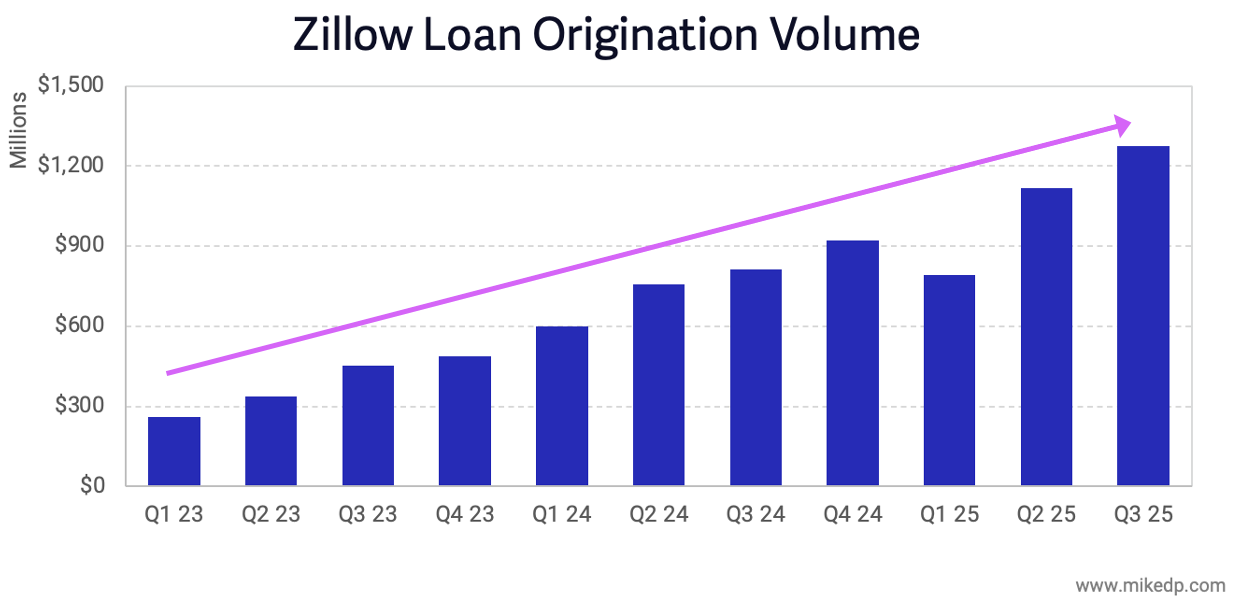

Zillow’s loan origination volume closely follows its increase in MLOs.

Zillow is on track to originate over $4 billion in loan volume in 2025, up over 33 percent from the previous year (and up over 170 percent from 2023).

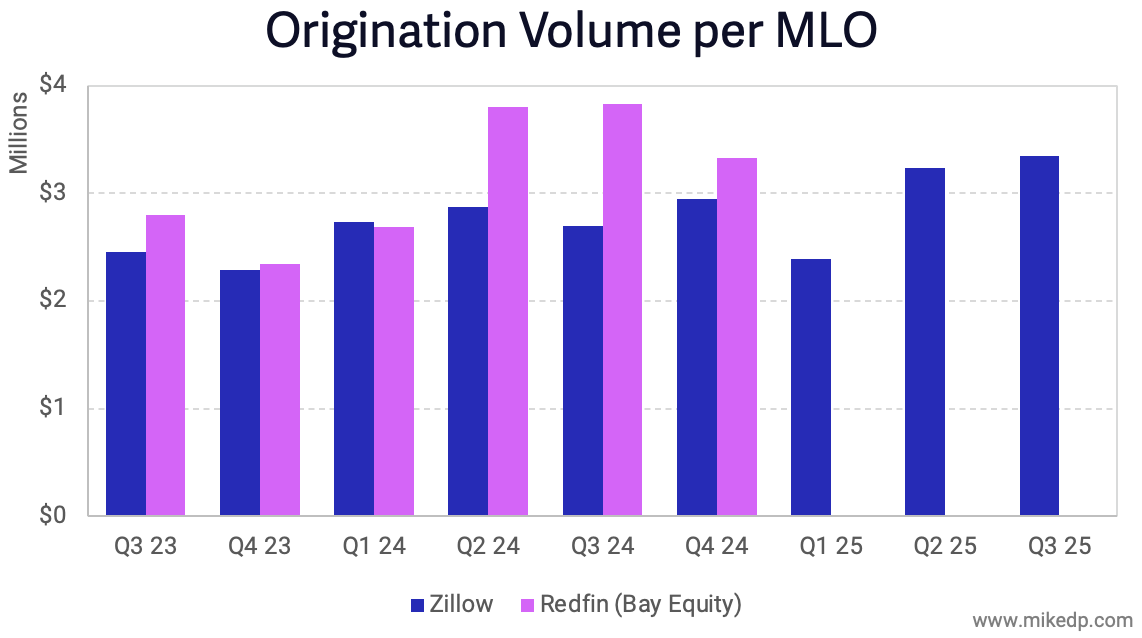

Zillow’s overall MLO efficiency is increasing as well.

After a blip in Q1 2025, the average loan volume per MLO has steadied above $3 million – higher than anytime in the past.

This could be the result of productivity gains (tech), or simply higher overall loan volume; in either case, it’s not industry-leading, but is a positive sign.

The bottom line: It’s illuminating to compare the headlines to reality; even with increasing regulatory and legal pressure, Zillow isn’t slowing down.

If anything, it’s speeding up: hiring faster, closing more loans, and accelerating revenue growth.

And it remains “game on” for the one-stop-shop Power Move being led by Zillow and Rocket, something that will define the industry in many ways moving forward.