Agent Migration and Brokerage Transformation Continues

/As 2023 grinds into the final months of the year, agents are continuing to migrate from legacy brands to low-fee, cloud-based brokerages.

Why it matters: A receding tide reveals, and the current market dynamics are revealing clear agent attraction trends – with implications that may affect the industry for years to come.

The data: Between the second and third quarter of the year, agents continue to flock to the low-fee / high-split brokerages where they are able to keep more of their commission dollar.

This is at least the third straight quarter of declining agent counts at the large legacy brands: Anywhere, RE/MAX, and Keller Williams.

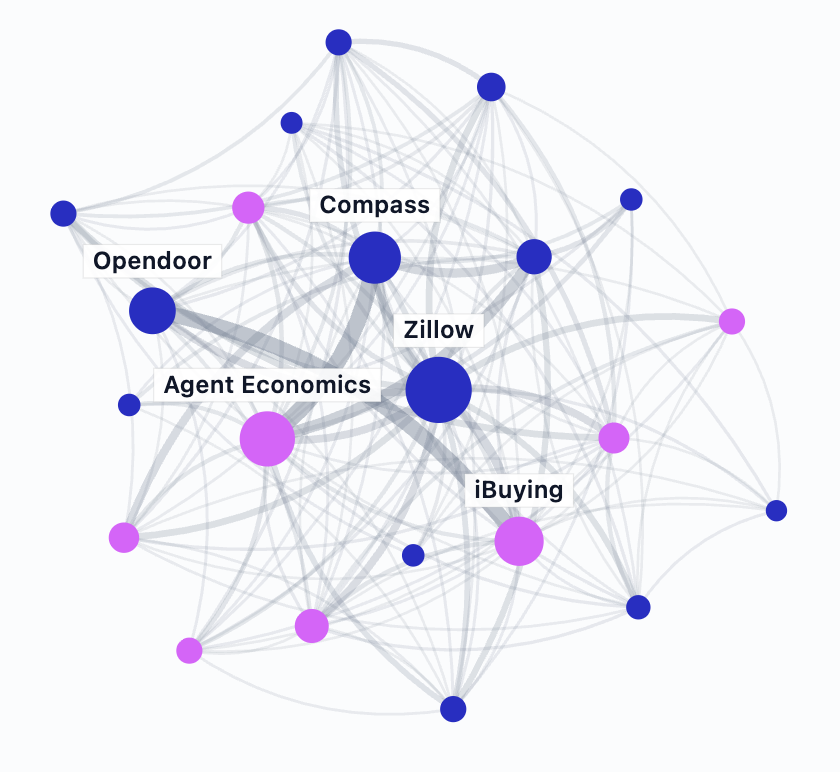

The noteworthy outlier is Compass – which acquired Realty Austin and its 630 agents – which operates as a legacy brand but has the growth rate of a low-fee brokerage.

Since the beginning of the year, 10,500 agents have left the big legacy brands, while the exact same number of agents have joined the low-fee brokerages.

Agents are voting with their feet, and moving from one brokerage paradigm to another.

Agent migration is shaping transaction volumes and brokerage market share.

Between Q2 and Q3 of this year, the number of U.S. existing home sale transactions was down five percent, with some brokerages over- and others under-performing the market.

Low-fee models Real, United, and eXp Realty continue to outperform the market and grow during a down market – a remarkable achievement.

Yes, but: While this metric shows momentum, it’s not perfect; one down quarter can result in a subsequent up quarter, which appears to be the case with Compass – it didn’t have a bad Q3, it just had a great Q2.

The bottom line: As measured by agent count, there is an undeniable shift occurring across the industry in this time of upheaval, uncertainty, and change.

It’s worth noting that the low-fee / cloud-based brokerage models have another important attribute: low operating expenses (no offices!).

That fact, coupled with growing agent numbers, is laying the groundwork for a transformational shift in the industry that may set the tone for years to come.

Note: Thank you to Keller Williams, United Real Estate, and RealtyOne for trusting me with their data. As private companies they don’t have to share. Certain data for RE/MAX and Berkshire Hathaway HomeServices is not publicly available, which is why it is not included.