Zillow Flex Grows In a Cooling Market

/Zillow and realtor.com's Q1 results shine a light on two key factors: overall revenue growth is slowing in a cooling market, and Zillow's next gen lead gen business, Zillow Flex, is building momentum.

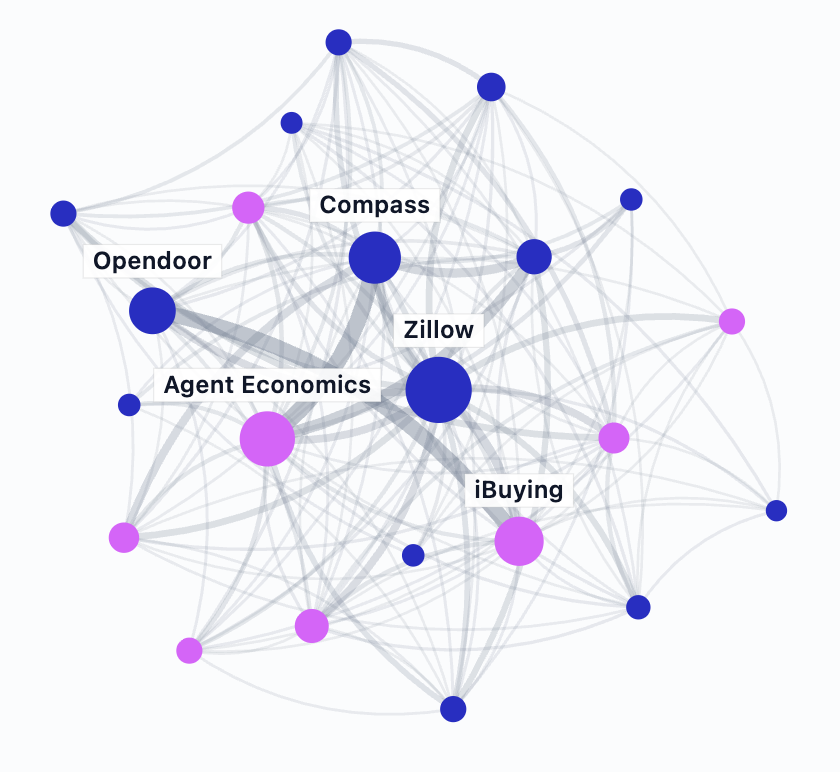

Why it matters: Zillow is going all in on next gen lead gen; it's an important evolution of the real estate portal business model, and perhaps the singularly most critical component of Zillow's future growth (Zillow 3.0: Back to Basics).

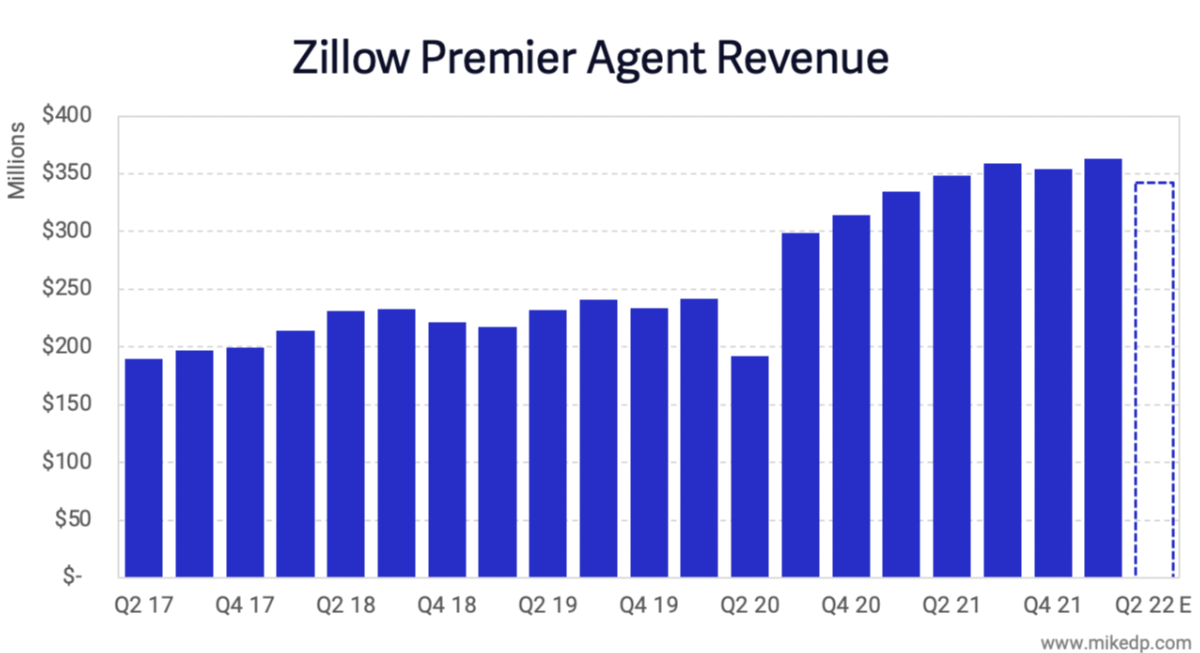

Revenue growth in Zillow's Premier Agent business, which includes Flex, has slowed, and is projected to remain relatively flat in the months ahead.

Zillow's plan is to double premier agent revenue by 2025.

It's far too early to pass judgement, but the results highlight future challenges -- and that Zillow will need to do something new to re-accelerate its business.

Comparatively, realtor.com's revenues are also flat, and its next gen lead gen business accounts for a similar amount of revenue as at Zillow (28 vs 25 percent).

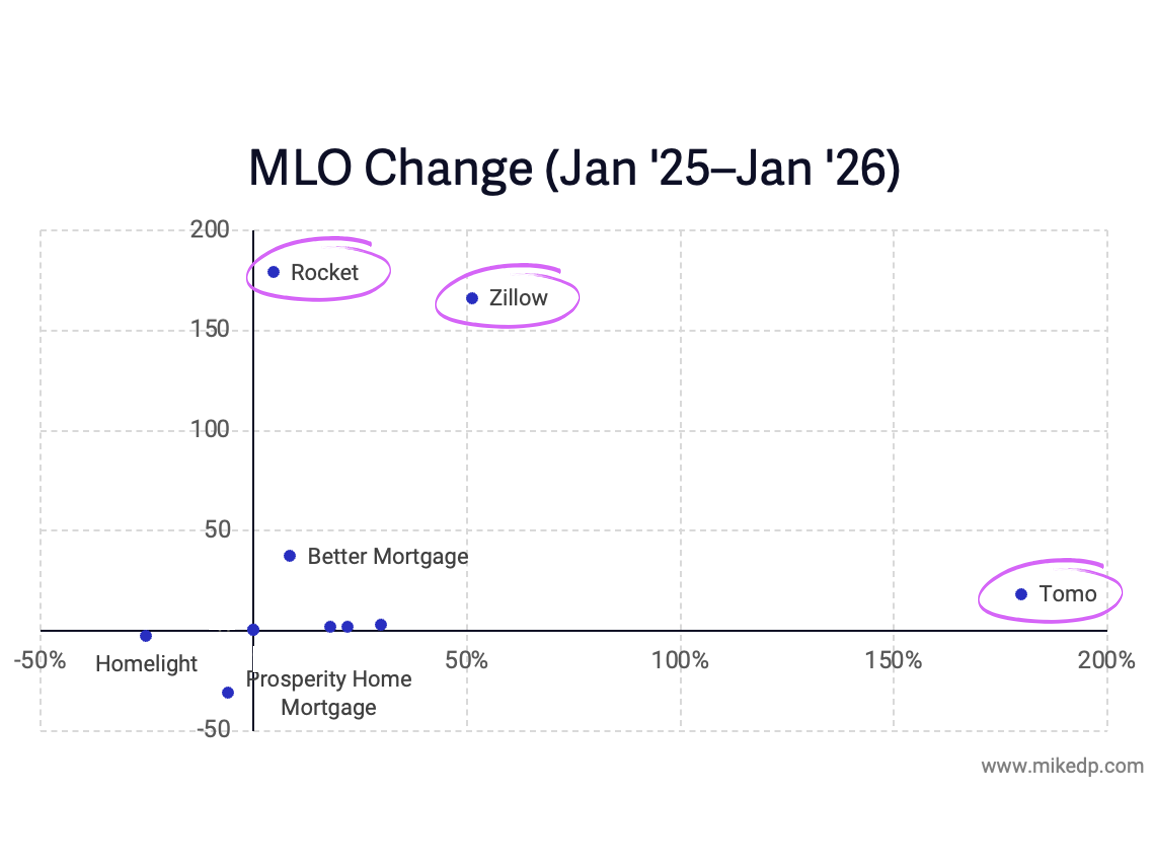

But growth rates are radically different. Zillow's Flex revenues increased 200 percent from the same period last year, compared to an 18 percent increase at realtor.com.

Meanwhile, revenue in Zillow's traditional lead gen business dropped (!) 10 percent during the same time, compared to growth of 3 percent at realtor.com.

The evidence supports the narrative that Zillow is going all in on next gen lead gen.

It's extremely unlikely that Zillow will hit its 2025 targets with traditional, market-based pricing; it's all about Flex.

Yes, but: Even though traffic and lead volumes are down at the portals (22 percent lower for realtor.com), overall lead gen revenues are up (7.5 percent at realtor.com and 9 percent at Zillow).

The portals always win: In a slowing market, agents are paying more money for fewer leads.

The bottom line: It won't happen overnight, but the future of Zillow appears very much tied to the future of Flex.