Zillow Still Crazy About Mortgages

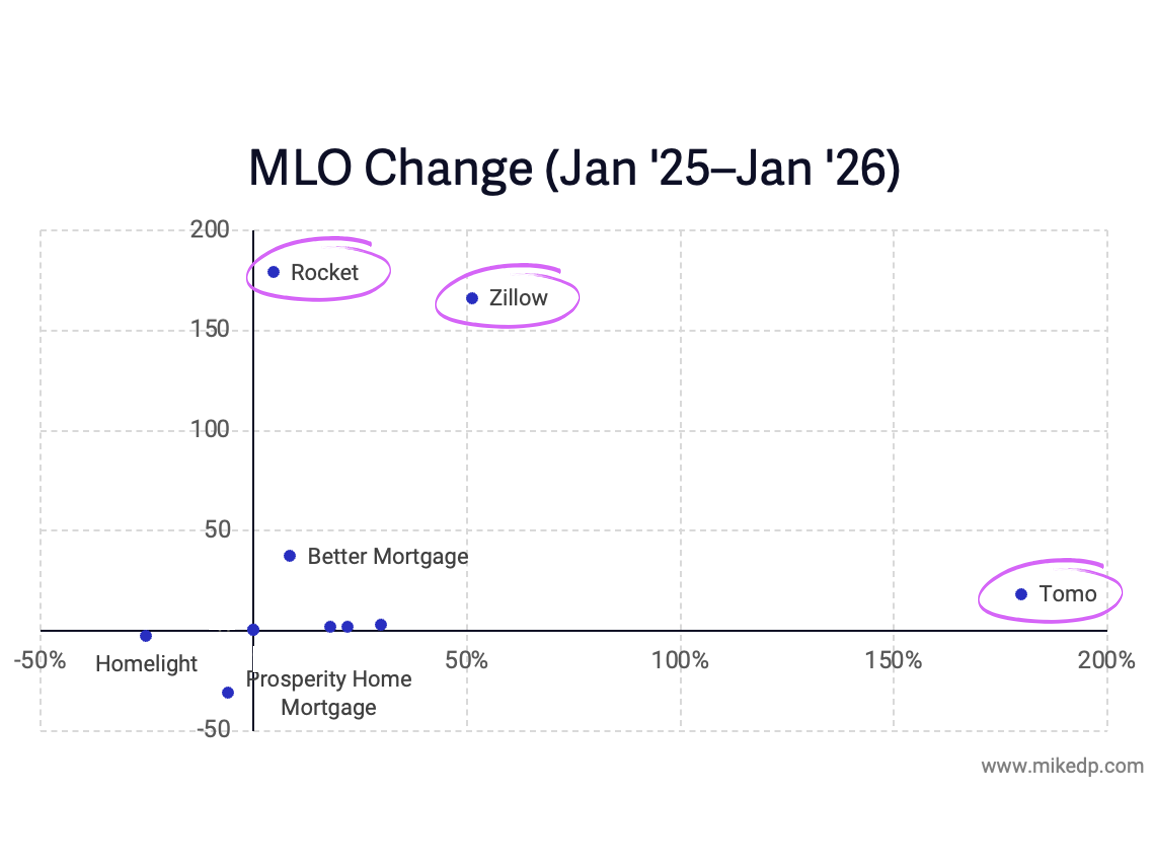

/In a down market with historically high interest rates, Zillow continues to invest in its mortgage business – Zillow Home Loans – and is the only company among its peers that is adding mortgage loan originators (MLOs) to its headcount.

Why it matters: While other real estate tech companies are shedding mortgage headcount, cutting expenses, and closing their mortgage operations, Zillow’s investment is a clear sign of strategic intent and a reflection of its ability to invest for the long-term.

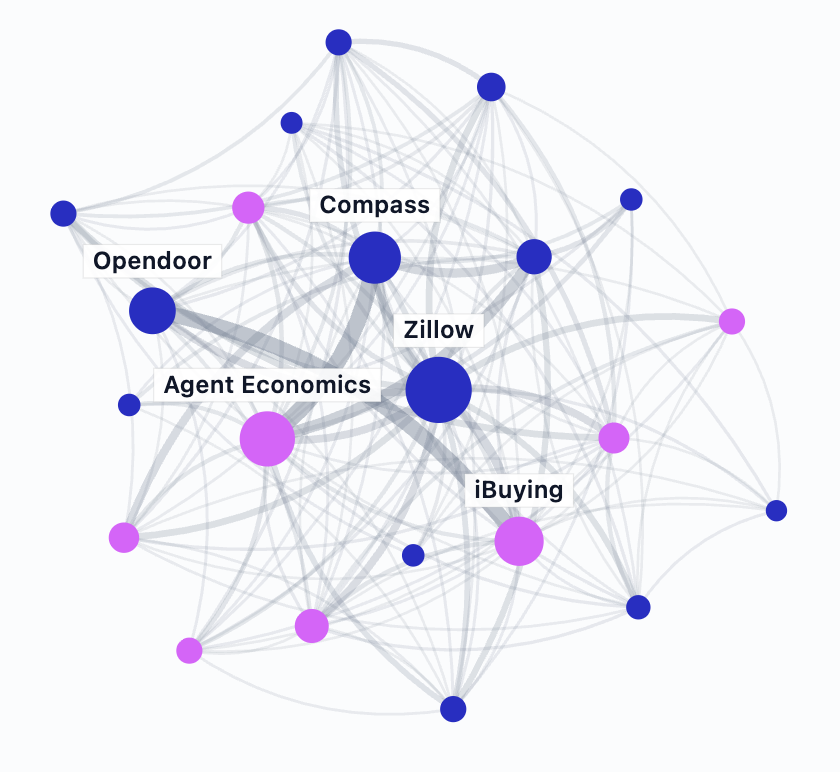

Zillow’s real estate peers, including iBuyers, Power Buyers, digital brokerages, and mortgage start-ups, have all shed MLOs over the past 18 months.

Some companies, like Opendoor, have shut down their entire mortgage operations, while others have cut MLO headcount by half (or more).

The number of Zillow’s MLOs has fluctuated over time, but there has been a sustained and noticeable increase throughout 2023.

Zillow’s MLO headcount is up around 40 percent since February ‘23.

Better Mortgage, which recently went public via a SPAC, presents a very different story of MLO headcount.

Zillow Home Loans is still relatively small compared to industry peers, including Redfin’s Bay Equity and Prosperity Home Mortgage (a subsidiary of mega-broker HomeServices of America).

Zoom out: And as I’ve written in the past, these companies are a drop in the bucket compared to mortgage industry behemoth Rocket Mortgage.

Remember: Zillow’s recent financial reporting changes have removed an informative layer of transparency from its business.

After six years of losses, it’s no longer possible to track the profitability and operating expenses of the mortgage business unit.

The bottom line: The number and growth of MLOs is an important leading indicator of a company's firepower and strategic intent.

With continued struggles around profitability and uncertainty around adoption, Zillow Home Loans is far from an unequivocal success story – but the company continues its heavy investment.

The depth of investment stands out by going against the grain of other mortgage companies, real estate tech disruptors, and the overall market – which highlights the importance of mortgage for Zillow.