New Zealand's V-Shaped Real Estate Recovery

/With zero cases of Covid-19 in the community, New Zealand is one of the very few countries where life has returned to normal. After two months of lockdown, the country's property market is demonstrating healthy market dynamics on its road to a true V-shaped recovery -- and serves as an interesting comparison to the U.S.

New Listings Supply

New listing volumes at Barfoot & Thompson, Auckland's largest real estate agency with over 40 percent market share, rebounded quickly after the country emerged from lockdown. New listing volumes in June were higher than normal -- an expected effect of pent up supply from the lockdown.

At a national level, new listing volumes (as tracked from a major real estate portal) show a similar trend: an extreme dip during lockdown, followed by a healthy rebound.

Compare this to the U.S., where new listing volumes (as tracked nationally by Redfin) are still depressed and below last year's numbers.

New listings -- supply -- are the lifeblood of a healthy property market. A lack of inventory can create liquidity problems in a market recovery.

Buyer Demand

Critically, buyer demand has closely matched seller demand in New Zealand. The number of sales in Auckland has rebounded quickly and strongly, reaching levels higher than last year in June.

Comparatively, home sales in the U.S. are still recovering and below last year's levels. But the overall trend is the same: a temporary dip followed by a recovery. New Zealand appears to have recovered fully, while the U.S. is still catching up.

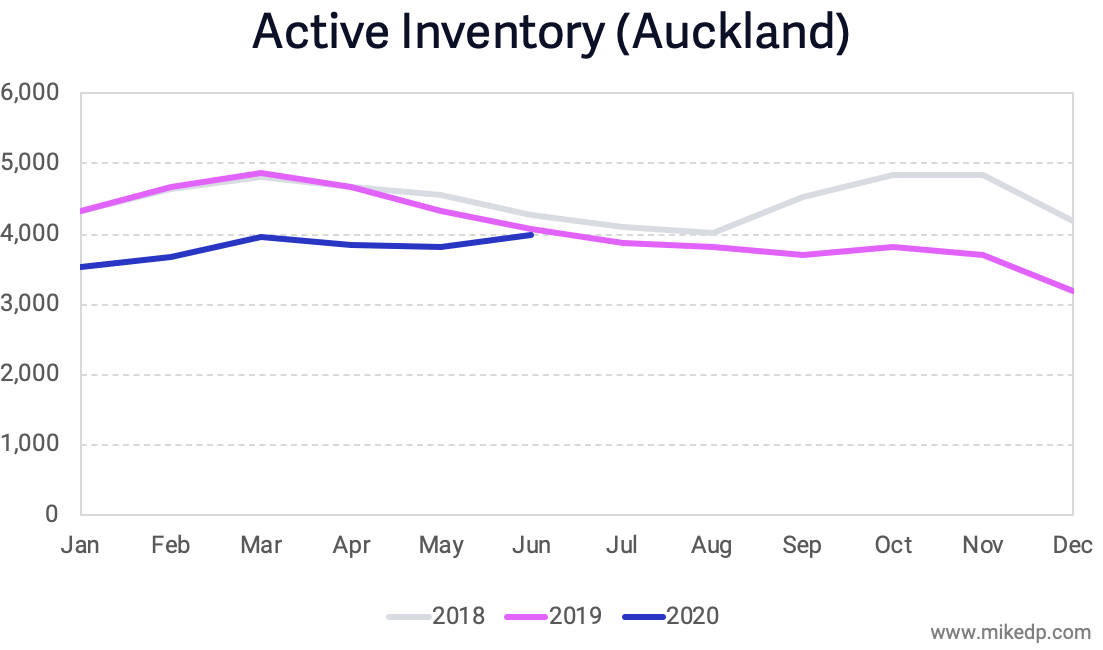

Inventory

A strong measure of a healthy market is inventory -- the number of active listings in a market -- and which direction it is trending. In some U.S. markets, buyer demand is outstripping new listings coming to market, creating a precipitous drop in inventory.

At a national level, inventory levels in the U.S. continue to drop in a season when they normally grow. Buyers are picking up houses faster than sellers are bringing new homes to market.

The story is different in New Zealand. Inventory levels in Auckland have remained relatively constant through lockdown, and -- most importantly -- have not dropped as buyers and sellers come back to the market. In other words, buyer demand is being matched by seller demand.

The evidence suggests that New Zealand's housing market is experiencing a true V-shaped recovery. Buyers and sellers are back on the market at levels similar to or exceeding last year (driven by pent up demand).

In New Zealand, life returned to normal fairly quickly, and the housing market appears to have followed suit. As the U.S. continues to wrestle with waves of the pandemic and increasing uncertainty about the future, the housing market is reacting with greater extremes. There is a frenzy of buyer activity, while new listing volumes continue to lag historical levels -- all leading to an unprecedented drop in inventory.